- within Consumer Protection and Antitrust/Competition Law topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Transport and Law Firm industries

Michael Bacina, Steven Pettigrove, Jake Huang, Luke Misthos and Kelly Kim of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Grayscale draws sword in ETF battle

Grayscale's appeal against the US Securities and Exchange Commission's (SEC) refusal to approve the Grayscale Bitcoin spot ETF finally progressed to the US appeals court this week. Greyscale alleges that the SEC violated the Administrative Procedure Act by arbitrarily refusing permission to allow Grayscale's flagship spot bitcoin fund (GBTC) to trade on exchange.

The SEC rejected Grayscale's application in part due to market manipulation concerns relating to the fragmented market for spot Bitcoin trading. Bitcoin futures on the other hand trade on the Chicago Mercantile Exchange (CME), which is a regulated derivative exchanges. Grayscale has sought to address those concerns in an attempt to seek approval for the first US traded spot Bitcoin ETF.

The SEC's attempt to differentiate spot Bitcoin from Bitcoin futures markets attracted significant scepticism from the Court, with Judge Rao stating:

[The SEC] really needs to explain...how it understands the relationship between bitcoin futures and the spot price of bitcoin....one is just essentially a derivative. They move together 99.9% of the time. So, where's the gap, in the Commission's view?

The Court peppered the SEC's legal teams with further questions regarding their justification for rejecting Grayscale's spot Bitcoin ETF.

The Court's close questioning of the SEC excited market hopes that the Court will overturn its decision. This has seen a positive shift in sentiment for Grayscale, driving the GBTC price up by 5% on Tuesday. GBTC is currently only available to accredited investors and has been trading at a steep discount to its net asset value due in part to fading optimism over the prospect of ETF approval by the SEC.

A ruling on the appeal is expected in 3 to 12 months. Even if Grayscale is successful in overturning the SEC's decision, it remains to be seen whether the SEC will admit defeat or seek to block the ETF on other grounds. A number of other securities regulators have approved spot Bitcoin ETFs for trading, however, the performance of these funds has tracked the collapse in the Bitcoin price over the past 18 months. In Australia a spot ETF for Bitcoin has not been approved.

UK Court rejects copyright in Bitcoin File Format

An English Court has rejected Craig Wright's claim to copyright in the Bitcoin File Format in an initial blow to his attempt to prove breach of copyright and block the further operation of the main Bitcoin blockchain (BTC blockchain) and the Bitcoin Cash blockchain (BCH blockchain) without his consent.

Dr Wright is an Australian computer scientist who claims to have invented bitcoin and authored the Bitcoin Whitepaper under the pseudonym Satoshi Nakamoto. In this action, Dr Wright claims breach of copyright in database rights relating to the Bitcoin blockchain, the Bitcoin Whitepaper and the Bitcoin File Format in an effort to thwart two popular forks of the Bitcoin blockchain (the BTC and BCH blockchains, which underpin Bitcoin and Bitcoin Cash).

The High Court's judgment focused on a procedural matters: whether Dr Wright may serve his claim on defendants outside the UK. For that, Dr Wright must show that there is a serious issue to be tried. In other words, his claim must have a real prospect of success.

While Justice Mellor decided that Dr Wright had some prospect of successfully claiming database rights and copyright in the Bitcoin Whitepaper, he was not convinced that Dr Wright has any copyright in the Bitcoin File Format.

Justice Mellor's reasoning focused on the "fixation" requirement of copyright, a general principle which is codified in section 3(2) of UK's Copyright Designs and Patents Act 1988:

Copyright does not subsist in a literary, ... work unless and until it is recorded, in writing or otherwise

Therefore he queried:

When and in what form the alleged literary work in the Bitcoin File Format was first recorded

While Justice Mellor accepted there was no doubt as to what the Bitcoin File Format is - because it had been clearly described in the particulars of claim - he said Dr Wright failed to identify what exactly made up the relevant "work" which defined the Bitcoin File Format:

despite all these opportunities, the Claimants have not filed any evidence to the effect that a block contains content indicating the structure, as opposed to simply reflecting it.

In other words, it was not sufficient that a block reflects the structure of the Bitcoin File Format, it needs to contain content that indicates the structure in order to demonstrate original thought. Mellor J said the absence of evidence on "content" confirmed his view that, nowhere was the structure of Bitcoin File Format fixed in a copyright sense in a material form.

Justice Mellor went on to give an example of what might meet the requirement in his view:

By 'content indicating the structure', I mean, by way of a crude example, a flag or symbol in the block which signals 'this is the start of the header' or 'this is the end of the header', or an equivalent of the sort of content which is found in an XML file format.

As to "when" did the fixation/recording take place which gave rise to a copyright, the Claimant argued that,

"the requirement for fixation/sufficient identifiability was met automatically when the program was run...when the software runs and the hashing problem is solved, a block is created in the Bitcoin File Format.. this is sufficient to meet the fixation/sufficient identifiability requirements."

Justice Mellor said the above view is "plainly incorrect", based on the facts already stated above. Again, it is not sufficient to show that when the software of the Bitcoin system runs, a particular block on the blockchain is created in the Bitcoin File Format. Evidence is required that a block contains content that indicates the structure and original thought.

Dr Wright is no stranger to disputes. Over the past few years, he has made a number of allegations and initiated various court actions (including this one) asserting that he has various rights in the bitcoin blockchain. Some of these cases, such as the Tulip case, are still ongoing and may end up setting interesting precedents in relation to different areas of law including intellectual property, copyright and the duties of software developers.

Utah passes latest DAO law

The Utah State Legislature has passed HB 357, the "Utah Decentralized Autonomous Organizations" Act (Utah DAO Act) aimed at fostering an environment for DAOs to operate within its jurisdiction and providing legal personality for DAOs.

Starting in January 2024, Utah will classify DAOs that register in the state as 'Utah LLDs' under the Utah DAO Act. This legislation was developed through collaboration between the Digital Innovation Task Force and the Utah Blockchain Legislature, and after undergoing rigorous discussions in both the Senate and House committees, it was officially passed on March 1, 2023.

The framework underpinning the Utah DAO Act was derived from the COALA model law, which requires DAOs to comply with a set number of rules to be granted legal personality. The Utah DAO Act, on the other hand, defines ownership of DAOs and protects DAO-compliance anonymity through bylaws and anonymity redactions.

Additionally, the Utah DAO Act aims to:

- Incorporate a technology gatekeeping function to assure the DAO is a DAO and not another type of entity.

- Introduce quality assurance requirements for DAO protocols.

- Introduce nuanced tax treatment consistent with DAO functionalities.

- Establish no implicit fiduciary duties owed by DAO participants unless those duties are explicitly stated to apply.

The Utah DAO Act passed both the House and Senate committees with narrow approval, and concerns raised by opposing members. Unaccountable anonymity, inconsistent state and federal tax legislation and a lack of ramp-up time for the Utah Division of Corporation to prepare for implementation were flagged as serious concerns.

Another issue that DAOs, such as protocol DAOs, likely face is the risk of violating the Corporate Transparency Act, which mandates that certain entities must disclose information about their beneficial ownership to the Financial Crimes Enforcement Network (FinCEN).

The use of smart contract codes as the primary foundation of DAOs, coupled with the absence of traditional corporate beneficial owners, creates a roadblock for DAOs wanting to incorporate in Utah. As a result, the Utah DAO Act has been criticized for being at best a stop-gap solution, with suggestions that a different structure would better serve the needs of DAOs.

The Task Force has announced, however, that it will work with the Utah Department of Commerce to engage with industry to ensure that the law is working. Weaknesses in the legislation will be explored and rectification attempted before DAOs are allowed to incorporate in 2024.

Utah joins the US States of Wyoming, Tennessee and Vermont in giving some form of legal recognition to DAOs. Late last year, the Marshall Islands also enacted a DAO Act in an effort to attract DAOs to incorporate in the jurisdiction.

Australia at present has no legislation proposed or drafted to recognise DAOs.

It's all on chain: analyzing the latest crypto crime trends

Every year, Chainalysis publishes estimates of illicit cryptocurrency activity and reveal the latest trends in cryptocurrency-related crime. These kinds of estimates aren't possible in traditional finance, but are enabled by public and immutable blockchain records. This work demonstrates the significant transparency of blockchain technology, including its advantages in tracking and analysing financial crime.

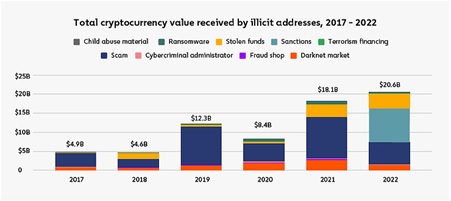

The 2023 report paints an interesting picture of one of the most eventful years in the history of crypto. Despite the market downturn in 2022, illicit transaction volume rose for the second consecutive year, hitting an "all-time high" measured in dollars of $20.6 billion:

However, 43% of 2022's illicit transaction volume came from activity associated with sanctioned entities, in a year when the US and EU launched some of their most ambitious crypto-related sanctions. A great example of this is crypto exchange Garantex, which accounted for the majority of sanctions-related transaction volume last year. The US sanctioned Garantex in April 2022, but as a Russia-based business, the exchange has been able to continue operating with impunity and so adds to the volume based total in the above graphic.

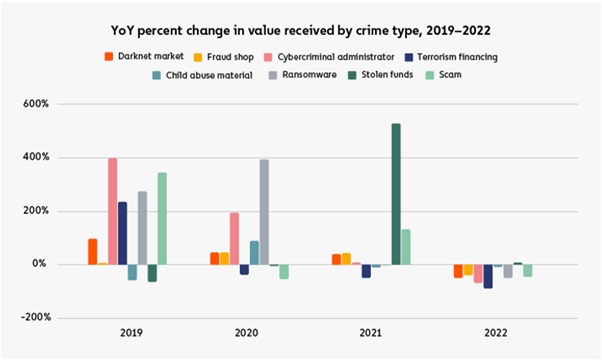

On the other hand, transaction volumes fell across almost all other categories of cryptocurrency-related crime, with the exception of stolen funds, which rose 7% year-over-year:

Chainanalysis explained this trend:

The market downturn may be one reason for this. We've found in the past that crypto scams, for instance, take in less revenue during bear markets, likely because users are more pessimistic and less likely to believe a scam's promises of high returns at times when asset prices are declining. In general, less money in crypto overall tends to correlate with less money associated with crypto crime.

The rise in stolen funds was attributable to a record year for crypto hacks, which raked in $3.8 billion. Nearly half of this sum has been linked to North Korean-linked hackers.

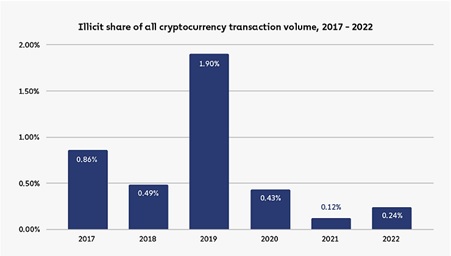

Overall, the report found that the share of all cryptocurrency activity associated with illicit activity had risen for the first time since 2019 - from 0.12% in 2021 to 0.24% in 2022. But it still stands much lower than 2019's figure:

Chainalysis said:

Overall, illicit activity in cryptocurrency remains a small share of total volume at less than 1%. It's also worth keeping in mind that despite this year's jump, crime as a share of all crypto activity is still trending downwards.

The 2023 report also details the criminal activity behind that 0.24% of illicit usage, as well as what their on-chain analysis reveals about the market failures of the last year. While Chainalysis acknowledge that it estimates are likely to rise as they continue to attribute new wallet addresses and crypto flows to illicit activity, the relatively small percentage of illicit activity runs contrary to popular perceptions of cryptocurrency use. It also demonstrates the easy traceability of blockchain crimes, which is made possible by the inherent transparency of blockchains.

Against the backdrop of major crypto exchange collapses last year, Chainalysis said that the crypto industry still has room to improve transparency and visibility by connecting off-chain liabilities and on-chain data:

There are opportunities to connect off-chain data on liabilities with on-chain data to provide better visibility, and transparency of DeFi, where all transactions are on-chain, is a standard that all crypto services should strive to achieve. As more and more value is transferred to the blockchain, all potential risks will become transparent, and we will have more complete visibility.

You can read more about Chainalysis' crypto crime reports in 2020, 2021 and 2022 in our previous updates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.