Formula 1 – Two Parents, Single Child Support Case, No Non-Parent Carer

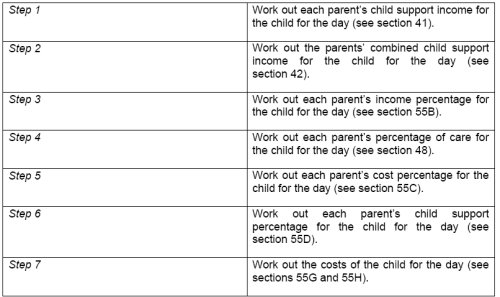

Section 35 – Method Statement

The Example

Paul and Freda have three children, Alexandra, who is 9, Emma, who is 7, and Nicole, who is 5. They separate, and the children live with Freda most of the time, but spend every second weekend and some school holidays with Paul, as well as some evenings during the week.

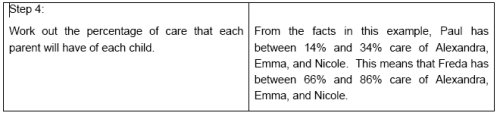

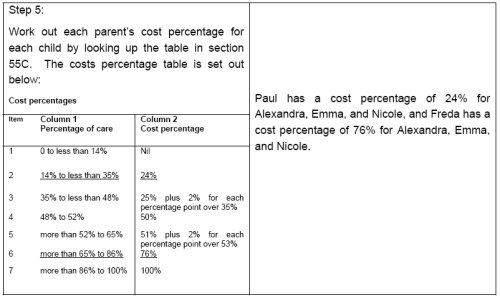

Their care arrangements are flexible, but for all the children Paul’s care level amounts to regular care of between 14% and 34%. Paul has an adjusted taxable income of $50,000 and Freda has an adjusted taxable income of $30,000. Neither Paul nor Freda has a relevant dependent child.

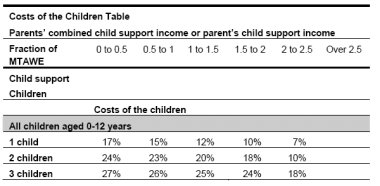

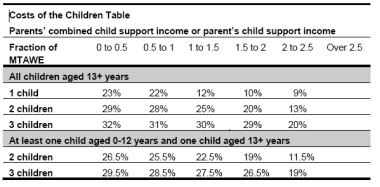

Step 7 requires you to look at the Costs of the Children Table in Schedule 1 to the Act. Interpreting this table involves several sub-steps:

Step A: Use the MTAWE (see Step 1) to calculate the income ranges covered by each column of the Costs of the Children Table. In this example, the MTAWE is taken to be $50,378.

Step B: Determine in which column the parents’ combined child support income falls. In this example, Paul and Freda’s combined child support income of $46,234 falls in the second column (0.5 to 1)

Step C: Use the formulae set out in section 3 of Schedule 1 to the Act to calculate the costs of the children. In this example, Paul and Freda’s combined child support income falls within the second column, so the formula in section 3(3) must be used.

Start by multiplying the percentage in the preceding column (in this case, the first column) by the amount of combined child support income that represents the high end of the range for that column (in this case $25,189). If Paul and Freda’s combined child support income had fallen in, say, column 5, it would have been necessary to do this for each of columns 1 to 4 and to add the resulting amounts together.

Subtract the amount of combined child support income that represents the high end of the range for the previous column (in this case $25,189) from the parents’ combined child support income (in this case $46,234). Multiply the resulting amount (in this case $21,045) by the percentage shown in the column in which the parents’ combined child support income falls (in this case 26%).

Australia's Best Value Professional Services Firm - 2005 and 2006 BRW-St.George Client Choice Awards

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.