- within Law Practice Management, Antitrust/Competition Law and Consumer Protection topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Environment & Waste Management, Property and Law Firm industries

If you are a director you need to apply for an Australian Director Identification Number (Director ID) before 30 November 2022. If you were a director but have resigned on or after 4 April 2021, you still need to apply for a Director ID by this date.

With the deadline fast-approaching, we answer some common questions to help you navigate the application process and how you can lodge your application. Find out more about the Director ID regime and its purpose here.

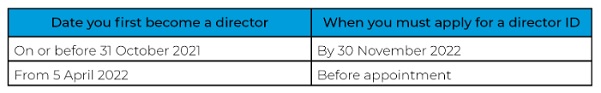

1. When do I need to apply for a director ID?

When you must apply for your Director ID depends on when you first became a director of any company, relevantly:

If you are unable to apply for a Director ID within the required timeframe, you can apply for an extension to the Registrar of Australian Business Registry Services (ABRS), by downloading and completing an application form here.

2. How do I apply for a director ID?

Directors who are living in Australia can apply online for a Director ID through the ABRS website. To apply online, you need to have a myGovID account set up. Alternatively, Australian based directors who are not able to apply online using the myGovID app can call the ABRS and register over the phone (on +61 2 6216 3440).

Directors who are living outside of Australia can download and complete an application form here and provide certified copies of documents that verify your identity.

The ABRS also recently published a new demonstration video to guide directors through the steps needed to apply for their Director ID online.

3. Can my accountant apply for my director ID on my behalf?

Your authorised tax, BAS or ASIC agent can help you decide if you need to apply, but they can't apply on your behalf. Only directors can apply for their own Director ID. The reason you need to apply personally is because you must verify your identity with ABRS. If you use a tax agent, they can assist you with your records, for example, by providing you with your notice of assessment details and bank account details used for ATO refunds.

4. I was previously a director of a company, but have since resigned. Do I still need to apply for a Director ID?

Yes, a Director ID may still be required. If you are a director that resigned after the new laws came into effect on 4 April 2021, but have since resigned, you should still apply for a Director ID.

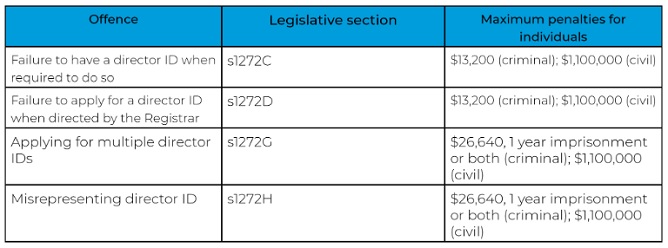

5. What are the director ID offences and penalties?

It is a criminal offence if directors do not apply for a Director ID on time, and other significant penalties may apply. These include:

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.