What is Homeowners' Warranty Insurance?

Homeowners warranty insurance (HWI) is a type of mandatory insurance designed to protect homeowners in the event that certain residential building works are defective or incomplete. HWI is known by many different names throughout Australia.

National Approach

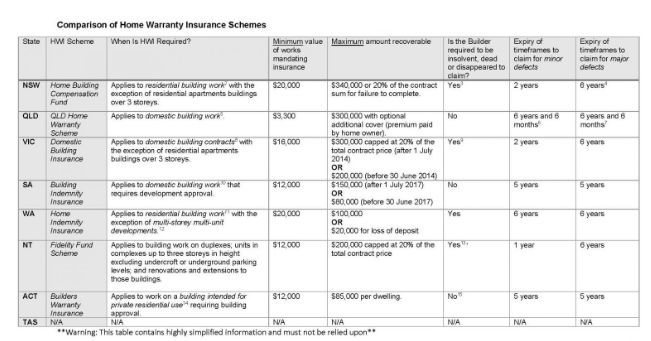

Currently there is no uniform national approach to HWI, rather it is provided for via differing mandatory schemes across all Australian jurisdictions with the exception of Tasmania1. The effect of this is that the key requirements of the schemes and the resulting protections afforded to homeowners differ in each jurisdiction.

This lack of uniformity can have significant consequences for builders and tradespeople who operate across jurisdictional lines, and for homeowners who may not be afforded the same protections as their interstate or territory counterparts.

As can be seen from the image, the maximum amount recoverable and timeframes for bringing claims vary considerably. In addition to this, there are differences between the way completion of work is defined which accordingly affects timeframes. In NSW for example, there is a different definition for completion for residential building work which forms part of a strata scheme. Further, the exact definition of minor and major defects vary across the jurisdictions and as can be seen from the table below may or may not make a difference with respect to timeframes to claim.

To view the original article please click here.

Footnotes

1. Introduction of a HWI scheme is currently being considered by the Tasmanian Government following community consultation.

2. Home Building Act 1989 (NSW)

3. Claims can also be made where the builder has had its licence revoked by NSW Fair Trading.

4. Or within 6 months of becoming aware of defects (if in final 6 months of period of insurance).

5. Queensland Building and Construction Commission Act 1991 (QLD)

6. From the date of the contract being entered into or the premium being paid (whichever is earlier) (able to be extended if construction takes over 6 months to complete).

7. From the date of the contract being entered into or the premium being paid (whichever is earlier) (able to be extended if construction takes over 6 months to complete).

8. Domestic Building Contracts Act (Vic)

9. A claim can also be made where the builder fails to comply with the order of a court or a tribunal.

10. Building Work Contractors Act 1995 (SA)

11. Home Building Contracts Act 1991 (WA)

12. Home Building Contracts (Home Indemnity Insurance Exemptions) Regulations 2002 (WA)

13. Claims can also be made where the builder has had its registration cancelled by the NT Building Practitioners Board.

14. Building Act 2004 (ACT)

15. Claims can also be made where the works are incomplete or defective but the possibility to make these claims can be excluded by the terms of the policy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.