- within Media, Telecoms, IT and Entertainment topic(s)

This year's Black Friday deals and the ensuing shopping frenzy might be only a few days away, but online retail is waking up to a dramatically changed environment.

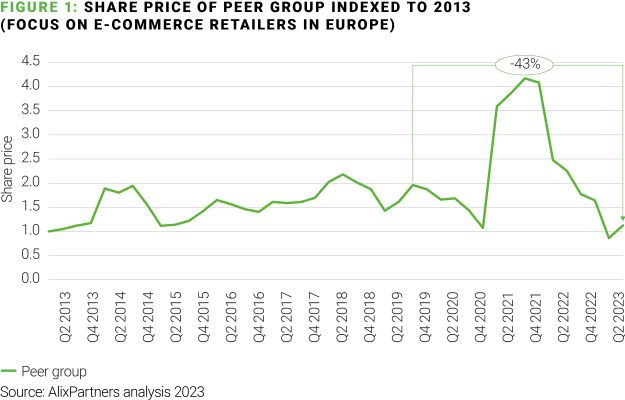

E-commerce has undoubtedly been the disruptive force of the past two decades in retail; an investor who put $1,000 into Amazon at IPO in 1997 would be sitting on approximately $1.5m today. However, throughout that time, most online retailers have delivered very little operating profit or free cashflow. Now faced with decreased consumer spending power driven by recent economic headwinds, and online saturation, the industry is facing up to its structural challenges.

As online retailers move from being growth companies to mature businesses, there are five harsh realities to address.

1. Expected profitability never materialized

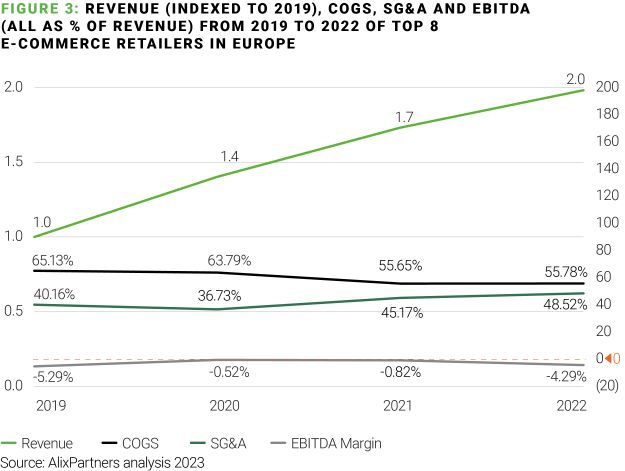

In the long term, scale was always supposed to lead to profitability. But while the pandemic drove extraordinary growth for many online retailers, expected profitability did not materialize. Our analysis of Europe's largest online retailers shows that their collective EBITDA margin never exceeded 2.5% even at the height of the pandemic – and was in fact negative for almost the entire period.

Online retailers must address the structural challenge of keeping cost and capital structures lean enough to deliver a profit.

2. Business models rely on investor subsidies

Amazon and other early online retailers set a standard that customers now expect: "Fast, Good and Cheap". To compete, online retailers must offer the best price, free and fast delivery, free returns, deep and wide assortments, and constant availability, while also reaching customers at the top of Google search and social media.

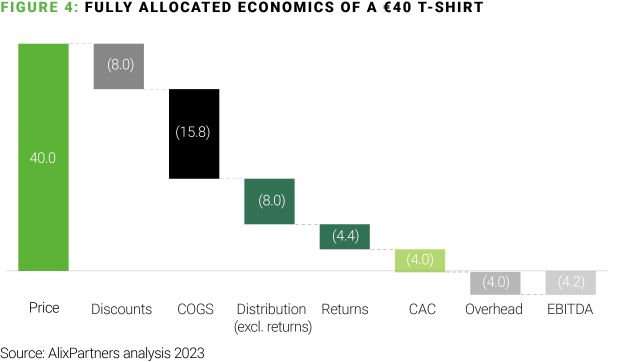

No European retailer has yet found a way to fund this comprehensive offer from their own revenue. Without a generous subsidy from investors, the economics don't stack up. Our analysis shows that a €40 T-shirt sold as a single package online might have a gross margin of 60%, but is almost always loss-making once all costs are considered.

Inflation has had a double impact. While suppliers and producers have passed on cost increases to retailers, retailers have been more reticent to do so for consumers suffering from declining real incomes and reduced spending power. Online, pricing pressure is compounded by the ease with which consumers can find the same product elsewhere, at a lower price.

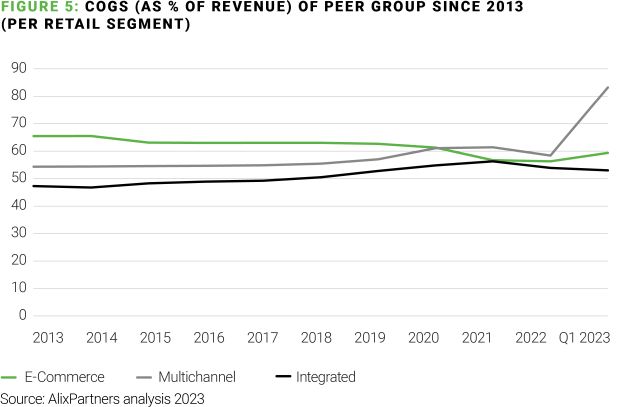

This leaves no room for online retailers to price products up, even if this means pricing below cost. Our analysis shows that online retail delivers a consistently lower gross profit margin than comparable offline retailers.

3. Return rates are the Achilles heel

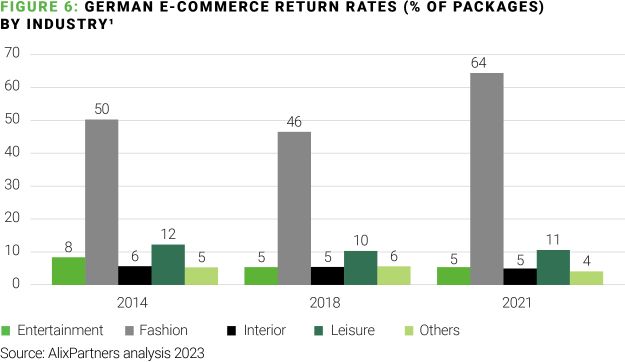

The industry will not be sustainably profitable until return rates are brought under control. In apparel, the return rate at leading retailers is over 50%, with barely half of returned items going back on sale as they are either damaged or out of season by the time the return is processed. Retailers essentially need to make each sale twice before they can rely on the revenue.

High return rates drive huge impacts on COGS, logistics costs, and working capital, not to mention the environment. In other verticals, return rates are lower, but the complexity is greater – dealing with returned sofas and TVs has an outsized impact on the P&L.

4. Big Tech are the new retail landlords

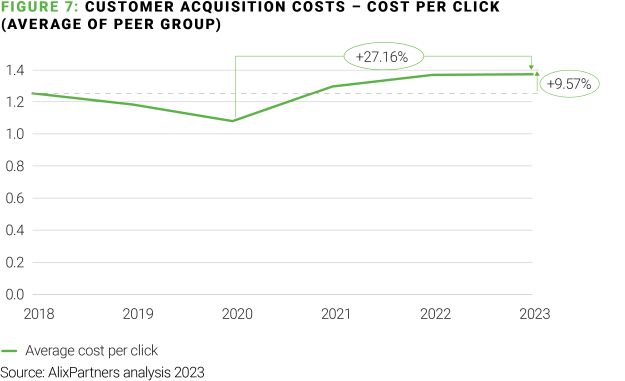

A supposed advantage of online retail was eliminating rent for physical stores. But to reach customers online, retailers must hand over a large share of earnings to the digital gatekeepers at Google, Meta and co. Examining the average cost per click and website conversion rate of a leading fashion online retailer, the acquisition of a new customer can cost more than €40.

Big Tech is in pole position here and, as prices increase, they benefit from an increasing share of the value generated by online retail. Our analysis shows that cost per click increased almost 30% between 2020 and 2023 and is now 10% higher than before the pandemic.

5. SG&A costs have grown faster than sales

Online retailers have placed little focus on SG&A costs over the last decade, relying on rapid sales growth to deliver operational leverage. But that effect never came – in fact, our analysis shows that the share of revenue consumed by SG&A costs among listed online retailers has increased by 12 percentage points since 2013.

So what can retailers do? With its unmatchable customer reach, the place of e-commerce at the heart of modern retail is not in doubt. There are concrete, pragmatic actions that online retailers can take now, to survive in a challenging marketplace and ensure a more profitable performance.

1. Sophisticated pricing

Most retailers we work with still follow simple pricing principles, for example applying discounts across the board to move stock. This is an expensive practice – discounting reduces gross margin across the industry by up to 20 percentage points.

More sophisticated use of data and automated pricing solutions allow a more nuanced approach, enabling retailers to better understand elasticity and identify where higher prices can be realized. This can be a dramatic EBITDA driver, with relatively low investment.

2. Discipline in category management

Critically, online retailers need to review their approach to category management and assortment. Without the discipline imposed by shelf space limitations, many favored an ever-growing assortment over a curated offer. This was an effective driver of top line growth, but at the cost of margin and complexity. Advancements in big data now enable retailers to make better assortment decisions than ever before. A data-driven, profit-maximizing approach to category management can drive several points of gross margin.

3. Understanding the complex causes of returns

Reasons for returns are multi-dimensional. Solutions lie deep in the data – for example, looking at the item level drivers of returns; the serial returners in the customer base; whether certain products are more prone to particular channels of return; whether specific suppliers are presenting issues and whether that varies by category or location.

In partnership with Palantir, AlixPartners has developed a returns optimization toolkit that reviews millions of data points across product lines, brands, suppliers and customer to identify the underlying causes, helping retailers to build a much richer picture of the drivers of returns, and become more sophisticated and efficient in reducing and processing them.

The reward for tackling the issue is huge: our analysis shows that for a €1bn e-commerce retailer with an average 45% returns rate, a mere 5% improvement could mean an increase of c.€15m in EBITDA.

4. Smarter investment in marketing, SEO, and returning customers

Avoiding big tech isn't an option, but there is significant potential to improve organic traffic through more effective SEO. Consider partner marketing, increased content marketing, and targeted influencer and affiliate marketing. Retailers can also explore alternatives to search and social, such as advocacy marketing and traditional media.

The cost of acquiring new customers also underscores the importance of retaining customers through effective loyalty schemes.

5. A keen eye on operational costs, while protecting company culture

Through rapid growth, and the "fail fast" mentality of many online retailers, there are inevitably pockets of cost reflecting dated bets and investments. Identifying these, and having the discipline to address them, is one of the fastest ways to cut costs.

But even when doing so, the struggle for talent remains critical. A rapid swing from visionary growth company to cost leader risks alienating employees and future candidates. Company leaders must ensure that the ambition and culture that has driven the company so far is kept alive at a time when rebalancing the books will be vital for a successful future.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.