- within Family and Matrimonial, International Law and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Aerospace & Defence industries

On December 29, 2022, President Biden signed into law a $1.7 trillion omnibus spending package. The omnibus bill includes provisions that will soon raise existing Hart-Scott-Rodino Antitrust Improvements Act (HSR Act) filing fees for the first time in two decades and impose new HSR disclosure requirements for "foreign subsidies" from certain "foreign entities of concern." The legislation also exempts from transfer and consolidation into related federal court proceedings, certain civil antitrust actions brought by states.

The legislation is in keeping with the Biden Administration's commitment to strengthening antitrust enforcement. The additional revenue from the new HSR filing fees is earmarked for the FTC and DOJ, which will allow the agencies to increase staffing and provide more resources for antitrust investigations and litigation. Antitrust cases brought by attorneys general will have the same exemption from consolidation that the DOJ currently has, which may complicate efforts to manage and defend multi-state federal litigation. And the burden of collecting and disclosing information will increase for certain HSR filings.

Merger Filing Fee Modernization Act of 2022

- The HSR Act requires notification for mergers or acquisitions over a certain value ($101 million USD in 2022) unless an exemption applies. HSR thresholds for 2023 are expected to be announced later in January and will become effective 30 days after they are published in the Federal Register.

- Under the HSR Act, these fees are payable by the acquiring person(s) (although merging parties can contractually agree to allocate the fees however they choose). The fees are indexed to thresholds related to the size of the transaction, which are adjusted each year based on changes to the gross national product (GNP).

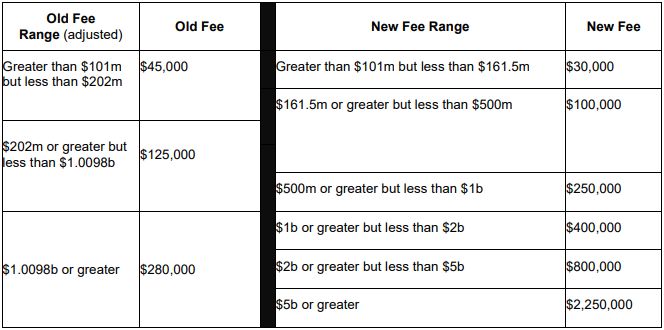

- The Merger Filing Fee Modernization Act of 2022 will adjust pre-merger filing fees. Fees for most transactions valued under $500 million USD will be slightly lower, while fees for larger transactions will be raised substantially (by nearly $2 million, or approximately 800%, for deals valued at $5 billion USD or more). Filing fees will also increase each fiscal year based on the percentage increase in the consumer price index (CPI).

- The FTC's Premerger Notification Office (PNO), which administers the HSR Act, has advised filers to proceed under the old fee structure until notice of the change to the fee schedule is posted on the FTC website. This is expected to happen shortly.

State Antitrust Enforcement Venue Act

- The Act amends 28 U.S.C. § 1407 to exempt civil antitrust actions brought by states in federal court from consolidation or transfer where there is "one or more common questions of fact."1 Until this amendment takes effect, only antitrust actions brought by the U.S. (i.e., DOJ) are exempt.

- An effective date for this amendment has not yet been set as of January 9, 2023.

Disclosure of Subsidies by Foreign Adversaries Act

- The Act also contains new disclosure requirements that, according to the Act, will seek to mitigate the impact of foreign subsidies on the competitive process where those subsidies are provided by nations or entities that the U.S. deems to be a strategic or economic threat.

- Once the regulations are implemented, transacting parties will be required, as part of their HSR filing submission, to include information on "foreign subsidies" received from "foreign entities of concern." Such subsidies can take the form of "direct subsidies, grants, loans (including below market loans), loan guarantees, tax concessions, preferential government procurement policies, or government ownership or control."2

- "Foreign entities of concern" are currently defined

under 42 U.S.C. § 18741(a) as:

- Foreign terrorist organizations (designated by the U.S. Secretary of State).

- Specially Designated Nationals (SDN) list entities (maintained by the Office of Foreign Assets Control of the Department of the Treasury).

- Those owned, controlled, or subject to the jurisdiction or government of a covered nation (North Korea; China; Russia; and Iran).

- Those alleged by the Attorney General to have been involved in activities for which a conviction was obtained under certain espionage acts.

- Or others determined by the Secretary of Energy, in consultation with the Secretary of Defense and the Director of National Intelligence to be engaged in conduct detrimental to the national security or foreign policy of the U.S.

- Based on the definition of "Foreign entities of concern," subsidies from EU countries are unlikely to require disclosure under this new rule.

- Under the amendment, the antitrust agencies are required to publish rules outlining the specific materials filing parties must disclose with their HSR filing to comply with these new requirements. Parties will be required to submit these materials on the date the required rule takes effect (such date has yet to be determined as of January 9, 2023).

What This Means

As soon as the new filing fees are implemented, parties engaging in larger transactions will pay significantly higher HSR filing fees. In addition, companies can expect that cases brought by state antitrust enforcers may be litigated in their home states, even if there are multiple cases that raise common claims, because the amendment will limit transfer and consolidation of antitrust cases brought by state attorneys general to out-of-state federal courts. Defending these cases in multiple courts will present challenges for defendants and courts alike – and risk conflicting rulings on a range of matters, including discovery and liability. Finally, HSR filers should, where relevant, begin collecting information on contributions or subsidies from "foreign entities of concern."

Longer term, it remains to be seen whether the increased revenues from filing fees translates to more antitrust enforcement or litigation. FTC and DOJ officials frequently cite historically high volumes of HSR filings in 2020 and 2021 as a justification for increased funding. There were significantly fewer HSR filing for the agencies to review in 2022, but the agencies have broadened the scope of their merger reviews and vow to challenge more deals in court. With fewer M&A deals to review, increased agency resources might result in more deals being investigated and Second Requests being issued than in the past. And more resources might make it somewhat more likely that a deal raising antitrust concerns will result in litigation (particularly given the agencies' express distaste for merger settlements). The actual risks that any given deal will be subject to greater scrutiny or litigation depends on the specifics of the relevant transaction, businesses, and industry, as well as the transaction documents created by the parties and reactions of customers and other stakeholders. Clients should turn to experienced antitrust counsel in planning a transaction to determine whether such scrutiny is likely and mitigate such risks.

Footnotes

1. 28 U.S. Code § 1407 (a)

2. Merger Filing Fee Modernization Act of 2022, Title II Disclosure of Subsidies by Foreign Adversaries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.