- within Employment and HR topic(s)

- within Employment and HR, Government, Public Sector and Law Department Performance topic(s)

Cyprus has an attractive payroll system with payroll tax consisting of PAYE tax (Pay As You Earn), Social Security Tax, and National Healthcare Tax (GESY). Learn more for Cyprus Tax System and the benefits of hiring Cypriots and Non Cypriots Employees.

Payroll in Cyprus is affected by three kinds of Direct Taxes;

- Social Insurance Contributions & NHS - paid by employees & employers (a.k.a S.I.C), and

- Personal Tax - paid by employees, called Pay As You Earn (a.k.a. P.A.Y.E).

- NHS (National Health System) Contributions paid by employees & employers

A. Social Insurance Contribution (S.I.C) - Employed & Self Employed Persons & NHS Contributions

Employed Persons

Social Insurance is payable on the total income. For 2022 the rate applied to both the employee and the employer is 8.3%.

The employer is also subject to an additional 3.7% of Security Contributions analysed as follows:

- Social Cohesion fund 2%

- Redundancy Fund 1.2%

- Industrial Training fund 0.5%

- NHS for employees is 2.65% & employers contribution 2.90%

In some cases where the employees offer labor in seasonal industries such as construction and tourism the employer may also be responsible for the Holiday Fund at 8% of the gross salary.

For 2022 Social Insurance Contributions are capped to a maximum Amount of Income / Salary of €54,396. Therefore, in the event that an employee earns annual income > €54,396 no social insurance contribution or deduction is due on the excess amount except of Social Cohesion Fund paid by the Employer at the 2% rate ( => i.e Social Cohesion Fund does not have a Cap).

Example on Social Insurance:

If an individuals' salary is €1,500 per month

Employee:

The net salary will be €1,500 – (€1,500 x 8.3%) = €1,375.50 per month.

The social insurance deducted from this salary is €124.50 per month.

1500 * 2.65% =€39.75

Employer:

The employer will have to pay all of the contributions mentioned above (we will assume that the company is exempt from holiday fund since the annual leave is paid from the employer).

Therefore, the total contribution / cost for the employer is 12% (8.3% + 2% + 1.2% + 0.5%) + 2.90% NHS

=> €1,500 * 12% = €180 will be paid to by the employer each month. This will be a Tax Allowable Cost to the Company. Also, NHS 1,500*2.90% = 43.5 euros each month

Self-employed Persons

Self-Employed persons are subject to a contribution of 15,6% of their total income.

NHS for the self-employed is 4% of their own income.

*Same NHS Contributions for employers.

Note:

Each year the Social Insurance Office issues a Tax Table which illustrates the minimum and maximum accepted remuneration range per job description for self employed persons is given. Typically for smaller clients we use the minimum accepted salary based on their job description for Social Insurance Purposes.

B. The "Pay As You Earn" Tax (P.A.Y.E.)

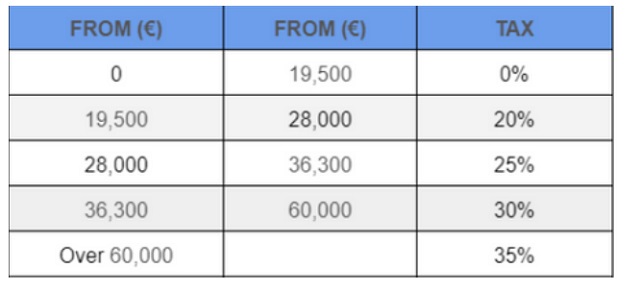

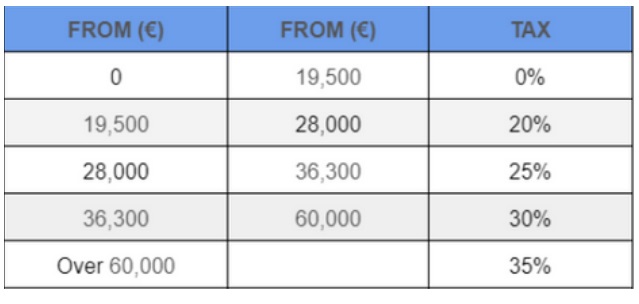

P.A.Y.E. is payable on taxable income (net of all applicable deductions, including Social Insurance) of an individual that exceeds the Cyprus Tax Free amount of €19,500 per annum. After that, the income is subject to bands as mentioned on the below table:

Amount in € Tax Rate % Accumulated Tax in €

P.A.Y.E Calculation - Example 1:

Annual Gross Salary €19,500

Let's assume that the monthly salary of an employee is €1,500 per month payable in 13 installments (i.e including 13th salary). The gross salary per annum is €19,500.

=>This employees' salary is tax free. No P.A.Y.E. is due.

P.A.Y.E Calculation - Example 2:

Annual Gross Salary €65,000

Let's assume that the gross salary of an employee per annum is €65,000 after all applicable deductions (including social insurance explained above). Therefore, the tax payable will be calculated as follows:

Income Received Tax rate % Accumulated tax in €

First 19,500 0 0

From 19,501 - to 28,000 20 1,700

From 28,001 - to 36,300 25 3,775

From 36,301 - to 60,000 30 10,885

From 60,000 - to 65,000 35 1,750

=> TOTAL TAX DUE 12,635 (1,750+ 10,885 (accumulated up to Euro 60,000)

----------------------------------------------------------------------------------------------------------

C. Example of Social Insurance & P.A.Y.E Taxes - Typical Real Life Scenario

Annual Gross Salary €36,000

a. Calculation of Social Insurance

Employee: 36,000 * 8.3% = 2,988 / 12 Months = €249 per Month

Employer: 36,000 * 12% = 4,320 / 12 Months = €360 per Month

b. Calculation of NHS

Employee: 36,000 * 2.65% = €952 / 12 Months = €79.33 per Month

Employer: 36,000 * 2.90% = €1,044 / 12 Months = €87 per Month

c. Calculation of P.A.Y.E tax:

Taxable Amount (assuming no other deductions such as life insurance etc)

= Gross Salary 36,000 - 249 * 12 Social Insurance (above) = 33,012

= Salary after deduction 33,012 - 79.33 * 12 NHS (above) = 32,060

Income Received Tax rate % Accumulated tax in €

=> TOTAL P.A.Y.E Deductible = 2,715 per annum (1,700+ 1,015) or 226.25 per month (2,715/12)

=> Monthly Deductions:

Employee: SIC 249 + P.A.Y.E 226.25 = 475.25

Employer: SIC 360

Why use CYAUSE Audit Services Ltd payroll services:

By outsourcing your payroll function to our firm, you are guaranteed:

- Timely and Accurate Payroll Information

- Compliant with all Payroll Tax Amendments

- Saving on the Purchase of a Payroll Software

- Saving on the Training and Error Corrections of the Software

- Highly Qualified and Experienced Staff Payroll Management

- Save time, effort and energy which can be used on more essential functions

Cyause Audit Services Ltd is providing Global Payroll Solutions for your Global Business. Our International networks and associations gave us access worldwide, al you need to do is contact us and we will be able to manage the onboarding process in accordance with the local regulations of each country.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]