- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- in India

- INTRODUCTION AND OVERVIEW

On April 2, 2022, India, and Australia signed the India-Australia Economic Cooperation and Trade Agreement (ECTA).1 The ECTA is an interim arrangement and parties will begin negotiations on a full-fledged free trade agreement in the next 75 days.2

Apart from regular chapters like Trade in Goods and Services, Technical Barriers to Trade, Sanitary and Phytosanitary measures, Temporary Movement of Natural Persons, etc., this time the parties vide certain "side letters" have made broad commitments on wine, organic goods, work, and holiday visa, post-study work visas, etc.

With respect to goods, presently the average customs duty rate for imports to India is 13.8% across goods.3 On the other hand, Australia has maintained a tariff rate of 5%4 on a majority of its tariff lines, and many items are subjected to nil rates.5 Under the ECTA, Australia has offered a nil rate of duty on all tariff lines with 98% of tariff lines being liberalized with immediate effect on items like textiles, leather, footwear, furniture, etc.6 India on the other hand has offered to eliminate duties on 40% of its tariff lines immediately and for another 30.3% in a phased manner over 3/5/7/10 years.7 Further 29.8%8 of tariff lines that were considered sensitive including agricultural items such as dairy, chickpea, wheat, rice, etc. have been excluded from India's commitments.9

It is expected that the ECTA would help in promoting bilateral trade between the parties and would increase the exchange from USD 27.5 billion at present to USD 45-50 billion in comping 5 years.10

This article provides a high-level summary of the key provisions of interim ECTA, specifically highlighting novel trends that are being negotiated by the parties. The article also concludes with some key implications for Indian businesses.

- EMERGING TRENDS

The ECTA, even though interim, has a variety of novel provisions which will promote India's economic goals. Some of these are highlighted below:

- Trade-in Goods

- Parties have agreed on Tariff Rate Quotas (TRQs) for certain items like pears, oranges, almonds, etc.11

- With respect to wine, India has made specific commitments to reduce the rate of customs duties over the span of 10 years depending upon the CIF value.12

- Certain strategic items such as various articles of steel have been subject to a phased elimination of duties over 5 years by Australia.13

- Interestingly, Government procurement has not been excluded from the ambit of this chapter while it is expressly excluded from the ambit of Trade in services.14

- Trade remedies

The ECTA provides that agricultural goods of a party shall not be subjected to the special safeguard duty mechanism.15

- Rules of Origin

In line with the Indian Government's ongoing efforts to curb the misuse of its FTAs, the CEPA:

- Provides additional product-specific rules applicable to certain strategic items.16

- Provides for retrospective issuance of certificates of origin.17

- Makes preferential treatment subject to a verification process prescribed under Article 4.25 of the ECTA.18

- Requires the issuing authority and (exporter/producer/manufacture) to maintain records for a period of 5 years, as well as importers to maintain records in line with the laws and regulations of the importing Party.19

- Appoints the Department of Commerce as the competent authority for the issuance of certificates of origin.20

- Mutual Recognition in the Pharmaceutical Sector

Parties have dedicated a separate annexure to pharmaceuticals products to address technical barriers faced by the pharmaceutical industry. Parties have agreed that the relevant "Therapeutic Goods Regulator"21 of each party shall recognize reports from a regulatory authority which the party considers comparable, for the purposes of pre-market evaluation, quality assessment, etc. of the products manufactured in the territory of the other party.22

- Trade-in Services

A separate chapter has been introduced to facilitate the temporary movement of representatives of parties who are engaged in trade in goods, the supply of services, or the conduct of investment.23 Both the parties permit temporary movement for businessmen, installers and servicers, independent professionals, etc.24 Australia in its commitments has allowed temporary entry and stay to around 1800 professional Indian traditional chefs and yoga instructors under the category of Contractual Service Suppliers.25 Further, the following industries have been given specific emphasis under this head-

- Parties have agreed to allow financial institutes of other party in their territory. The parties might have taken this initiative to promote trade between both parties in local currencies.26

- Parties have agreed to provide access to public telecommunication, network, or services to service providers, which will include providing reasonable roaming rates.27

- Parties have decided to encourage recognition of professional qualifications and experience, registration, and licensing of professionals, including through mutual recognition to facilitate trade in professional services.28

- Parties have decided that any decision or requirement under the foreign investment framework of each party shall not be subjected to dispute settlement.29

- Institutional Mechanisms for Cooperation

The ECTA envisages the creation of various dedicated bodies to promote specific areas of engagement. For instance,

- Establishing a Joint Committee that will assess, review and monitor the implementation of the ETCA.30

- A Subcommittee on Trade in Goods will be set up to promote trade in both agricultural and non-agricultural goods and to address non-tariff barriers.31

- A Subcommittee on Trade in Services will be set up to facilitate trade in services between the parties.32

- A Joint Technical Subcommittee on Rules of Origin and Customs Procedures and Trade Facilitation will be set up to oversee any issues arising with respect to Rules of Origin or Customs Procedures and Trade Facilitation33

- A Working Group on the Temporary Movement of Natural Persons will be established to monitor and facilitate the temporary entry of each Party's respective34

- Professional Services Working Group is to be established for effective implementation and administration of systems for the recognition of qualifications, licensing, and registration procedures across professional services and services in regulated or licensed occupations.35

- Dispute Resolution

- In line with the India-Mauritius CECPA, the ECTA incorporates detailed provisions on dispute resolution, including with respect to rules of procedure.36 In the past, dispute resolution provisions of India's FTAs have remained largely unutilized. However, considering the ongoing stalemate concerning WTO dispute settlement at the WTO, cohesive dispute settlement mechanisms in India's FTAs may present an alternative mechanism to resolve trade disputes bilaterally.

- Side letters

- Strengthening bilateral cooperation on trade in wine by providing details on the customs procedure, regulatory procedure, certification requirement, etc.37

- Promoting organic goods trade by exchanging information related to certification, control systems, etc.38

- Parties agreed on a work-based immigration route for a post-study work visa.39

- The government of Australia has agreed to amend its taxation law to resolve the issue of double taxation.40

- Work and holiday visas to promote youth mobility for people aging between 18 to 31.41

- Establishing a working group to examine issues related to market access, maturation rules, etc. for whiskey and other alcoholic beverages.42

- India has agreed to give MFN status to wines imported from Australia.43

- IMPLICATIONS FOR BUSINESSES

Currently, India is Australia's 9th largest trading partner and Australia is the 17th largest trading partner for India.44 India has a surplus in services export and a deficit in merchandise exports as India imports coal in bulk from Australia.45

It is expected that the ECTA will further facilitate trade between the two countries and will provide better access to the Australian Market for pharmaceutical, clothing and apparel, and leather industries.46 The Australian government has agreed to a nil rate of customs duties for almost all the items from the date of implementation of ECTA.47 Limited items for which duty will be phased out over a span of 5 years are certain steel items covered under Chapters 72 and 73 of the Customs Tariff.48 Thus, there is a significant concession for various industries.

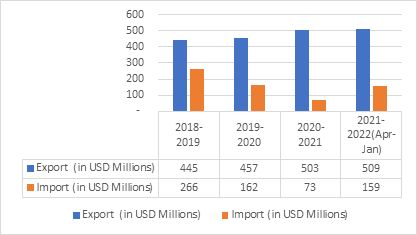

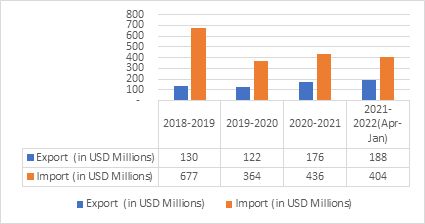

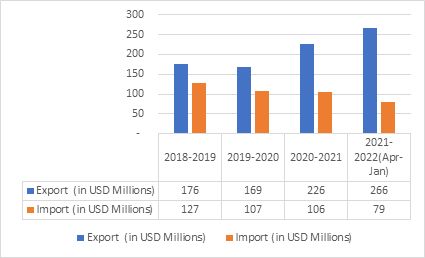

India-Australia Trade Statistics

India-Australia trade in goods is presently stands at about USD 19.23 Billion for the period of April 2021 to January 2022. Due to the trade agreement between the two nations, trade is expected to grow significantly in the next five years.

|

Trade Statistics |

Remarks |

|

Minerals and Ores:

|

India, which is a net importer of minerals and ores (largely coal), is currently subject to a 10% duty (excluding cesses) in India. The elimination of tariffs is likely to benefit the power and metal sectors where coal is consumed. |

|

Textile and related products

|

India is present as a net exporter of textile and related articles. The agreement proposes to eliminate tariffs on textile products which are presently subject to 0 to 5%. Accordingly, the Indian textile sector (which is competing with other Asian nations) is likely to benefit from such tariff eliminations. |

|

Chemicals and Fertilizers:

|

India is a net importer of products in the chemicals and fertilizers sector from Australia. Tariff concessions on some of these products under the chemicals and fertilizers sectors. For eg., Urea is likely to be in short supply in India49. The tariff concessions are likely to benefit the agriculture sector in India reducing the costs. |

|

Pharmaceutical Sector:

|

The agreement has provided a path for mutual recognition of pharmaceutical products. This paves a way for the Indian pharma sector to increase its exports to Australia. |

|

Steel and Iron sector:

|

Certain tariff eliminations for steel have been provided under the agreement. The Indian steel industry is likely to benefit from the proposed reduction of tariffs. |

However, for pharmaceutical industries, the Australian government

already has a nil rate for almost all items even without the

ECTA.50 Further, the annexure on Pharmaceuticals is

limited to broad level commitments with respect to market access,

without hashing out the details.51 It may be likely that

further details will be provided in the finalized agreement.

Further, it is being anticipated that visa negotiations will facilitate the immigration and mobility of people across borders. However, the Australian government used to issue temporary52 and post-graduation53 work visas to Indian citizens even before this ECTA. It is pertinent to note that the Australian government issues post-study work visas to British and Hong Kong nationals for 5 years54 as compared to Indian citizens who are issued 2-, 3- or 4-years visas depending upon their degree. There is no indication of an increase in the visa period under the ECTA, however, it remains to be seen whether the final agreement will shed more light on this issue.

Notably, India has chosen to keep certain sensitive goods out of the purview of its commitments. Goods55 such as dairy, live animals, certain meat, fruits, and vegetables, have been kept out of the purview of India's commitments. The Government's position with respect to these goods was similar under the UAE CEPA56. India has further agreed to promote and cooperate by providing all the relevant customs and regulatory details that may be required to strengthen the trade of wine.57

Even though the ECTA is interim at present, it has already provided substantial concessions for various industries like textile, leather, etc., and included various factors to promote trade in services while further clarity with respect to other issues such as non-tariff barriers is awaited. The holistic impact of the ECTA will become clearer once the final agreement is revealed.

Footnotes

1. India, Australia set up committee to start negotiations for expanding interim pact into CECA, The Economic Times, 03 April 2022, available at: https://economictimes.indiatimes.com/news/economy/foreign-trade/india-australia-set-up-committee-to-start-negotiations-for-expanding-interim-pact-into-ceca/articleshow/90626218.cms?from=mdr

2. India may get access to $10-billion Australian government tenders, The Economic Times, 04 April 2022, available at: https://economictimes.indiatimes.com/news/economy/foreign-trade/india-may-get-access-to-10-billion-australian-government-tenders/articleshow/90631268.cms

3. India - Import Tariffs, Privacy Shield, available at: https://www.privacyshield.gov/article?id=India-Import-Tariffs#:~:text=According%20to%20the%20latest%20WTO,WTO%20latest%202017%20data%20available).

4. WTO updated on Australia Tariffs and imports, available at: https://www.wto.org/english/res_e/statis_e/daily_update_e/tariff_profiles/AU_E.pdf

5. Import Tariff, Australia Custom Tariff Schedule No. 3, Section VI, Chapter 30, available at: Chapter 30 (abf.gov.au)

6. India's trade pact with Australia will click: It ticks the right boxes, LIVEMINT, 04 April 2022, available at: https://economictimes.indiatimes.com/news/economy/foreign-trade/india-australia-set-up-committee-to-start-negotiations-for-expanding-interim-pact-into-ceca/articleshow/90626218.cms?from=mdr

7. Id.

8. Id.

9. See. Annexure 2A, Schedule of Tariff Commitment of India on Trade in Goods of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

10. Supra Note 1, at 1.

11. See. Annexure 2A, Notes for Specific Tariff Schedule Of India of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

12. See. Annexure 2A, Schedule of Tariff Commitment of India on Trade in Goods of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

13. See. Annexure 2A, Schedule of Australia of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

14. Article 8.2, Chapter 8 Trade in services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

15. Article 3.10, Chapter 3 trade Remedies of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

16. For instance, all items of chapter 72 which covers iron and steel products "melt and pour" condition needs to be satisfied to receive preferential treatment. See. Annex 4B (Product Specific Rules of Origin), of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

17. Article 4.16, Chapter 4 Rules of Origin of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

18. Article 4.29, Chapter 4 Rules of Origin of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

19. Article 4.21, Chapter 4 Rules of Origin of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

20. Article 4.1, Chapter 4 Rules of Origin of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

21. Defined as - "for Australia, the Therapeutic Goods Administration (TGA) of Australia, or its successor; and for India, the Central Drugs Standard Control Organisation (CDSCO), or its successor. See. Annex 7A, Pharmaceuticals, of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

22. Annex 7A, Pharmaceuticals of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

23. Chapter 9 Temporary Movement of Natural Persons of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

24. Annex 9A, Schedule of specific commitments of Australia/ India of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

25. Annex 9A, Schedule of specific commitments of Australia of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

26. Annex 8A, Financial Services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

27. Annex 8B, Telecommunications services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

28. Annex 8C, Professional Services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

29. Annex 8D, Foreign Investment Framework of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

30. Chapter 12, Administrative and Institutional Provisions of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

31. Article 2.12, Chapter 2 Trade in Goods of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

32. Article 8.24, Chapter 8 Trade in Services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

33. Article 4.32, Chapter 4 Rules of Origin of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

34. Article 9.8, Chapter 9 Temporary Movement of Natural Persons of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

35. Article 8C.9, Annex 8C Professional Services of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

36. Chapter 13 Dispute Settlement of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

37. India letter dated 02 April, 2022, available at https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-wine-india-to-australia.pdf

38. India letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-organics-india-to-australia.pdf

39. India letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-post-study-work-india-to-australia.pdf

40. India letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-taxation-india-to-australia.pdf

41. India letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-work-and-holiday-visas-india-to-australia.pdf

42. Australia letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-whisky-australia-to-india.pdf

43. Australia letter dated 02 April, 2022, available at: https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-wine-most-favoured-nation-australia-to-india.pdf

44. From Textiles and Pharmaceuticals to Healthcare and Education: Here is how the India-Australia trade ECTA benefit India, opindia.com, dated 02 April 2022, available at: https://www.opindia.com/2022/04/here-is-how-the-india-australia-trade-ECTA-will-benefit-india/

45. Id.

46. Id.

47. See. Annexure 2A, Schedule of Australia of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

48. Id.

49. From India to South Korea, this chemical is in short supply available at https://economictimes.indiatimes.com/small-biz/trade/exports/insights/from-india-to-south-korea-this-chemical-is-in-short-supply/articleshow/88135285.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

50. Import Tariff, Australia Custom Tariff Schedule No. 3, Section VI, Chapter 30, available at: Chapter 30 (abf.gov.au)

51. Annex 7A, Pharmaceuticals of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

52. Business Innovation and Investment (Provisional) visa, Australian Government, Department of Home Affairs; available at: https://immi.homeaffairs.gov.au/visas/getting-a-visa/visa-listing/business-innovation-and-investment-188

53. Temporary Graduate Visa, Australian Government, Department of Home Affairs; available at: https://immi.homeaffairs.gov.au/visas/getting-a-visa/visa-listing/temporary-graduate-485

54. Id.

55. See. Annexure 2A, Schedule of Tariff Commitment of India on Trade in Goods of India- Australia ECTA, available at: https://www.dfat.gov.au/trade/ECTAs/negotiations/aifta/australia-india-ecta-official-text

56. Details of export made by UAE to India in the year 2020 available at: https://tradingeconomics.com/united-arab-emirates/exports/india

57. India letter dated 02 April, 2022, available at https://www.dfat.gov.au/sites/default/files/aiecta-side-letter-wine-india-to-australia.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.