Fraud recovery – Fraud +

Fraud and asset theft is destructive and costly for any business, state entity or individual. Whether you are a business or individual that has been defrauded or a new government that is seeking to recover stolen funds from former corrupt officials, we have designed a strategy to help secure a recovery.

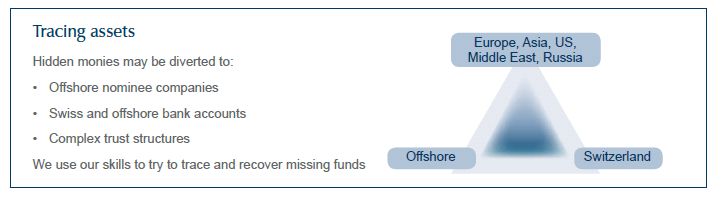

Complex fraud often requires co-ordination between the world's financial centres to trace and recover assets across jurisdictions. This may involve Europe, the US, Russia, the CIS, Asia, Africa, the Middle East and the offshore territories, with adept fraudsters hiding assets through a trail of complex companies, nominees and trusts based offshore. Unravelling the layers used to conceal assets requires persistence, commitment and expertise.

Withers' fraud experts are ruthless in their determination to trace and recover stolen funds and assets across the globe wherever they may be hidden. Our team has a formidable reputation having been involved in many of the largest fraud cases, including Bernard Madoff, Saini Abacha (former President of Nigeria) and a US$9 billion alleged fraud in the Middle East relating to the Algosaibi family.

We have designed a strategy to help secure and maximise any recovery. We call it Fraud +. Our approach is staged to first identify the location of assets, prior to taking swift action to preserve assets preventing dissipation, before seeking a financial recovery on behalf of our clients.

Key features

- Find out what happened, and move to secure and protect assets to enable later recovery.

- We can conduct an investigation in order to understand the fraud. Our investigation work is covered by "legal professional privilege" which typically prevents enforced disclosure of damaging and confidential documents into the public domain.

- If appropriate, we take co-ordinated legal action in jurisdictions worldwide to obtain a timely and effective recovery.

- Use of search and seizure orders, third party disclosure orders to reveal concealed and hidden assets, and freezing orders to prevent asset removal, as appropriate.

- We adopt a commercial approach to maximise any recovery1, whilst balancing the financial investment required.

- We can assemble a multi-discipline team and have relationships with IT analysts, forensic accountants and corporate investigators to try to reveal hidden assets.

- If required, we can provide or obtain advice on parallel criminal proceedings, insolvency aspects and handling the media.

Areas of expertise

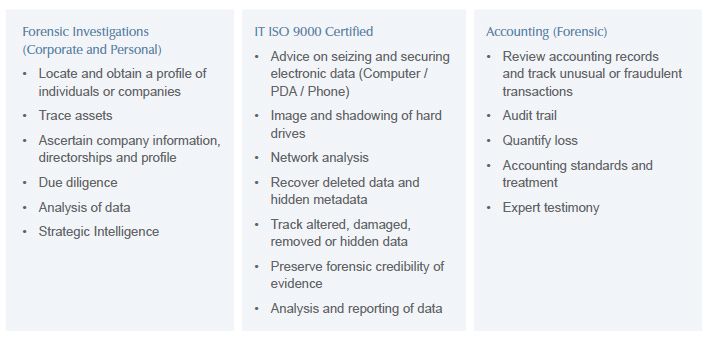

Our "FITA" approach – Forensic, IT, Accounts If the circumstances require, and if it becomes part of our retainer, we can utilise all or one of the following additional resources in conjunction with our partner firms:

About us

- Global law firm with ten offices worldwide in London, New York, New Haven (US), Greenwich (US), Hong Kong, Singapore, Milan, Geneva, Zurich and the British Virgin Islands.

- Fraud and asset tracing experts with a strong track record of unlocking assets hidden in offshore companies, structures or trusts to secure a financial recovery. Our professionals have worked on many of the largest fraud cases including Bernard Madoff, BCCI, President Abacha of Nigeria and Maan Al Sanea.

- First class global litigation team recognised as leaders in their field. Ability to draw upon significant specialist process and knowledge resources from over 700 staff worldwide.

- The only large international 'onshore' law firm with an office based 'offshore' and permanent lawyers located in Switzerland and the British Virgin Islands. Ability to act for and against banks, combined with a track record of working in the financial services field. This emphasises the strength of our fraud credentials. We are uniquely placed in this respect as we have offshore lawyers on the ground who are fraud experts.

- A market leading trust practice with the experience to attack and unravel sham trusts. Rated by the Legal 500 as one of the leading contentious trust firms and described as "legendary in this area".

- Winner of the "North American Team of the Year Award" and the "Contentious Trusts and Estate Team of the Year Award" at the STEP Private Client Awards 2009/2010.

- We operate a number of geographical interest groups bringing together lawyers with particular interest in Russia, the CIS, Africa, the Middle-East, Latin America, Asia, Italy and Cyprus.

Fraud Case Highlights

- We represented the liquidators of Kingate Global Fund Limited (in Liquidation) and Kingate Euro Fund Limited (in Liquidation) (the 'Funds'). The Funds were some of the largest institutional investors into Bernard L Madoff Investment Securities LLC (so called 'feeder funds'). As a consequence of the Madoff fraud, they suffered huge losses in excess of US$1 billion leading to the Funds' liquidation.

- We represented AHAB, a Saudi Arabian partnership, both in England and the BVI in their defence of 6 banks' claims which arise out of a huge alleged global fraud in excess of US$9 billion against AHAB in British Arab Commercial Bank ('BACB'), Arab Banking Corporation, ABC Islamic Bank, CACIB, HSBC & HSBC Middle East and BNP Paribas v Ahmed Hamad Algosaibi and Brothers Company ('AHAB').

- We represented a hedge fund administrator in defence of two multi million dollar claims relating to breach of duty brought by the liquidator and investing shareholder in a fraudulent hedge fund.

Footnotes

1 Success is dependent upon the merits of the claim, upon which we will advise.

2 StAR is a joint venture between the World Bank and the United Nations Office on Drugs and Crime. Estimates are that between $20 to $40 billion of corrupt money and bribes are received by public officials from developing and transition countries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.