A New Environment

The influx of regulatory initiatives in the UAE is having the dual effect of bringing the jurisdiction into alignment with international regulatory standards, while making many Financial Institutions ("FIs") reconsider their cost of capital / cost of funding, and reposition themselves in relation to risk, governance, compliance and associated costs.

Included in the multiple regulatory changes that have been implemented are the Basel III requirements, where the international framework has been adapted (as is the case in various jurisdictions), based on the UAE regulatory priorities and financial stability considerations.

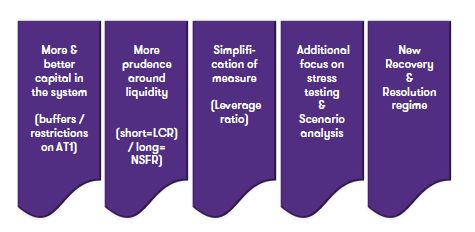

The Basel III framework, came as a reaction to the 2008 Financial Crisis; as such, it introduced many new "constraints" and various layers of additional analytical and reporting requirements. Amongst other things, the framework requires key areas of regulatory adoption, as listed below:

In the UAE, the new regulatory reality needs to be taken into account, in parallel to other constraints related to the region and macroeconomic cycle.

These include the opportunity cost related to the additional capital buffers required, the impact of sustained low oil price on the availability of liquidity, the drop in interest rate –and resulting lower yield on assets, the rise of non-performing loans and impairment–particularly within the context of a softer real estate market, and the risks from financial crime activities.

The Basel III implementation, holding everything else constant, has generally meant a higher cost of funding / capital and lower returns;

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.