1. INTRODUCTION

In a meeting on 6 November 2019, the Federal Council decided that the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA), together with the corresponding ordinances, will enter into force on 1 January 2020. On the same date, the definitive text of the respective ordinances, the Financial Services Ordinance (FinSO) and the Financial Institutions Ordinance (FinIO), was published. The amended text of the ordinances addresses numerous open questions regarding the transitory provisions.

This newsletter provides an overview of the transitory provisions of the FinSA and FinIA, with a strong focus on their impact on the Collective Investment Schemes Act (CISA). It is not intended to cover all particular aspects of the transitory provisions.

1.1 Why transitory provisions?

Transitory provisions exist mainly where the implementation of the new laws is more complex for the market participants. While most of the FinSA provisions are subject to transitory provisions due to the fact that they mainly entail new obligations, the FinIA provisions will be applicable as from 1 January 2020, except where financial institutes are confronted with a new licence or new licensing requirements.

1.2 General implications of transitory provisions

Most of the transitory provisions of the FinSO will apply for two years after its entry into force. This had already been anticipated by the Federal Department of Finance (FDF) on 9 September 2019. However, the industry was still awaiting the more specific transitory provisions as the initial drafts of the FinSO and the FinIO did not provide the required level of detail.

In principle, provisions which are subject to transitory provisions can, in the absence of specifications to the contrary, be voluntarily applied as from 1 January 2020. However, several transitory provisions prevent so-called cherry picking by linking the applicability of certain new provisions to the application of others. It is therefore advisable to make checks and balances of the whole package before deciding when to implement them.

1.3 Terminology

Before discussing the subject matter, it is worth clarifying some definitions. When referring to old or previous in connection with a legal provision, we actually mean the version prior to implementation of FinSA and FinIA. Therefore, when reference is made to a revised or new provision, we mean the FinSA and FinIA provisions, including the corresponding amendments made by them to other laws.

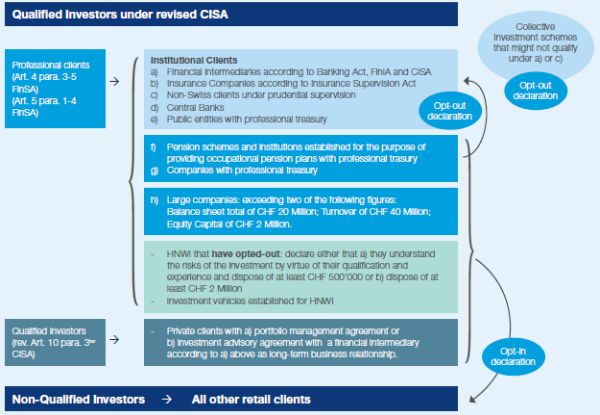

The definition of Qualified Investor and Non-Qualified Investor for the purposes of CISA is made with reference to the client segmentation in the FinSA. In order to avoid lengthy definitions and explanations of the client segmentation, the overview below shows more clearly which groups of clients exist and how the definitions of FinSA and CISA are interconnected.

2. TRANSITORY PROVISIONS

2.1 Rules of Conduct, Organizational Measures, Client Segmentation and Basic Training

The transitory period lasts for two years from the date FinSO enters into force, i.e. it starts on 1 January 2020 and ends on 31 December 2021. As outlined in the explanatory report of the Federal Department of Finance on the FinSO and FinIO dated 6 November 2019, it may not be advisable for new players starting their activities after 1 January 2020, to use the transitory provisions, but instead to start implementing the new provisions directly. However, according to the law, all players will have the same right to apply the transitory provisions, including new market players.

The FinSA rules of conduct, organizational measures, client segmentation and basic training duties for client advisors are interdependent to some extent as it will be outlined below. Even though there is no express obligation to implement all of these rules, measures and duties at the same time and the explanatory documentation on the final text of the FinSO and FinIO refers explicitly to the possibility of implementing the rules of conduct separately from the organizational measures, a careful analysis needs to be carried out to determine in which instances a staggered implementation is reasonable for the financial services provider in question.

First of all, the client segmentation (Art. 4 FinSA and 103 FinSO) is, from a practical point of view, a precondition for the application of the rules of conduct, even if the rules of conduct can also be complied with by treating all clients as retail clients as provided by Art. 4.7 FinSA. Provided that the definition of Qualified Investor according to the revised CISA refers to the FinSA, the new definition of Qualified Investor can only be used if the client segmentation of the FinSA is applied.

Furthermore, in our view a staggered implementation rules of conduct according to Art. 7-18 FinSA and organizational measures according to Arts. 21-27 FinSA during the transitory period is only worth consideration if the old CISA and the old Stock Exchange and Securities Trading Act (SESTA) rules of conduct do not apply, as outlined below.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.