The S&P Healthcare Services Index decreased by 3.0% over the last month, while the S&P 500 decreased by 6.6% over the same period.

Over the past month, the best performing sectors were Government Managed Care (up 10.1%), Specialty Managed Care (up 5.4%) and Healthcare REITs (up 5.3%). The sectors experiencing the most decline were Hospital Vendors (down 15.5%), Dialysis Services (15.1%) and Providers – Other (10.8%).

The current average LTM revenue and LTM EBITDA multiples for the Healthcare Services industry overall are 2.27x and 15.1x respectively.

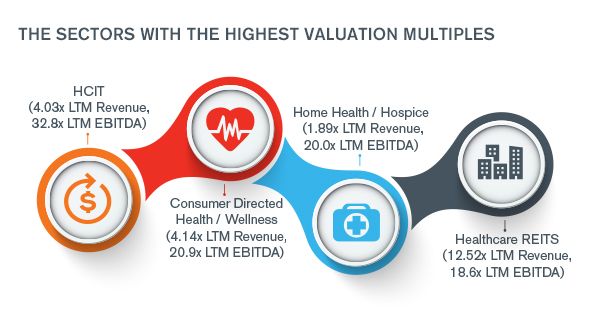

The sectors with the highest valuation multiples include:

- HCIT (4.03x LTM Revenue, 32.8x LTM EBITDA)

- Consumer Directed Health / Wellness (4.14x LTM Revenue, 20.9x LTM EBITDA)

- Home Health / Hospice (1.89x LTM Revenue, 20.0x LTM EBITDA)

- Healthcare REITS (12.52x LTM Revenue, 18.6x LTM EBITDA)

Read the report for more detail on sector activity.

Download: Healthcare Services Sector Update – May 2019.pdf (0.2) MB

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.