On November 2, 2017, the Internal Revenue Service ("IRS") updated its frequently asked questions ("FAQs") regarding Employer Shared Responsibility Payments ("ESRPs") under section 4980H of the Internal Revenue Code ("IRC 4980H") enacted by the Affordable Care Act ("ACA"). Although the IRS began collecting information from Applicable Large Employers ("ALEs") needed to assess ESRP liability beginning in 2015 (via mandatory Form 1094-C and 1095-C filings due in early 2016), it has not yet imposed any liability for ESRPs. That collection process will, however, start in "late 2017", according to the newly issued FAQs.

Background on ESRPs Under the ACA

The ACA established two types of ESRPs under IRC 4980H that might apply to an ALE (which is generally an employer with fifty or more full-time or full-time equivalent employees in the preceding calendar year):

- the "a" penalty (under IRC 4980H(a)) if the ALE fails to offer minimum essential health coverage to at least ninety-five percent of its full-time employees (and their dependents) and at least one full-time employee receives an ACA premium tax credit for purchasing coverage through the ACA Health Insurance Marketplace; and

- the "b" penalty (under IRC 4980H(b)) if the ALE offers minimum essential health coverage to at least ninety-five percent of its employees (and their dependents), but at least one full-time employee receives an ACA premium tax credit either because the ALE's coverage is not "affordable" or does not provide "minimum value" within the meaning of the ACA, or because the employee was not within the ninety-five percent of the employees who received the offer for minimum essential health coverage.

ESRPs are generally assessed on a monthly basis. When determined annually, however, the amount of the ESRPs owed for 2015 under IRC 4980H(a) are $2,080 for each full-time employee of the ALE in excess of 30, and the amount of the ESRPs owed for 2015 under IRC 4980H(b) are $3,120 for each full-time employee who receives an ACA premium tax credit. The amount of the ESRPs under IRC 4980H(a) and (b) are adjusted for inflation for calendar years after 2015.

Update on Procedures for Assessment of ESRPs

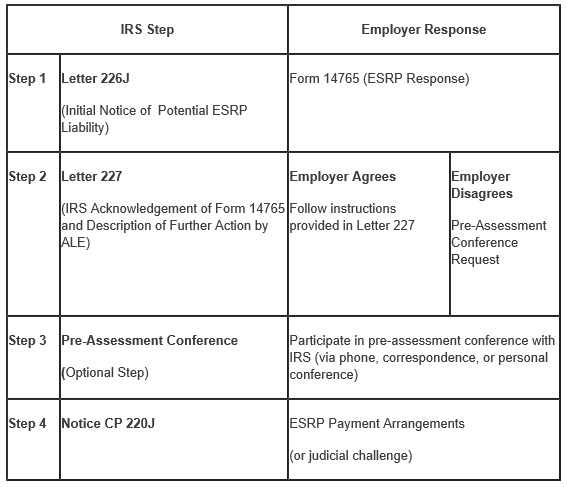

Through recent updates to its online FAQs, available here, the IRS has clarified how liability for ESRPs will be assessed - beginning in late 2017 for ESRPs owed for 2015. According to the guidance, the assessment process will consist of up to four steps, described below.

Step 1: Letter 226J. If the IRS determines that, for at least one month in the year, one or more of an ALE's full-time employees was enrolled in an ACA Health Insurance Marketplace for which a premium tax credit was allowed (and the ALE did not qualify for an affordability safe harbor or other relief for the employee), the IRS will issue "Letter 226J" (Initial Notice of Potential ESRP Liability) to the ALE. Letter 226J will provide the ALE with certain information, including the following:

- A brief explanation of IRC 4980H;

- A table itemizing the proposed payment by month and indicating for each month if the liability is under IRC 4980H(a) or IRC 4980H(b) or neither;

- An explanation of the itemized table;

- An employer response form called the Form 14764, "ESRP Response";

- A list, by month, of each full-time employee who received a premium tax credit and did not qualify for any relief and certain other explanatory information;

- A description of the actions the ALE should take if it agrees or disagrees with the proposed ESRP; and

- A description of the actions the IRS will take if the ALE does not timely respond to the Letter 226J.

Upon receiving Letter 226J, the ALE has an opportunity to respond before any liability is assessed. The ALE must generally respond to Letter 226J within thirty days of the date of the letter, using Form 14764. If a response is not timely filed, it appears that the IRS may proceed to Step 4 below.

Step 2: Letter 227. After receiving Form 14764 from the ALE, the IRS will issue "Letter 227." According to the FAQs, there are five variations of Letter 227. The version that is issued to the ALE will presumably depend upon the Form 14764 response filed by the ALE but will generally acknowledge the ALE's response and describe further actions the ALE may need to take. Upon receipt of Letter 227, the ALE may request a pre-assessment conference with the IRS Office of Appeals. Alternatively, the ALE may agree with the ESRP, or do nothing, in which case the IRS will presumably proceed to Step 4 below.

Step 3: Pre-Assessment Conference Request. An ALE must generally request a pre-assessment conference with the IRS Office of Appeals within 30 days of receiving Letter 227, following the instructions provided in the letter and IRS Publication 5 (Your Appeal Rights and How To Prepare a Protest if You Don't Agree). According to IRS Publication 5, a pre-assessment conference may be conducted by correspondence, phone, or a personal conference.

Step 4: Notice and Demand for Payment. If the IRS determines that the ALE is liable for the ESRPs (following any of the preceding steps), it will assess the ESRP and issue a notice and demand for payment, Notice CP 220J. This notice will contain information as to how to make payment of the ESRP liability. ALEs will not be required to include the ESRP on any tax return that they file, or to make payment of the ESRP, unless and until Notice CP 220J is issued.

These steps for the assessment of ESRP liability are summarized below.

Given the relatively short time period that an ALE will have to respond in the event it receives Letter 226J from the IRS regarding potential ESRP liability for 2015, ALEs should ensure that the information that was filed on Forms 1094-C and 1095-C for 2015 is readily accessible (either internally or through their ACA reporting vendors). For any assistance in preparing a response to the IRS, you may contact any member of the Employee Benefits and Executive Compensation Group at Troutman Sanders.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.