Our recent reports on the value of Jersey to Britain and Europe highlighted the role that globalisation is playing as a driver for change and how it's impacting cross-border investment flows.

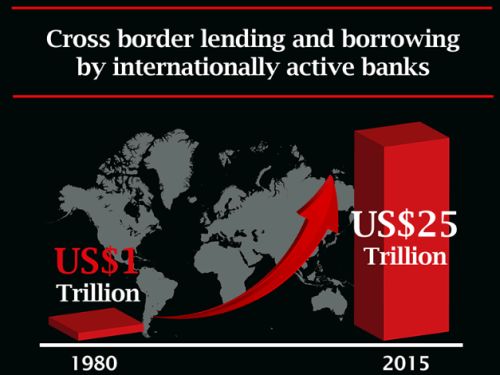

Did you know that over the past 30 years, world output has grown at an average rate of 2.8% a year and cross border trade by 7.9% each year? Trade now accounts for 31% of global GDP compared to under 20% 30 years ago.

So, what does this mean for capital flows?

Globalisation is making capital flow more freely as trade between countries gets larger and people become more mobile. This provides the investments needed to promote higher rates of economic growth and prosperity. Individuals and corporations are more willing and able to make cross-border investments, whether that be economic investment in fixed capital, or financial investment through the purchase of financial assets.

Buying financial assets such as bonds and shares is a major source of corporate finance directly supporting economic investments. Trading them on secondary markets allows investors in primary markets to sell their investments when it suits them, reducing the cost of financing for companies. It also makes it easier to attract foreign capital, with global investors buying and selling assets when they choose. So these thriving secondary markets are essential for attracting foreign investment which can then foster longer-term investment.

So how does Jersey help facilitate this longer-term investment?

Jersey is an international finance centre for funds, trust and other vehicles for holding and managing investments, as opposed to engaging in speculative activities associated with short-term trading markets.

The shape of the global economy is changing with a greater share of global wealth held by those in emerging markets, or ‘transitional economies’. These economies may lack political stability or robust legislation, which is where well-regulated international finance centres (IFCs) like Jersey can play a key role. Elsewhere, with increased globalisation of capital, labour, business and tax, Jersey can ably facilitate the effective functioning of global capital and labour markets.

Our credentials as a leading IFC have been endorsed by many, including the IMF, OECD and EU and we remain at the forefront of international developments to improve transparency. These regulatory measures and our consistent performance help build our presence as a world-class finance centre.

So as the world gets smaller, Jersey the IFC continues to grow, broadening and deepening existing relationships with global trade partners and forging new alliances for future growth.

You can read more about our transparency measures and role in cross-border flows in our Value to Britain and Value to Europe reports.

Linkedin - www.linkedin.com/company/jersey-finance

Twitter - @jerseyfinance

Youtube - www.youtube.com/jerseyfinance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.