Introduction

Following the general election on May 5, 2015, Alberta's new government moved swiftly to strike a panel (the Panel) to review and recommend changes to Alberta's oil and gas royalty framework.

The Panel consisted of four members, drawn from a variety of backgrounds, who were given a mandate to produce a report (the Report) that would provide recommended changes to the royalty framework in order to: (a) provide optimal returns to Albertans as owners of the resource; (b) continue to encourage industry investment; (c) encourage diversification opportunities such as value-added processing, innovation or other forms of investment in Alberta; and (d) support responsible development of the resource. The Report was made public on January 29, 2016.

We anticipate the Alberta government will implement legislative and regulatory changes in the coming months to give effect to the Panel's recommendations. Until these legislative and regulatory changes are implemented, the Panel's recommendations will not have the effect of law.

New "modernized" Alberta royalty framework

In the Report, the Panel made four overarching recommendations. These recommendations were to:

1. Establish guiding principles and design criteria for Alberta's royalty framework;

2. Modernize Alberta's royalty framework for crude oil, liquids and natural gas;

3. Enhance the royalty process for the oil sands; and

4. Seize opportunities for value-added processing.

With respect to the first two recommendations, the Panel found that Alberta's existing royalties were comparable with those in international jurisdictions; however, certain issues should be addressed for crude oil, liquids and natural gas. The Panel therefore proposed a new modernized Alberta royalty framework (the New Framework). This New Framework will only apply to "new wells" drilled on or after January 1, 2017. The current Alberta royalty framework will continue to apply to "old wells" drilled prior to January 1, 2017 for a period of ten years, starting January 1, 2017. After expiry of the ten-year period, old wells will fall under the New Framework. The Panel also recommended that two existing government drilling incentive programs—the Natural Gas Deep Drilling Program and Emerging Research & Technology Initiative—be extended to cover all wells drilled to the end of 2016.

The New Framework will apply to crude oil, liquids and natural gas, and royalties will be determined on a "revenue-minus-costs" basis. This represents two significant changes from the current royalty framework. One significant change is the adoption of the concept of "payout", similar to the existing bitumen royalty framework, and the corresponding requirement for producers to pay a reduced royalty rate pre-payout. The other significant change is the move away from the categorization of a well as being either an oil well or a gas well, with different royalties applicable to each category. This differing treatment of oil wells and gas wells, and the difficulty, in some cases, in determining such classification, gave rise to a lack of clarity in the existing royalty framework. Under the New Framework, the same royalty calculation applies to both oil wells and gas wells, so the need to make the determination is now obviated.

The cost component of the New Framework will be based on a Drilling and Completion Cost Allowance (C*, pronounced "C-star") formula for each well. The C* formula will be based on the industry average drilling and production cost for any new well (the Alberta Capital Cost Index), which will be set by the Alberta Energy Regulator (the AER). In order to determine the Alberta Capital Cost Index, producers will be required to report on their actual capital costs to the AER. The AER will use this information to set the Alberta Capital Cost Index for each year, starting in 2017. The Alberta Capital Cost Index will be applied on a go-forward basis to new wells only. When drilling a new well, producers will input the well's vertical depth and lateral length into the C* formula to determine that well's C*.

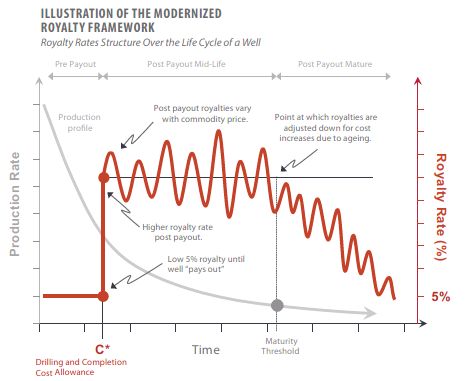

Producers will pay a flat royalty rate of 5 percent of gross revenue from a well until the well reaches payout. Payout for a well is defined as the point at which cumulative revenue equals C*. After payout, producers will pay an increased post-payout royalty on revenue. This increased royalty will be determined by reference to the current commodity prices of the various hydrocarbons, using the "Price Function". Similar to the current royalty framework, the post-payout royalty rate will vary according to the Price Function for the remaining life of the well. Once production declines below a certain level (the Maturity Threshold), royalty rates will be adjusted downward in proportion to declining production. The following chart, taken from the Report, provides an example of royalties payable over the life of a well under the New Framework.1

The C* formula described above relies on deemed costs and not actual costs incurred by a producer. Efficient producers will reap a significant benefit if their actual operating costs are lower than industry standard. This is because these producers will continue to pay the lower royalty for a period of time after their actual payout, which will occur prior to the C*-based payout.

The Report recommends that a "Calibration Team" be established to finalize the C* calculation, set post-payout rates and determine the Maturity Threshold. The Panel recommended that the Calibration Team's work should be completed by March 31, 2016, in order to give producers time to set budgets for 2017.

For bitumen, the existing pre-payout royalty rate of 5 percent and post-payout sliding scale rates of 25 - 40 percent will remain in place and unchanged. The Panel did make recommendations to increase clarity, transparency and accountability in relation to calculating deductible costs and payout for oil sands projects.

The Report identified two opportunities for value-added processing that the province should pursue. The first recommended opportunity is to develop a value-added natural gas strategy. This would involve using natural gas to "bridge the gap" in electricity generation while coal powered plants are phased out in favor of renewables. This strategy would also involve using natural gas as an input into other value-added sectors, such as bitumen upgrading, gas-to-liquids processing, fertilizers, and consumer-oriented products such as biomedical equipment and pharmaceuticals.

The Report also recommended that the province should examine opportunities to accelerate the development and commercialization of partial-upgrading and alternative value-creation technologies for bitumen. The Report noted that 50 percent of bitumen produced in the province is already upgraded, and there is likely no market capacity to take additional upgraded bitumen. The Report therefore recommended that partial-upgrading of bitumen, which would result in a medium to medium-heavy grade of oil, may represent an opportunity for creation of a marketable, value-added product. Coupled with emerging technology to leave the heaviest, "bottom of the barrel" bitumen in the ground, this could have the further benefit of improving project economics.

Questions to be answered

Although the Report is very comprehensive, exactly how the proposed changes will be implemented remains to be seen. As draft legislation and regulations have not yet been tabled, the following points remain to be clarified, pending determination by the Calibration Team:

- The sliding scale royalty rates, post-payout, that will apply to hydrocarbons other than bitumen;

- The exact formula that will be used to set C*, including what capital costs variables are included as inputs for this formula; and

- The Maturity Threshold and royalty rate calculation that applies once the Maturity Threshold is met.

Conclusion

At Dentons Canada LLP, we are monitoring developments in this area closely in order to provide our clients with practical analysis and market-leading advice.

Footnote

1 Alberta Royalty Review Panel, Alberta at a Crossroads: Royalty Review Advisory Panel Report (2016) at p. 61.

About Dentons

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Specific Questions relating to this article should be addressed directly to the author.