- within Family and Matrimonial topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Insurance and Healthcare industries

Canadian investors have traditionally been interested in yield-oriented investments. It was this preference that drove the income trust market in Canada to such an extent that the federal government felt that legislative intervention was necessary to stop the conversion of Canadian corporations to income trusts. The targets of the legislative amendments announced on October 31, 2006, were publicly traded trusts and partnerships, which had been allowed to ''flow through'' to investors profits from Canadian businesses and Canadian real estate, effectively eliminating the entity-level tax.

This arrangement created two policy concerns. First, the emphasis on distributable cash undermined situations in which capital reinvestment may have been the more appropriate business objective. Second, when investors were nonresidents or tax-exempt registered plans, there was a potential erosion of the Canadian tax base. The new tax rules, referred to as the specified investment flow-through (SIFT) rules in the Income Tax Act (Canada), were broadly drafted to apply to most intermediary structures when the income subject to flow-through treatment was sourced from either property used in carrying on business in Canada or from Canadian resource properties or Canadian real property.1

This has left open the possibility that some form of conduit structure could be offered to Canadian investors that replicates the earlier income trust structure but generates income from foreign assets. A few different cross-border income trust structures were in fact introduced before October 31, 2006. The market is now considering whether it is time to expand the offering of foreign assets through Canadian initial public offerings (IPOs) of newly established income trusts that have acquired the label of foreign asset income trust (FAIT). Three commodity-based offerings have been completed, at the time of writing, and other deals are being considered.

The FAIT will provide investors with new opportunities to invest in yield-oriented assets, packaged in a familiar income trust investment vehicle. Like other income trusts, the FAIT is structured to qualify as a mutual fund trust (MFT) under the ITA. However, unlike other income trusts, the FAIT will invest only in foreign business assets and consequently should not be subject to the SIFT rules. The combination of MFT status and non-application of the SIFT rules should enable the FAIT to attract registered plan investors by providing a higher yield relative to a similar investment strategy undertaken through a taxable Canadian corporation.

The structuring objectives of a FAIT and the related IPO require the consideration of Canadian and foreign tax implications, integrated with Canadian and foreign securities law requirements. This article will discuss the tax considerations and the business rationale for a Canadian IPO.

Principal Tax Structuring Objectives

From the perspective of the asset owner, a Canadian IPO may have several advantages over a foreign IPO. Generally, the Canadian market is very receptive to mid-market type transactions; it also has a history of assigning a premium to yield investments. Further, a Canadian IPO may take place faster and at a lower cost than a foreign IPO (particularly a U.S. IPO), and ongoing compliance costs may be lower in Canada than in the relevant foreign jurisdiction. The Canadian listing entity may also be structured to qualify for exclusions or exemptions from foreign registration and compliance requirements under relevant foreign securities law and other regulatory statutes. Also, some industry participants may benefit from favorable disclosure rules in Canada.2 Indeed, many international mining and oil and gas companies have already sought out the benefits of listing in Canada: As of the end of 2011, 58 percent of the world's public mining companies were listed on the Toronto Stock Exchange (TSX) and the TSX Venture Exchange, as well as 35 percent of the world's public oil and gas companies.3

From a Canadian income tax perspective, the principal objectives in structuring a FAIT are to ensure that it qualifies as an MFT under the ITA and that it is not subject to the SIFT rules. If those two objectives are satisfied, under current Canadian tax rules the FAIT will not be subject to Canadian income tax for a tax year as long as it distributes all of its taxable income and capital gains for the year to its unit holders.

From a foreign income tax perspective, the principal objectives in structuring a FAIT are to ensure that investors in the FAIT are not subject to foreign tax filing obligations and to minimize any applicable foreign income taxes.

Basic Structuring Options

Recent prospectus filings describe the use of two different FAIT structures.

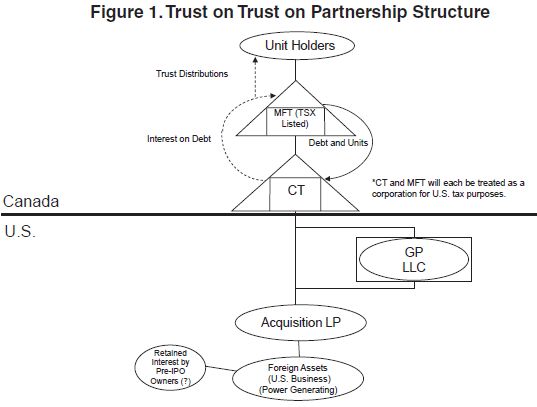

Figure 1 shows a trust on trust on partnership structure.

This is the original FAIT structure and is most closely aligned with the income trust structure Canadian investors were familiar with before the introduction of the SIFT rules. The prospectus for Parallel Energy Trust provides an example of this type of structure.4

The FAIT and the underlying commercial trust are each established as an open-ended limited purpose trust under Canadian law. The FAIT uses the net proceeds of the IPO to acquire the commercial trust units and the commercial trust notes. In turn, the commercial trust uses the net proceeds from issuing the commercial trust units and the commercial trust notes to acquire and hold a 99.999 percent interest in the Acquisition LP. The Acquisition LP is formed as a limited partnership under the laws of the foreign jurisdiction. The general partner is formed as a limited liability company under the laws of the foreign jurisdiction and is wholly owned by the commercial trust. The general partner acquires the remaining 0.001 percent interest in the Acquisition LP. The Acquisition LP uses net proceeds funds drawn under a bank credit facility to acquire business assets situated in the foreign jurisdiction, which it then operates and manages.

The monthly distributions made by the FAIT to its unit holders are funded primarily from interest payments on the commercial trust notes, as well as from monthly distributions on the commercial trust units, which in turn are funded by distributions of foreign-source income from the Acquisition LP to the commercial trust regarding the commercial trust's partnership interest.

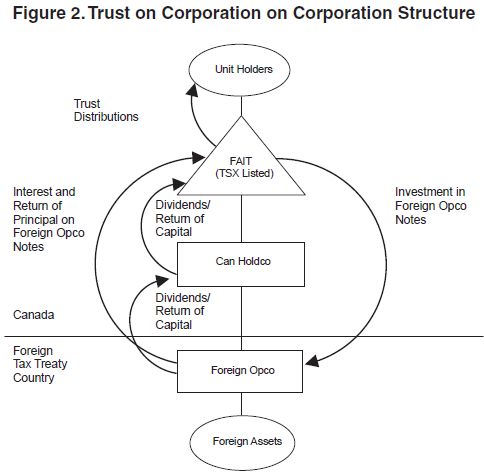

Figure 2 shows a trust on corporation on corporation structure.

This is a more recent FAIT structure. The prospectus for Argent Energy Trust provides an example of this type of structure.5

As is the case with the first structure, the FAIT is established as an open-ended limited purpose trust. However, instead of using an intermediary commercial trust, Can Holdco is incorporated under the laws of Canada to form, acquire, and hold all of the issued and outstanding shares of Foreign Opco. Foreign Opco is incorporated under the laws of a foreign jurisdiction that has entered into a tax treaty with Canada.

The FAIT uses the net proceeds of the IPO to acquire Can Holdco shares. In turn, Can Holdco uses a portion of the proceeds received from the FAIT to acquire additional Foreign Opco shares, and it loans the remaining proceeds to Foreign Opco in exchange for Foreign Opco notes. The Foreign Opco notes are later distributed by Can Holdco to the FAIT, such that the interest and principal are paid directly to the FAIT and are not subject to taxation at the Can Holdco level. If it is not already the owner of the business assets situated in the foreign jurisdiction, Foreign Opco uses its net proceeds and funds drawn under a bank credit facility to acquire the business assets, which it then operates and manages.

The monthly distributions from the FAIT to its unit holders are funded mainly from interest payments on the Foreign Opco notes, as well as from distributions of exempt surplus dividends and returns of capital made on the Foreign Opco shares to Can Holdco that are then distributed by Can Holdco to the FAIT (as discussed below).

Canadian Tax Considerations

To qualify as an MFT, the FAIT must:

- be a Canadian resident (that is, the trustees must be resident, and manage the business of the trust, in Canada);

- qualify as a unit trust under the ITA (unit trust status is usually obtained by making the units of the trust redeemable on demand by the unit holders6);

- restrict its undertaking to investing its funds in property (normally, the trust indenture will impose investment restrictions to preclude the FAIT from violating its permitted undertakings as an MFT); and

- comply with prescribed minimum requirements regarding the ownership, dispersal, and public trading of its units (generally, the trust must have at least 150 unit holders, each holding at least one ''block'' of units having a fair market value of at least $500).

In addition to permitting the FAIT to distribute all of its income for a tax year to its unit holders without tax, MFT status means that the FAIT's units are qualified investments for registered plans. One advantage of FAITs over other MFTs under current rules is that as long as the FAIT holds only foreign assets and no taxable Canadian property,7 it is not required to comply with nonresident ownership restrictions in order to maintain its MFT status.8 However, doing so may still be prudent, for example, to limit reporting and compliance requirements under foreign securities laws.

The FAIT must also be structured so that the SIFT rules do not apply. To achieve that, typically the FAIT would not be allowed to hold at any time ''non-portfolio property,'' which is defined to include:

- property used by the trust or a non-arm's-length person in the course of carrying on a business in Canada;

- a 10 percent or greater interest in a Canadian resident trust, corporation, or partnership unless the entity qualifies as a ''portfolio investment entity'' (that is, the entity itself does not hold any non-portfolio property);

- a 10 percent or greater interest in a nonresident person or partnership whose principal source of income is from one or more Canadian sources unless the person or partnership qualifies as a portfolio investment entity; and

- Canadian real property or resource property if at any time in the tax year the total FMV of that property of the trust exceeds 50 percent of the total equity value of the trust.

Foreign situated business assets held by Acquisition LP or Foreign Opco in the structures described above do not constitute non-portfolio property because they are used in the course of carrying on a business in the foreign jurisdiction (not Canada). Consequently, the entities owning that property (Acquisition LP and Foreign Opco) each qualify as a portfolio investment entity. This in turn qualifies each entity's partner or shareholder (commercial trust or Can Holdco) as a portfolio investment entity.

To ensure the FAIT does not become subject to the SIFT rules as a result of a later acquisition of non-portfolio property made either by it or by another entity further down the chain, normally each entity's governing documents contain investment restrictions that preclude the entity from holding any non-portfolio property or taking any action that would cause the SIFT rules to apply. The trustee or administrator of the FAIT generally assumes responsibility for monitoring the investments and property holdings of each entity in the group to ensure that the FAIT does not become subject to the SIFT rules.

As long as the SIFT rules do not apply, there will be no Canadian tax at the entity level (although some foreign taxes may be payable). Moreover, for taxable investors, an investment in the second-generation FAIT may have the added advantage of distributing eligible dividends taxed at lower rates than ordinary income.

Distributions of taxable capital gains and foreign-source income to unit holders of the FAIT will retain their character in the hands of the unit holders if the FAIT (and the commercial trust, if applicable) makes the appropriate designations under the ITA.

Nonresidents are not precluded from investing in a FAIT. Distributions of income (but not capital or capital gains) to nonresidents are generally subject to withholding tax under Part XIII of the ITA at a 25 percent rate (subject to reduction under an applicable income tax treaty). Generally, no Canadian tax or reporting requirements would arise on a disposition of units of the FAIT by a nonresident.

Additional Implications

First Structure

The structure anticipates that the commercial trust will not have to pay tax on its share of the income of the Acquisition LP for a tax year because that income will be offset by interest deductions on the commercial trust notes and distributions to the FAIT.

As the main source of the FAIT's income is interest payments on the commercial trust notes, as well as distributions of foreign-source income on the commercial trust units arising from the commercial trust's allocable share of the foreign business, it is likely that most distributions from the FAIT to a unit holder (other than on a redemption of units) will be taxed as ordinary income or a return of capital.

Second Structure

While the main source of the FAIT's income is interest payments on the Foreign Opco notes, the FAIT will also receive distributions on its shares of Can Holdco, which will be funded by Can Holdco from distributions received on its shares of Foreign Opco. Since Foreign Opco is a foreign affiliate9 of Can Holdco, distributions on the Foreign Opco shares received by Can Holdco are generally treated as dividends or a return of capital.

An exemption system applies to active business income earned by a foreign affiliate of a Canadian resident corporation when it is resident in a country that has entered into a tax treaty with Canada and the business that generates the dividend is carried on in that country. That income is included in the foreign affiliate's exempt surplus. Dividends paid to the Canadian corporation out of the foreign affiliate's exempt surplus are exempt from Canadian tax: While the Canadian parent corporation must include the dividend in income, it is entitled to an offsetting deduction. No foreign tax credits are available for foreign taxes paid regarding that income. Similarly, dividends paid to the Canadian corporation out of the foreign affiliate's pre-acquisition surplus (generally earnings before the time Foreign Opco became a foreign affiliate of Can Holdco) are exempt from Canadian tax, although Can Holdco must deduct an amount equal to the dividend from the adjusted cost base of its Foreign Opco shares.

The structure is implemented so that dividends paid to Can Holdco on the Foreign Opco shares generally can be paid out of exempt surplus.10 Can Holdco is generally entitled to designate taxable dividends paid by it to the FAIT as eligible dividends to the extent that it is entitled to a deduction from income regarding the dividends received from Foreign Opco that have been paid from exempt surplus or pre-acquisition surplus. In turn, the FAIT can make a designation so that eligible dividends received from Can Holdco and made payable to the FAIT's unit holders retain their character as eligible dividends.

Eligible dividends are taxed at a lower rate than ordinary income, so the trust on corporation on corporation structure may provide a tax advantage for unit holders over the trust on trust on partnership structure to the extent that distributions from the FAIT take the form of eligible dividends rather than ordinary income. Also, to the extent that an election can be made under proposed amendments to the foreign affiliate rules in the ITA to treat all or part of a dividend as being paid out of pre-acquisition surplus and that dividend does not exceed Can Holdco's adjusted cost base of its Foreign Opco shares, Can Holdco will be able to receive a return of capital based on its adjusted cost base (rather than simply on the paid-up capital) of the shares without being subject to Canadian tax, although Can Holdco's capital gain on a future disposition of the Foreign Opco shares would increase correspondingly.

Foreign Tax Considerations

From a foreign tax perspective, the principal structuring objectives are to minimize foreign taxes through the generation of deductible expenses to offset business income earned in the foreign jurisdiction and to maximize the tax basis of any foreign business assets being acquired.

Some commonly employed strategies to minimize foreign taxes involve:

- creating debt at the acquisition level and maximizing interest expense that can be deducted against business income in the foreign jurisdiction;

- arranging the acquisition structure so that there is a step-up in the tax basis of the foreign business assets upon their acquisition by the Acquisition LP or Foreign Opco; and

- arranging the payment of reasonable management fees by Foreign Opco (subject to transfer pricing restrictions in Canada and the foreign jurisdiction). In determining the most appropriate structure to minimize the impact of foreign taxes, several important issues would be considered, including:

- managing any foreign jurisdiction inversion rules that could cause the Canadian acquisition vehicle to be considered a resident of the foreign jurisdiction as a consequence of retained interests held by the vendors of the assets;

- any foreign tax rules that would affect the characterization of commercial trust notes or Foreign Opco notes as debt for foreign tax purposes;

- restrictions on the deductibility of interest payments on the commercial trust notes or Foreign Opco notes under foreign tax laws, such as limitations regarding related-party debt;

- foreign income tax, branch profits, and withholding tax rates;

- foreign withholding tax on interest payments on the commercial trust or Foreign Opco notes or on later distributions from the FAIT to its unit holders;

- entitlement of structure participants to treaty benefits under a tax treaty between Canada and the foreign jurisdiction, and applicable rate reductions under the treaty;

- foreign tax issues, if any, arising from the inclusion of foreign real property in the package of foreign business assets acquired11;

- the foreign tax attributes of the foreign business assets being acquired; and

- the foreign tax position of any pre-IPO owners who intend to retain an interest in the foreign business following the completion of the Canadian IPO.

What's Next for the FAIT?

There has been a mixed reception to the FAIT structure to date. A couple of commodity-based offerings have done very well. Other prospective deals have faltered. This could be solely a function of market conditions at the time of the offering, or it could reflect some reservation or perhaps exhaustion over the asset class being offered. What would be interesting is the market reaction to an offering based on infrastructure-type assets that fit the traditional income trust model of low capital reinvestment and predictable yield.

Originally published in Tax Notes Int'l, October 29, 2012

Footnotes

1 Real estate investment trusts are exempted from the SIFT rules if they satisfy specific tests annually regarding owned assets, revenue sources, and listing/trading of their units.

2 For example, a listing on the Toronto Stock Exchange can be completed more quickly (two to three months versus five to six months) and less expensively than a listing on a U.S. stock exchange. Ongoing compliance costs in Canada are also generally lower than in the U.S. Offerings may be structured so that the Canadian listing entity qualifies for an exclusion or exemption from registration, reporting, and compliance requirements under U.S. securities law statutes and other regulatory statutes such as the Investment Company Act and the Sarbanes-Oxley Act. Further, some industry participants, such as mining companies, may be able to benefit from more favorable disclosure rules in Canada than in the U.S.

3 See http://www.tmx.com/en/pdf/TSX_TSXV_CapitalOpportunity_USA.pdf.

4 Final Prospectus, dated Apr. 14, 2011.

5 Final Prospectus, dated Aug. 1, 2012.

6 The prospectuses generally note, however, that the redemption right will not be the primary mechanism for unit holders to dispose of their FAIT units.

7 Taxable Canadian property includes:

- real property situated in Canada (including interests in Canadian mining and oil and gas properties);

- most property used in a business carried on in Canada;

- listed shares, mutual fund corporation shares, or mutual fund trust units if at any time during the previous 60 months:

-

- 25 percent or more of any class of the corporation's shares or trust's units were owned by the FAIT and non-arm's-length persons; and

- more than 50 percent of the FMV of the shares or units were derived directly or indirectly from one or more of Canadian real property, Canadian resource properties, timber resource properties, or options or interests in any of the foregoing (FMV test);

- unlisted shares (excluding mutual fund corporation shares) if at any time during the previous 60 months the FMV test was met;

- an interest in a partnership or an interest in a trust (excluding a mutual fund trust or an income interest in a Canadian resident trust) if at any time during the previous 60 months the FMV test was met; and

- an interest, option, or right regarding any of the foregoing property, whether or not the property exists.

8 A trust may lose its status as an MFT if it can reasonably be considered that the trust was established or is maintained primarily (that is, more than 50 percent) for the benefit of nonresidents. However, the rule does not apply if all or substantially all (that is, 90 percent or more) of the trust's property is not taxable Canadian property.

9 Under the ITA, Foreign Opco will qualify as a foreign affiliate of Can Holdco as long as Can Holdco holds at least 1 percent of Foreign Opco's equity, and Can Holdco (together with related persons) holds at least 10 percent of Foreign Opco's equity.

10 For example, the prospectus for Argent Energy Trust states that:

based on the activities of Foreign Opco and its intention to maintain, at all times, central management and control of Foreign Opco in the U.S., [the Administrator] anticipates that the earnings of Foreign Opco will be included in exempt surplus, and accordingly Can Holdco will not be subject to a material amount of Canadian income tax on the dividends received by it on its Foreign Opco shares.

11 For example, when business assets are primarily U.S. real estate assets, the disposition of shares of the foreign corporation could be subject to the U.S. Foreign Investment in Real Property Tax Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.