When you make the decision to invest your hard-earned money in stocks, bonds, GIC’s etc, and then manage those investments, you usually make the following decisions on a regular basis:

- What are my investments worth today?

- Do I think the value will increase/decrease over my expected holding period, and what rate of return do I expect?

- Depending on the answer to #1 and #2), and what my cash flow needs are, when do I want to sell my investments?

In making these decisions, you consult your investment brokerage statements for the value of the investment today, and you may get some professional help from a financial planner or wealth management professional in answering the other questions.

But what if your investment is your privately-held business? The business may be your single largest investment, and you may be relying on that investment to fund your retirement. So, the same information and decision-making process should still apply in managing the investment in your business:

- What is my business worth today (value measurement)?

- Do I think the value will increase/decrease over my expected holding period, and what rate of return do I expect? (value creation)

- Depending on the answer to #1 and #2), and what my cash flow needs are, when (and how) do I want to sell my business (value realization)?

While these questions are the same for both types of investments (passive investments and the investment in your business), how you answer these questions is very different.

In order to answer the first of the three questions, “What is my business worth today?”, there is no monthly brokerage statement coming to your door showing you what your business is worth. For many family business owners their business is their single largest investment, but many family business owners don’t know the value of their business.

A business valuation prepared by a trained and independent professional business valuator is one of the best ways of understanding what the value of your business is, without having to test the market for it by putting your business up for sale. A survey of entrepreneurs who sold their businesses (conducted by Newport Partners) found that 74% of those surveyed would recommend that business owners get a professional, independent valuation done before selling their business.

For the second question, “Do I think the value will increase/decrease over my expected holding period, and what rate of return do I expect”, the good news is that, unlike owning a few shares in a public company, you have some degree of control and influence over whether the value of your business will go up or down. There are a host of internal and external factors that impact on the value of a business. The owner manager has influence and control over the internal factors. While you don’t have control over external factors, the degree to which the management team responds to and adapts to such external factors will impact on the value of the business.

In answering the third question, “When (and how) do I want to sell my business”, the big difference between realizing on the value of a portfolio investment and the investment in your business, is that it will take time, planning, and cost to ultimately exit your business and realize on its value.

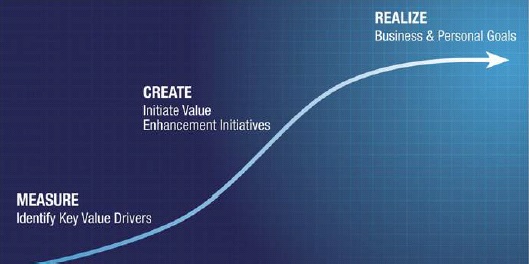

The above three questions can be broken down into the following strategies:

- Value measurement

- Value creation

- Value realization

These strategies are part of what we call The Shareholder Value CurveTM.

Value Measurement

The fundamental premise on which all investment decisions are based is that value to you as an investor in your business (and to a potential buyer of your business) is equal to the present worth of the future benefits.

There are two bases on which to determine the value of a company: going-concern and liquidation. In the case of a company that is expected to continue operating well into the future, a prospective buyer will evaluate the risks and expected returns of the investment on a going-concern basis. There are a number of valuation methodologies that can be used. All methodologies applied to the valuation of a business may be broadly classified into the market, income or asset (adjusted book value) approaches.

While valuation can be a complex process that considers a variety of aspects of the business, value is primarily driven by three elements:

- The quantum of expected future cash flows

- The quality of (or risk associated with) those cash flows. The quality of the cash flows translates into a required rate of return; and

- Capitalization of the business (its balance sheet). The amount of debt on the balance sheet, and whether the company has sufficient working capital, will impact on the ultimate value and price for the shares of the company

Quantum of cash flows, referred to as maintainable earnings or cash flows, reflects the revenues generated by the business minus the costs associated with generating those revenues. When valuing a business, a prospective buyer of the business will study these factors, generally over a three or five-year historical period, because they can often be used as a starting point in estimating maintainable future results. A business valuator or prospective buyer will look for cash flows patterns – volatility or trends upward or down.

The quantum of cash flows, however, should not be considered in isolation. The second major element in determining value is the quality of cash flows. Quality refers to the sustainability, variability and sensitivity of the cash flows to risks.

The risk associated with the cash flows is generally reflected in the value of a business by the multiple or capitalization rate applied to those cash flows. Many operating businesses are valued based on a multiple of earnings or the present value of expected future cash flows.

The rate of return is a function of market conditions and rates of return in the marketplace generally (e.g. interest rates) and risk factors specific to a business.

Chartered Business Valuators are trained and experienced in measuring the value of privately-held businesses. Having an independent business valuation done has the benefit of:

- Providing an objective value for purposes of share purchases/investments that may be made in the business by family members as part of succession planning;

- Clarifies the current owner’s equity value for estate planning;

- Gives you a benchmark value so you can objectively review any offers received from interested parties who may approach you; and

- Gives you a benchmark from which value creation strategies can be measured.

Value Creation

Understanding what drives value in your business is the first step to understanding how to create value going forward. While these drivers vary according to the business, the industry, and the potential buyers for your business, there are a number of common categories of drivers that can add value to many operations. Identifying and optimizing the appropriate drivers for your business can help the management team focus on strengthening the attributes that will be highly valued by prospective purchasers.

Finding ways to increase revenue and profitability is one way of improving value. Generally, prospective buyers will place more value on cash flow that is expected to increase in the future. Companies that demonstrate strong cash flow generation with good expectations for future growth tend to have higher values than those that don’t. However, not all revenue growth will equate to value creation.

In determining the price or value of a business, it is important to recognize the interrelationship of the quantum of the cash flows and the quality of those cash flows. Management may initiate activities that increase revenues and cash flows, but those activities may inadvertently increase the risk profile – which may result in a decrease in value.

Effectively managing the internal risk factors and responding to the external risk factors will impact a company’s quality of cash flows or risk profile, and ultimately the value of the business. Examples of qualitative factors that tend to reduce the risk profile of a business (and increase the value) include:

- A strong and experienced management team

- Good quality customer base

- Having strategic advantages (like intellectual property)

- Strong market position in your industry

- Good quality information systems that provide the necessary information to management for decision making

The above strategies are focused on the “management” of the business. There are other strategies that are focused on the “ownership” of the business, and improving the after-tax proceeds available to the owners when they sell. These include such strategies as:

- Estate Planning for the Business

- Insurance considerations

- Tax planning, will planning

- Shareholder agreements

- Ownership of key assets or redundancies

- Debt management and financial leveraging

- Business Succession Plans

- Family law considerations

Identifying value creation strategies early will give you a roadmap to better manage the future growth in the value of your business. Implementing these strategies may take a number of years. Identifying and implementing these strategies well in advance of a sale (2 to 5 years ahead) means that the business will be ready to sell when you are.

Value Realization

Value realization means converting the value of your business into cash that you can use for other purposes (investing in another business, retirement, etc). Value realization can happen over time, or all at once through a sale of 100% of the business.

Every business owner must face the reality that someday the business will be sold – it may be sold voluntarily or involuntarily (death, bankruptcy, and illness). Despite the prevalence of articles and books dealing with “succession planning”, many business owners often don’t consider value realization strategies until they are forced to do so. By that time, the owner may not have the variety of choices available to maximize his/her proceeds.

There are a number of ways that a business owner can realize on the value of his/her investment. These include through internal sources or external sources.

The benefit of knowing ahead of time what your options are and what is involved in selling your business, allows you to create some choices. Planning ahead is the best way to create the choice of when and whether you will realize on the value of your business.

Conclusion

Investing your hard-earned money in stocks, bonds, GIC’s etc, and then managing those investments is important in maximizing the proceeds available to you when you retire. Managing the value of your business is just as important.

Value creation strategies are most successful when the business owner times the sale to coincide with favourable personal and business conditions. These conditions include the owner’s personal situation, economic and industry conditions, and the company’s recent and prospective operating results. When the business, economic and industry conditions are favourable, the prices fetched tend to be higher.

One of the keys to Successful Value Realization is to plan ahead – two years or more, ideally. Some value creation strategies take time to implement. Understanding your alternatives and being prepared to be flexible will also improve your probability of success.