One of ASIC's major priorities for 2024 is cracking down on credit providers engaging in predatory lending and high-cost credit provided to consumers and small businesses. ASIC is concerned that business models operated by such credit providers have been designed to avoid consumer credit protections. ASIC will pursue directors personally where there has been alleged corporate misconduct.

What is Predatory Lending?

Predatory lending refers to unfair practices that benefit the lender and hinder the consumer's ability to repay debt, resulting in significant harm to consumers and investors. The NCCP Act and associated regulations aim to ensure that lenders do not provide unsuitable loans to consumers.

Predatory lending includes imposing unreasonably high fees as well as terms that prevent the consumer from being able to repay their debt accordingly.

Recent Cases:

The enforcement action against Cigno Pty Ltd (Cigno) and BSF Solutions Pty Ltd (BSF Solutions) highlights ASIC's concerns about lenders operating models where the objective purpose of the lending model is to avoid the provisions of the NCCP Act and the National Credit Code.

ASIC alleged that together, both Cigno and BSF Solutions charged over $70 million in fees without either entity holding an Australian Credit Licence. Cigno and BSF Solutions operated a model where consumers entered into a loan agreement with BSF Solutions where no fees or interest was charged, however consumers were subject to substantial fees under a Services Agreement with Cigno throughout the term of the credit contract. Some consumers were charged fees of more than 600% of their total loan amount. ASIC's position is that the model was designed to avoid the consumer protection laws.

In October 2023, ASIC extended the proceedings to include action against the directors of both Cigno and BSF Solutions claiming that the directors of the entities were involved in unlicensed activities, therefore, breaching the NCCP Act.

Directors should not ASIC's willingness to pursue directors personally where significant corporate misconduct is alleged and that ASIC will investigate and take action against models or structures designed to avoid the licensing regime or NCCP Act.

Key Takeaways:

Credit providers should take note of ASIC's focused enforcement action against those engaging in predatory lending activities.

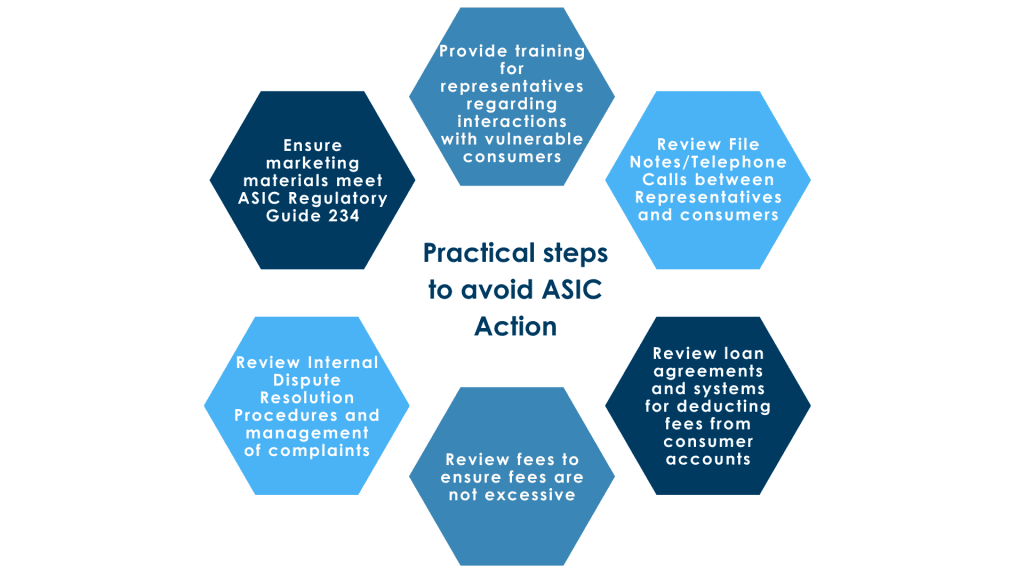

Practical steps for credit providers wanting to avoid this type of regulatory action include:

- ensure marketing materials meet the requirements of the ASIC Act 2001 (Cth) and ASIC's guidance in Regulatory Guide 234;

- provide training for representatives regarding interactions with vulnerable consumers and how to ensure false statements and misrepresentations of its credit services or products do not occur;

- regularly review file notes or telephone calls between representatives and consumers;

- consider whether commissions received (if any) is disclosed to consumers;

- review loan agreements and systems which deduct fees to ensure fees are not excessive and are charged in line with the NCCP Act; and

- review internal dispute resolution procedures and the management of complaints.

Background:

ASIC's latest Corporate Plan details ASIC's intention to protect financially vulnerable consumers who have been affected by predatory lending practices.

Further Reading:

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.