We are pleased to present the latest edition of our Bermuda Public Companies Update which features a recap of significant transactions involving Bermuda public companies listed on the NYSE and Nasdaq for the period of H2 2018.

US IPO MARKET HITS 4-YEAR HIGH, DESPITE Q4 SLUMP

Despite volatility, especially in Q4, the major US stock exchanges had a busy year for IPOs in 2018. The total reached 190, a rise of 19% on 2017 and a 32% increase by proceeds to US$47 billion. Healthcare and technology sectors dominated the US exchanges in 2018 by deal number and proceeds, with ten IPOs raising US$1 billion or more.

2018 as a whole saw M&A deal volume up 25% on 2017, despite a year on year decrease in M&A volume in H2. The US was the fastest growing transaction market, accounting for 44% of all global M&A activity, and deal values soared by 57%. The energy and power sector led the way, followed by technology and healthcare.

BERMUDA MARKET: QUALITY NOT QUANTITY IN H2 2018

The M&A activity among Bermuda public companies that marked the first half of 2018 continued into the second half. Notable transactions announced included the LVMH Moët Hennessy Louis Vuitton acquisition of Bermuda-incorporated Belmond Ltd. for US$2.6 billion, and Apollo Global Management's agreement to acquire Bermuda insurer Aspen, also for US$2.6 billion. The latter is part of an ongoing M&A trend in the insurance/reinsurance market. Both topics are featured in this issue.

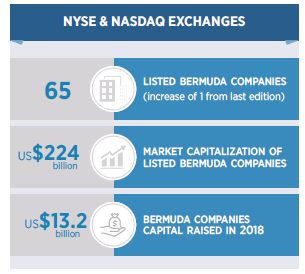

There was one IPO in H2 2018 – Bermuda incorporated and UK headquartered biotechnology company Urovant Sciences Ltd. completed an IPO in the amount of US$140 million on Nasdaq in September. Fixed income and secondary offerings by a number of other companies, including Norwegian Cruise Line Holdings' US$962 million ordinary shares offering, brought the total value of Bermuda company securities offerings on NYSE and Nasdaq in 2018 to US$13.2 billion.

In general, market activity focused on the insurance, biotech and shipping sectors. We have included details of the transactions referenced above as well as other market developments in this edition of our update, along with statistical information about the Bermuda public companies market which we hope will be of interest to our legal colleagues, clients and Bermuda market followers.

| FEATURED

DEAL LVMH acquisition of Belmond Conyers advised French luxury brand group LVMH Moët Hennessy Louis Vuitton SE on its pending acquisition of the entire issued share capital of Belmond Ltd. for an equity value of US$2.6 billion. Belmond is an NYSE listed Bermuda company that owns and operates a portfolio of luxury hotels, train services and river cruises around the world. Conyers was involved throughout the competitive bid process that ultimately led to LVMH's selection as the winning bidder. Belmond is unusual amongst Bermuda public companies because of its capital structure. Belmond's Class A common shares are publically listed and traded; however the company has a further class of shares – Class B common shares – that are unlisted and are 100% owned by a direct subsidiary of Belmond. Both the Class A and Class B common shares vote together as one class, with every one Class B common share carrying 10 times the voting power of one Class A common share. In effect, Belmond is not controlled by its public shareholders, but by its Board of Directors. Belmond has also adopted further anti-takeover provisions, including a shareholder rights plan (or poison pill) and the requirement for supermajority votes on certain interested party transactions. The structuring of the acquisition was therefore complex and required extensive Bermuda law engagement to ensure the takeover does not inadvertently trigger any anti-takeover mechanisms while simultaneously minimising execution risk for LVMH. The transaction is ultimately structured as a Bermuda statutory merger on the basis of a Belmond Board approved offer of US$25 per Class A common share. The transaction is expected to close in the first half of 2019. |

HIGHLIGHTED TRANSACTIONS

NYSE:

- Shipping company Tsakos Energy Navigation Limited (NYSE:TNP) completed a US$135 million offering of 5,400,000 series F fixed-to-floating rate cumulative redeemable perpetual preferred shares. (June)

- Bermuda reinsurer RenaissanceRe Holdings Ltd. (NYSE:RNR) completed a US$250 million offering of depositary shares, each representing a 1/1000 interest in a share of its 5.75% series F preference shares. (June)

- AIG completed its US$5.56 billion acquisition of Bermuda reinsurer and specialist insurer Validus Holdings Ltd. (NYSE:VR). (July)

- Funds managed by Apollo Global Management LLC (NYSE: APO) entered into a definitive agreement to acquire Bermuda property and casualty insurer Aspen Insurance Holdings Limited (NYSE:AHL) for US$2.6 billion. (August)

- French insurance and investment company AXA completed its US$15.3 billion acquisition of Bermuda-based XL Group Ltd (NYSE: XL). (September)

- Connecticut-based aviation company Aircastle Limited (NYSE:AYR) completed a US$645 million offering of 4.4% senior unsecured notes due September 2023. (September)

- Bermuda-based marine shipping company Ship Finance International Limited (NYSE:SFL) completed a US$72.94 million offering of floating rate senior unsecured bonds due September 2023. (September)

- Bermuda-based RenaissanceRe Holdings Ltd. (NYSE:RNR) announced an agreement to acquire Tokio Millennium R e for US$1.22 billion of cash and US$250 million of RenaissanceRe common shares. (October)

- Horizon Maritime Services Ltd. cancelled the acquisition of Bermuda oil & gas services company Nordic American Offshore Ltd. (NYSE:NAO) (November)

- Bermuda-domiciled Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) completed a US$962.73 million secondary offering of 18,877,089 ordinary shares by selling shareholders Apollo Global Management, LLC (NYSE:APO) and Star NCLC Holdings Ltd. (November)

- French luxury brand LVMH Moët Hennessy Louis Vuitton SE (LVMH.PA) announced an agreement to acquire Belmond Ltd. (NYSE:BEL) for US$2.6 billion. (December)

- Bermuda oil & gas services company Nordic American Offshore Ltd. (NYSE:NAO) completed a US$5 million private placement of 11,904,762 common shares. (December)

NASDAQ:

- Bermuda-headquartered semiconductor manufacturer Marvell Technology Group Ltd. (NasdaqGS:MRVL) completed a US$498.98 million offering of 4.2% senior subordinated unsecured notes due June 2023 and a US$500 million offering of 4.875% senior subordinated unsecured notes due June 2028. (June)

- Bermuda-based reinsurer Enstar Group Limited (NasdaqGS:ESGR) completed a US$400 million offering of depositary shares, each representing a 1/1000 interest in a share of its 7% series D fixedto- floating rate perpetual non-cumulative preference shares. (June)

- UK headquartered biotechnology company Axovant Sciences Ltd. (NasdaqGS:AXON) completed a US$25 million private placement of 14,285,714 common shares. (June)

- IHS Markit Ltd. (NasdaqGS:INFO) completed a US$500 million offering of 4.125% senior unsecured notes due August 2023 and a US$750 million offering of 4.750% senior unsecured notes due August 2028. (July)

- UK headquartered biotechnology company Myovant Sciences Ltd. (NasdaqGS:MYOV) completed a US$75 million secondary offering of 3,333,334 common shares. (July)

- UK headquartered biotechnology company Urovant Sciences Ltd. (NasdaqGS:UROV) completed an IPO in the amount of US$140 million. (September)

- Bermuda-based reinsurer Enstar Group Limited (NasdaqGS:ESGR) completed a US$110 million offering of depositary shares, each representing a 1/1000 interest in a share of its 7% series E perpetual non-cumulative preference shares. (November)

- Bermuda-based reinsurer Sirius International Insurance Group Ltd. (NasdaqGS:SG) completed a US$226.12 million private placement of 1,225,954 common shares and 11,9091,670 series B preference shares. (November)

- UK headquartered biotechnology company Axovant Sciences Ltd. (NasdaqGS:AXON) completed a US$30 million secondary offering of 30,000,000 common shares. (December)

BERMUDA PUBLIC INSURANCE COMPANIES - M&A ACTIVITY 2018

The second half of 2018 saw further M&A activity in Bermuda's insurance/ reinsurance sector as the market continues to consolidate and remains attractive to private equity investors. The trend is towards divergence into large-scale, multi-disciplinary organisations and smaller, niche specialists. Despite the consolidation, the number of insurance-reinsurance companies in Bermuda continues to grow, as new companies are regularly added to the register, and the jurisdiction remains a key player in the global market.

- Conyers advised AXA in connection with its US$15.3 billion deal to acquire Bermuda-based XL Group Ltd (NYSE: XL). The transaction was agreed in March and completed in September 2018, following fulfilment of customary closing conditions, including approval by XL Group shareholders and regulatory bodies. French insurance and investment giant AXA is the largest multiline insurer in Europe as measured by gross written premiums, with a strong presence in major insurance markets worldwide. Following the XL purchase, it now claims to be the foremost P&C commercial lines insurer and has strengthened its position in global reinsurance markets.

- AIG completed its US$5.56 billion acquisition of Bermuda reinsurer and specialist insurer Validus Holdings Ltd. (NYSE:VR) in July 2018. The all-cash transaction was first announced in January 2018. Validus adds diversified franchises to AIG including a reinsurance platform; an insurance-linked securities asset manager; Talbot, a Lloyd's syndicate; a specialty U.S. small commercial excess and surplus underwriting team; and Crop Risk Services, which provides access to the North American crop insurance market.

- In August 2018, investment manager Apollo Global Management LLC announced that certain of its affiliated funds would take Bermuda-based Aspen Insurance Holdings Limited (NYSE:AHL) private in an all-cash transaction valued at US$2.6 billion. The deal is expected to close in the first half of 2019. Apollo Funds will pay US$42.75 per share. Upon completion, Aspen will be a privately held portfolio company of the Apollo Funds. Conyers is acting for Aspen on the deal.

- In October 2018, Bermuda-based RenaissanceRe announced it agreed to pay about US$1.5 billion to acquire Tokio Millennium Re from its parent Tokio Marine Holdings, Inc. Conyers is acting for RenaissanceRe on the deal. The transaction is expected to close in the first half of 2019, subject to customary closing conditions and regulatory approvals. No shareholder approval is necessary. The transaction consideration consists of approximately US$1.22 billion of cash and US$250 million of RenaissanceRe common shares.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.