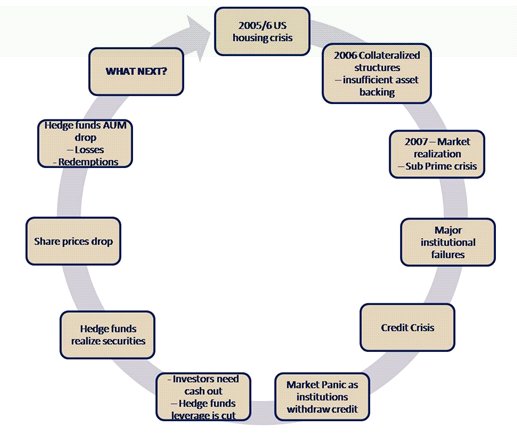

It goes without saying that 2008 was a year of turmoil for the Hedge Fund industry as liquidity dried up and share prices fell. The chart below tells the story, which starts with the US housing crisis in 2005.

One week after this chart was put together the What Next question was answered with the Madoff scandal but that is entirely another story. So what changed in 2008 that affected the British Virgin Islands Hedge Fund industry? In fact everything affecting the global industry was replicated in the British Virgin Islands Hedge Fund industry. From September 2008, liquidity was squeezed for the first time by two critical factors – margins calls from lenders reducing leverage and redemption requests from investors; with both lenders and investors taking flight to cash. What followed was the purest economic model come true. As institutions were forced to sell securities and with little market appetite for purchasing those securities, the theory of supply and demand kicked in. Stock prices fell and continued to fall as supply outstripped demand.

Whilst commentators contend that world economies are in turmoil, it is easily argued that what we have in the Hedge Fund space is a credit squeeze that has rippled into the stock market and that there has in fact been no fundamental shift in general economic conditions nor have the companies in which Hedge Funds invest been performing any worse that before. Market forces will ensure that the strong will survive, the weak will be replaced and once the market realizes that the fundamentals have not changed, normality will return.

For British Virgin Islands Hedge Funds in this period, as security values dropped dramatically, so managed futures and short bias strategies were the only ones coming out ahead. As fund performance for almost all other strategies declined and with the call for redemptions came a sizable drop in assets under management for Hedge Funds generally. At the turn of the year one view is that the outlook for British Virgin Islands Hedge Funds is bleak - another however is there has never been so much opportunity.

If that is so, the British Virgin Islands Hedge Fund industry is well placed to lead the recovery in 2009 with its nimble ability to quickly and economically form new Hedge Funds to replace those that have fallen. For sure there needs to be a catalyst and that can come from any number of places. Take for instance the vast numbers of talented people now looking for new market challenges following the intuitional financial failures last year. This abundant talent will not be sitting on their laurels and the opportunity to launch new funds to take advantage of the current market conditions will surely come. All they have to do is find the investors, now seeking new opportunities with interest rates at their lowest rate ever.

So what's in the mind of inventors right now? Answer – Is the market going any lower? Over the next few months those investors will re-evaluate their positions and know that they have to return to market with such meager returns on cash. And when they return, they will come back with a rethought strategy. They will not pile into the biggest names as they have done before but will seek out smaller more creative managers with innovative ideas – ones with individualism and a driven need to be successful. And those managers will have to be imaginative to attract new investors, not just with their strategies but with their fee levels, with their investor relationships and with their risk management practices. An entirely new strain of manager is possible – cost conscious, fee sensitive and investor-centric. That would be good. And once again the British Virgin Islands domicile will provide the economic framework for such funds to be created – because it is well regulated, quick to start and less costly than other jurisdictions.

British Virgin Islands Fund assets under management grew from an estimated $50 billion in 2006 to in excess of $100 billion before the market turned in 2008. It may be fair to say the market has returned to 2006 levels and if so the opportunities for another period of extended growth are around the corner. As confidence returns to the market, many of the stocks that are currently undervalued will start the inevitable cycle of returning to their pre-2008 market-crash price.

Whether it be start up opportunities with incubators, or managers who have weathered the storm with capacity and room for controlled growth, a cautious return is expected over the coming months followed by strong growth in the sector thereafter.

A final overriding thought. Hedge Fund investment is for sophisticated investors and generally for the long term. Short term peaks and troughs in the Hedge Fund sector are quite natural and normal. The past three months has seen a substantial decline and some failures in the Hedge Fund space but for many managers and investors, with long term horizons, performance measured over years rather than months is what counts and what will ensure the survival of this critical business sector.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.