We are pleased to present the latest edition of our Bermuda Public Companies Update which features a recap of significant transactions involving Bermuda public companies listed on the NYSE and Nasdaq for the first half of 2018.

DEAL NUMBERS DECLINE, GROSS PROCEEDS RISE

Following a solid 2017 (229 IPOs), the first half of 2018 saw a decline in deal numbers with 66 IPOs year-to-date on the NYSE and Nasdaq. Political uncertainty was likely a contributing factor. However, the trend towards larger transactions continued with growth in IPO proceeds. The first quarter of 2018 was the biggest in terms of gross proceeds in more than three years, at US$17 billion.

Nearly two-thirds (21/32) of the transactions involving Bermuda public companies in this first half have been M&A deals, with an approximate value of US$25.8 billion. There have been some high-profile insurance deals including AXA SA's bid to acquire XL Group Ltd for US$15.2 billion and American International Group's agreement to acquire Validus Holdings Ltd for US$5.6 billion.

AN ACTIVE HALF YEAR FOR BERMUDA PUBLIC COMPANIES

Bermuda companies have seen a busy half year, with two IPOs, a spike in M&A activity and the conclusion of Seadrill Limited's major restructuring (see right). In general, market activity by Bermuda public companies in H1 2018 has been focused in the telecoms, insurance, financial, aviation and pharma sectors.

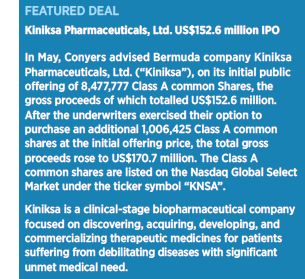

Airport retail company Hudson Limited launched its IPO on the NYSE in January and biopharma company Kiniksa Pharmaceuticals Ltd launched on Nasdaq in May, raising a combined total of US$901.5 million. Conyers acted as issuer's counsel on both transactions. Secondary offerings by a number of other companies, including Norwegian Cruise Line Holdings offering in the amount of US$1 billion, brought the total value of Bermuda company securities offerings on the NYSE and Nasdaq in H1 2018 to approximately US$11.5 billion.

Nearly two-thirds (21/32) of the transactions involving Bermuda public companies in this first half have been M&A deals, with an approximate value of US$25.8 billion. There have been some high-profile insurance deals including AXA SA's bid to acquire XL Group Ltd for US$15.2 billion and American International Group's agreement to acquire Validus Holdings Ltd for US$5.6 billion.

We have included details of the market activity referenced above in this edition of our update, along with statistical information about the Bermuda public companies market which we hope will be of interest to our legal colleagues, clients and Bermuda market followers.

HIGHLIGHTED TRANSACTIONS

NYSE: SECURITIES OFFERINGS

- Bermuda insurer Athene Holding Ltd. (NYSE:ATH) completed a US$998.46 million offering of senior unsecured notes. (January)

- Bermuda domiciled travel retailer Hudson Ltd. (NYSE:HUD) launched its US$748.9 million Initial Public Offering of Class A common shares. (January)

- Miami headquartered and Bermuda domiciled cruise line Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) completed a US$1 billion secondary offering of 19,500,000 ordinary shares by selling shareholders Apollo Global Management, LLC and Star NCLC Holdings Ltd. (March)

- Bermuda insurer Athene Holding Ltd. (NYSE:ATH) completed a US$512.93 million secondary offering of 10,320,544 Class A common shares by selling shareholder Procific (a subsidiary of the Abu Dhabi Investment Authority). (March)

- Bermuda based marine shipping company Ship Finance International Limited (NYSE:SFL) completed a US$150 million offering of senior unsecured notes. (April)

- London headquartered and Bermuda domiciled biopharmaceutical company Myovant Sciences Ltd. (NYSE:MYOV) completed a US$22.5 million private placement of 1,110,015 common shares. (April)

- Texas based and Bermuda domiciled oil and gas drilling company Nabors Industries Ltd. (NYSE:NBR) completed a US$250 million offering of preferred shares and a secondary US$271.25 million offering of 35,000,000 common shares. (May)

- Connecticut headquartered and Bermuda domiciled aviation company Aircastle Limited (NYSE:AYR) completed a US$169.57 million secondary offering of 7,887,029 common shares by selling shareholder Ontario Teachers' Pension Plan. (May)

- Bermuda headquartered financial services provider The Bank of N.T. Butterfield & Son (NYSE:NTB) completed a US$75 million offering of subordinated unsecured notes. (May)

NYSE: M&A ACTIVITY

- New York based insurer American International Group, Inc. (NYSE:AIG) entered into an agreement to acquire Bermuda reinsurer Validus Holdings, Ltd. (NYSE:VR) for US$5.6 billion. (January)

- Evergreen Parent, L.P. signed a definitive agreement to acquire an additional 45% stake in AmTrust Financial Services, Inc. (NasdaqGS:AFSI) from sellers including Atlanta based and Bermuda domiciled investment manager Invesco Ltd. (NYSE:IVZ) for US$1.3 billion. (January)

- Bermuda based hotel and travel business Belmond Ltd. (NYSE:BEL) acquired Tuscan Luxury Hotel Castello di Casole S.r.l. for €41.9 million (approximately US$48.9 million). (February)

- Dutch specialty chemical company Corbion N.V. (ENXTAM:CRBN) signed a share purchase agreement to acquire a 49.9% stake in Brazil's SB Renewable Oils from Bermuda domiciled agribusiness Bunge Limited (NYSE:BG) for an undisclosed sum. (March)

- Bermuda headquartered financial services provider The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) completed the acquisition of Global Trust Solutions Business from Deutsche Bank Aktiengesellschaft (DB:DBK) for an undisclosed sum. (March)

- UK based Ark Syndicate Management Ltd – 3902 acquired Upstream Energy Insurance Portfolio from Bermuda reinsurer PartnerRe Ltd. (NYSE:PRE.PRF) for an undisclosed sum. (March)

- French multi-line insurer AXA SA (ENXTPA:CS) entered into a definitive agreement and plan of merger to acquire Bermuda insurer XL Group Ltd (NYSE:XL) for US$15.2 billion. (March)

- Bermuda domiciled agribusiness Bunge Limited (NYSE:BG) completed the acquisition of a 70% stake in the Dutch vegetable and palm oil producer IOI-Loders Croklaan Oils B.V. from IOI Corporation Berhad (KLSE:IOICORP) for US$946 million. (March)

- Atlanta based and Bermuda domiciled investment manager Invesco Ltd. (NYSE:IVZ) completed the acquisition of Accretive Asset Management LLC, Guggenheim Specialized Products, LLC and other assets of ETF business from Guggenheim Investments, Inc. for US$1.2 billion. (April)

- Bermuda financial services provider Credicorp Ltd. (NYSE:BAP) acquired an additional undisclosed minority stake in Peru's Mibanco Banco de la Microempresa S.A. (BVL:MIBANC1) from Swiss asset management firm responsAbility Investments AG. (May)

- Norwegian based and Bermuda domiciled shipping company BW LPG Limited (OB:BWLPG) made a proposal to acquire Bermuda domiciled and Connecticut headquartered LPG shipping company Dorian LPG Ltd. (NYSE:LPG) from BW Group Limited and others for approximately US$440 million. (May)

- Bermuda insurer White Mountains Insurance Group Ltd. (NYSE:WTM) completed the acquisition of a 95% membership interest in Conshohocken, Pennsylvania based NSM Insurance Group LLC for approximately US$370 million. (May)

NASDAQ: SECURITIES OFFERINGS

- Bermuda insurer Arch Capital Group Ltd. (NasdaqGS:ACGL) completed a US$502.45 million secondary offering of 5,674,200 common shares by selling shareholders American Home Assurance Company, Lexington Insurance Company and National Union Fire Insurance Company of Pittsburgh, Pa. (March)

- Bermuda insurer James River Group Holdings, Ltd. (NasdaqGS:JRVR) completed a US$120.35 million secondary offering of 3,297,238 common shares by selling shareholder New York-based hedge fund sponsor D.E. Shaw Investment Management, L.L.C. (May)

- Bermuda based clinical-stage biopharmaceutical company Kiniksa Pharmaceuticals, Ltd. (NasdaqGS:KNSA) launched its US$152.6 million Initial Public Offering of Class A common shares. (May)

NASDAQ: M&A ACTIVITY

- UK investment management firm Lonsin Capital Limited made a non-binding indication of interest to acquire an additional 44.5% stake in Bermuda domiciled and Taiwan headquartered telecommunications manufacturer Asia Pacific Wire & Cable Corporation Limited (NasdaqGM:APWC) from Pacific Electric Wire & Cable Co., Ltd. for US$24.6 million. (February)

- Bermuda domiciled telecommunications company Liberty Latin America Ltd. (NasdaqGS:LILA) entered into a definitive agreement to acquire an 80% stake in Costa Rican television provider Cabletica from Televisora de Costa Rica S.A. at an enterprise value of approximately CRC140 billion (approximately US$247 million). (February)

- Bermuda based speciality insurer and reinsurer Argo Group International Holdings, Ltd. (NasdaqGS:AGII) completed the acquisition of Italian insurer Ariscom Compagnia Di Assicurazioni Spa for €20 million (approximately US$23.4 million). (March)

- UK based and Bermuda domiciled global information provider IHS Markit Ltd. (NasdaqGS:INFO) acquired France's DeriveXperts, a provider of valuation services for OTC derivatives and other complex financial securities, for an undisclosed sum. (April)

- Chinese multinational telecommunications company ZET Mobile Limited agreed to acquire the remaining 98% stake in the Tajikistan internet service provider Tacom LLC from Dutch headquartered and Bermuda domiciled telecommunications company VEON Ltd. for an undisclosed sum (NasdaqGS:VEON). (April)

- An undisclosed buyer acquired a 50.2% stake in the global wind and solar farm operator Eurus Holding B.V. from Dutch headquartered and Bermuda domiciled telecommunications company VEON Ltd. (NasdaqGS:VEON) for an undisclosed sum. (April)

- UK based and Bermuda domiciled global information provider IHS Markit Ltd. (NasdaqGS:INFO) announced its acquisition of New York based capital markets analytics company Ipreo Holdings LLC, as well as plans to divest the MarkitSERV trade manager. (May)

- Bermuda insurer Enstar Group Limited (NasdaqGS:ESGR) completed the acquisition of a 51.8% stake in Class 4 reinsurer KaylaRe Ltd. from Beijing and Hong Kong based investment firm Hillhouse Capital for approximately US$420 million. (May)

- The Government of The Laos People's Democratic Republic completed its acquisition of the remaining 78% stake in VimpelCom Lao Co., Ltd. from Dutch headquartered and Bermuda domiciled telecommunications company VEON Ltd. (NasdaqGS:VEON) for US$22 million. (May)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.