OVERVIEW- THE GLOBAL PICTURE

WINDING-UP PETITIONS

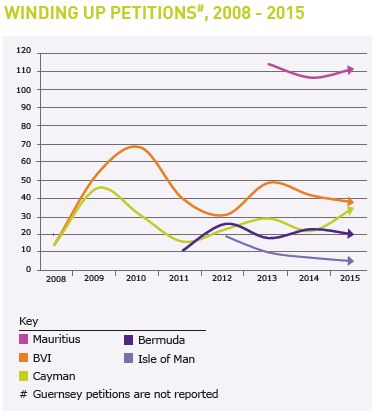

In total, across the six offshore jurisdictions analysed, there were 211 winding-up petitions filed during 2015, and 113 orders were made as a result. The number of filings was therefore slightly up on the 202 recorded in 2014, and the number of orders reported so far, down on the 120 we have identified from last year.

With the exception of the Cayman Islands and Mauritius, the volume of filings in 2015 represented a drop-off in the number of insolvency petition filings across most offshore jurisdictions, relative to the previous year. The Isle of Man, the British Virgin Islands (BVI) and Bermuda all saw a slight decrease in court filings, while the increase of 59% in Cayman, and 5% in Mauritius, led to an overall jump of 4% across the jurisdictions analysed.

WINDING UP PETITIONS TOTALS, 2015

Placing the overall filings in the wider context of statistics for recent years, the broadly flat figures recorded for 2015 across the surveyed jurisdictions as a whole reflect a continuing levelling off in the number of filings since the high-point of 2013, and before that, the years immediately following the 2008 global financial crisis. In that wider context, to some degree the figures reflect positive changes in global macroeconomic conditions over the course of 2015, however as the insolvency petition filing statistics in the Cayman Islands (and early indications of 2016 filings) suggest, this overall trend of dwindling petition filings is not anticipated to continue.

WINDING UP PETITIONS

The United Kingdom

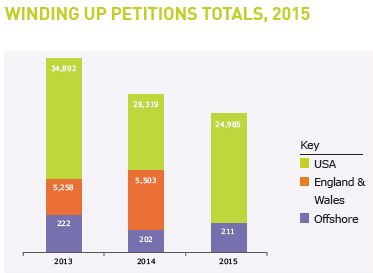

In order to provide some context and comparison to our offshore numbers, we have also tracked petitions recorded in the United Kingdom. During 2014 – the latest year for which comprehensive figures are available – the Royal Courts of Justice for England & Wales recorded 5,503 filings and 2,942 orders, which calculates as a 53% conversion rate. In addition, the UK Insolvency Service publishes a more up to date total of all compulsory company liquidations across the whole of the UK (although not the number of petitions filed beforehand), and in 2015, there were 3,679 compulsory UK company liquidation orders, a 20% drop from 2014.

As a percentage of the company registry, insolvency petitions made up 0.29% of the UK registry in 2014. With the exception of Mauritius, this is considerably higher than any offshore jurisdiction, with most of them well below 0.10%. Partly this can be put down to the UK having a much larger population and the increased presence of active trading companies, as opposed to holding companies or companies used for tax efficient structuring. It is also true that the absence in most offshore jurisdictions of a government-funded official receiver often means that companies with no assets simply cease to be active and will be administratively struck from the register, rather than formally wound up.

The United States of America

The general downward trend in petition filings in the surveyed jurisdictions also reflected trends seen in the United States of America (USA) in 2015, where a double-digit drop was recorded in bankruptcy court petitions published by the Administrative Office of the US Courts. Business petitions fell 12% to 24,985 in 2015, part of a continuing downward trend, with the number of 2015 filings half the level of the annual total being reported just five years earlier.

RATES OF CONVERSION

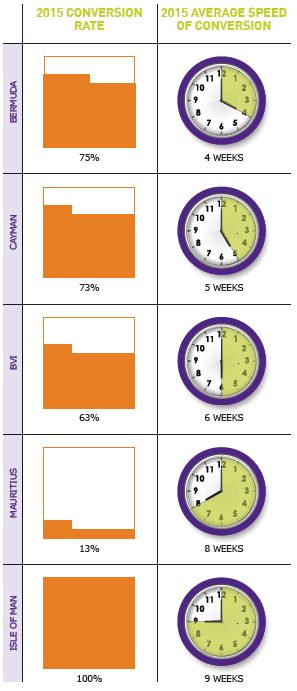

In reviewing all the different types of petitions in 2015 we witnessed something of a divergence in the conversion rate among offshore jurisdictions. In 2014, the majority of the surveyed offshore jurisdictions saw an average conversion rate of petitions filed to orders made of around 60%, but a year later the picture is more complex. In 2015, the conversion rate ranges from 100% in the Isle of Man, where a low base of just five filings all converted to orders in 2015, down to 13% in Mauritius, where 113 filings led to just 15 orders. The three other major offshore centres of Bermuda, the BVI and the Cayman Islands were more consistent in their conversion rates, all settling at around 70%.

Mauritius is clearly the biggest outlier, but late delivery of data in that jurisdiction is likely to be a factor. Using 2013 and 2014 as a guide, we can expect the conversion rate in Mauritius to be closer to one third following adjustment for this lag in reporting. The BVI conversion rate came off its 2014 79% high, with a 63% conversation rate recorded in 2015.

SPEED OF CONVERSION

During 2015, the average time between the date a petition was submitted and the date a court order was made was six weeks.

Bermuda was the jurisdiction in which winding up orders were made the quickest, with an average of just four weeks to conversion, while the Isle of Man tended to take the longest, with an average response time of nine weeks.

The Cayman Islands produced by far the most court orders in 2015, with 52 as against second-ranked BVI, and still managed an average turnaround time of five weeks, placing it behind only Bermuda in terms of conversion time.

ANALYSIS OF 2015 FILINGS BY JURISDICTION

BERMUDA

During the course of 2015, Bermuda witnessed 20 winding up petitions, which converted into 15 orders. The number of petitions was therefore down 13% compared to the 23 petitions recorded in 2014, though still up on the 18 filings seen in 2013. Last year Bermuda was the only jurisdiction to show an increase in petitions, when compared to 2013. The conversion rate for Bermuda has significantly increased since 2013, with three out of four petitions converted in each of the last two years, as against a conversion rate of just 44% in 2013.

In 2015, the number of weeks between an initial application being submitted and a court order being made averaged at just four, making the jurisdiction the most efficient of those included in our survey when it comes to conversion times.

Schemes of Arrangement

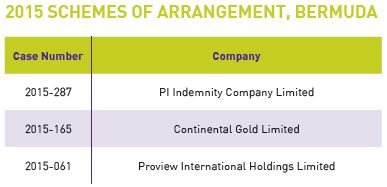

In addition to winding up petitions, there were also three schemes of arrangement ordered by the Bermudian Court during the course of 2015, as compared to six that were ordered during 2014. All three schemes were solvent schemes of arrangement. In contrast to previous years when the scheme of arrangement process was used exclusively to re-domicile Bermuda companies to another jurisdiction, 2015 saw both inward and outward re-domestication of business.

BERMUDA - IN OUR VIEW

In 2015 the Bermuda Supreme Court saw a moderate increase in fund-related filings and orders, largely attributable to the conclusion of legacy litigation commenced during the financial crisis. Otherwise, there was a downturn in orders made in respect of local companies, potentially attributable to a moderate stabilisation in local economic conditions. It is notable in this regard that the majority of petition filings that did not result in orders were made in respect of local companies. The trend of filings in relation to Hong Kong-listed Bermuda companies with assets in the People's Republic of China continued but at a significantly reduced rate, with only a single such petition filed during the course of the year. The conversion rate of filings to orders remained constant, with three quarters of filings resulting in an order. This is due to the fact the Court Registry typically assigns a first hearing date about four weeks after the initial filing (although this can be substantially reduced in special circumstances). If the petition is unopposed a winding up order is granted on the first hearing date unless an adjournment of the petition is granted to explore the viability of a scheme of arrangement. Accordingly, the continued high conversion rate may also be indicative of a higher number of uncontested petitions.

To continue reading this article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.