The violent intra-day market volatility seen in the past two weeks has caused widespread panic and has undoubtedly seen many investors making irrational and emotionally-driven decisions.

These decisions are often sub-optimal and result in the destruction of wealth for the investor. It is times like these when hedge funds can prove their worth by protecting investors against the full extent of the losses experienced by their long-only counterparts. The relative flexibility of hedge fund strategies also allows them to capitalise on the opportunities brought about by these extreme market movements and the conversations we've had with hedge fund managers in the last few days certainly speak to the resilience of these products in volatile times. Paul Wiseman, Senior Investment Analyst with Maitland in London, explains why hedge funds still very much have a place in investment portfolios – and even more so in the light of recent events.

Recent years have seen meagre returns relative to equities for the average global hedge fund, while most cheap and cheerful index trackers have produced solid gains. As a result, for those investors who have carried allocations to hedge fund strategies in place of more traditional asset classes, the role of hedge funds has come into question. These concerns are driven largely by the relative underperformance and the ongoing debate over excessive fees in the hedge fund industry. It ignores the fact that the inclusion of hedge funds in a particular portfolio may well be entirely the result of a desire not to have more traditional asset class exposure.

Performance fatigue

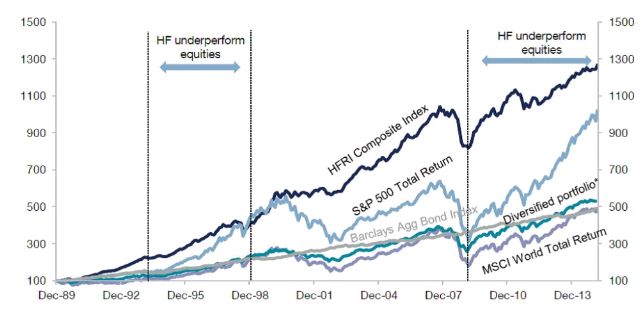

Indeed most criticism fails to address market exposure differences between hedge funds and long-only passive products. On average, hedge funds are neither fully exposed (beta of 1) nor are they fully hedged (beta of 0) to equity markets. It should therefore come as no surprise that hedge funds tend to underperform when markets rally strongly, and lose some money when markets sell off. Figure 1 compares hedge fund performance (HFRI Composite Index) to that of equities, fixed income and a generic, diversified portfolio of long-only assets over time. It is clear that there have been extended periods of out- and under-performance, and we are currently almost seven years into a sustained period of underperformance. The chart reflects the cumulative growth of a hypothetical US$ 100 invested in each of the asset classes listed. While hedge funds have outperformed over the very long-term, there are periods in between when other asset classes have performed better.

Figure 1: The long-term track record of hedge funds

Diversified portfolio is 60% MSCI World Index /40% Barclays Global Aggregate Bond Index

Source: Lyxor Asset Management

The decision to include hedge funds as part of a portfolio is often influenced by the type of investor in question. Certain investors, primarily ultra high net worth individuals, view hedge funds as high performance strategies that should outperform more traditional investments such as long-only equity or fixed income funds. Hedge funds charge high fees and are managed by some of the most talented people in the money management industry – and so it is fair enough to quickly come to a conclusion that hedge funds should be a pure outperformance product. But we think there is more to it than this.

Understand what you are buying

Hedge funds can play widely varying roles within a portfolio. They are often quite specific in nature and may often be used to fulfil a specific role in the portfolio construction process or to provide access to certain exposures, themes or ideas that are otherwise not possible within the more conventional approaches offered by long-only funds. As with any investment decision, its success or failure is assessed relative to the desired outcome. So what might these desired outcomes be if it is not simply about providing outperformance relative to long-only products?

Managing your downside risk

Whilst volatility is an imperfect measure of risk it is nonetheless a useful metric when appraising portfolio performance, particularly in comparing a portfolio's downside and upside volatility (that is, do you get more performance in up months than what you lose in down months?). The ability of hedge funds to short, use leverage and implement derivative structures means that hedge funds often tend to have low correlations to traditional long-only assets which can be comforting during turbulent periods for capital markets.

The combination of dampened volatility (be it downside or total) and low correlations is an attractive proposition for an investor considering their overall portfolio – adding such positions to a traditional portfolio willreducethe total risk of the portfolio but could increase or maintain long term returns.

The primary form of defence available to asset allocators faced with expensive asset or markets is to underweight these assets relative to a designated benchmark. This doesn't allow for the opportunity to directly benefit from a decline in the price of these assets, nor does it allow for the improvement in a portfolio's construction by adding uncorrelated positions. This is where hedge funds can be useful.

Consider the macro environment

While the last few years have been characterised by low volatility (in equities, fixed income and currencies) and low dispersion (that is most companies have benefitted from the wave of liquidity, irrespective of how well they have performed operationally) this benign environment cannot persist forever. The withdrawal of quantitative easing by the US Fed and the re-assertion of fundamental factors on asset prices should drive US markets back towards a state of relative normality. This process of adjustment is likely to create opportunities for those who are more flexible than their long-only counterparts.

Other central banks, most notably the European Central Bank and Bank of Japan, continue to ease monetary policy. This global divergence in monetary policy is a departure from prior years, where the central banks of the developed world were following expansionary policies, which creates opportunities particularly in the currency and fixed income markets. The opportunity set for relative value strategies looks a lot more attractive when assets are not all moving in the same direction.

Aside from the technical and macro perspectives, further opportunities exist due to activity in the corporate environment for event driven or merger arbitrage style managers. M&A activity has remained robust as financing remains cheap, corporate balance sheets are in a healthy condition and acquisitions are often accretive to earnings. This creates a fertile environment for further corporate activity.

Fees

For some, it is all about the fees, and nowhere is this debate more lively than with regard to hedge funds. We think the answer is simple – be very sure you are getting what you pay for. The relative performance versus volatility argument is even more relevant when you consider the fees you will be paying and what type of performance you are paying for. This is a substantive issue in its own right which merits further debate but the short answer is that investors should be most concerned with performance net of fees.

It isn't all about the upside

While on paper the returns generated by hedge funds over the last few years have lagged long-only strategies, it is important to assess these results in the context of the specific objectives from a total portfolio perspective. There are certainly a large number of hedge funds that have simply performed poorly, but don't ignore the others that have done what they said they would. Yes, hedge funds are more expensive investment vehicles but when skilfully selected and added to an existing portfolio, the long-term benefits can more than make up for the added cost.

Originally published on 01 September, 2015The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.