1. Budget 2016

1.1 Smith & Williamson commentary

Our 2016 Budget commentary is on our website at: www.smith.williamson.co.uk/budget-2016

The commentary is also available in a downloadable PDF together with a 2016/17 tax rate card at:

www.smith.williamson.co.uk/uploads/publications/budget-2016.pdf

www.smith.williamson.co.uk/uploads/publications/tax-rate-card-2016.pdf

1.2 Business tax road map

In addition to the detailed information on proposed tax changes in the Budget, the Government has also published a further Business Tax Road Map, setting out its plans for business taxes to 2020 and beyond. Its purpose is to give businesses the certainty they need to plan and invest for the longer term.

In broad terms, the package outlined is a reduction of tax rates by reducing business rates, cutting corporation tax, cutting the North Sea oil business taxes and reducing CGT. It also has a plan on avoidance, covering interest deduction, hybrid mismatches, withholding tax on royalties and taxing offshore developers. Finally, there is a theme on 'modernising', including the business energy tax regime, new rules on losses, stamp duty land tax and pay-as-you-go tax arrangements.

This document should be recommended reading for anyone directly involved in the area. While the individual components are dealt with elsewhere, the road map brings a degree of coherence to understanding the thinking that would be welcome for other taxes.

2. General news

2.1 Fees for paying tax by credit card

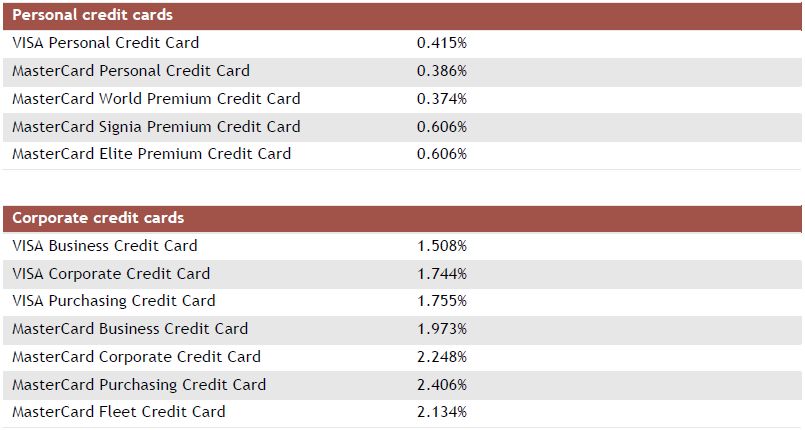

From 1 April 2016, HMRC will be able to charge fees where taxpayers pay their tax liability by credit card. The fee charged will reflect the fee HMRC is charged by the card issuer. Details are in SI 2016/333, with different levels for charging fees depending on the type of credit card. The fee rates are:

www.legislation.gov.uk/uksi/2016/333/pdfs/uksi_20160333_en.pdf

2.2 Determining realised profits and losses for company distributions

The ICAEW has issued an exposure draft of new guidance for determining realised profits and losses for Companies Act 2006 distribution purposes. Determining distributable profits is relevant for deciding what reserves are available for the declaration of a dividend. Companies may currently be considering whether to declare a dividend due to the imminent changes in dividend tax rates.

In addition to updating references to accounting standards and removing obsolete material, the following main changes are proposed:

- There is additional guidance on the definition of a distribution, including in relation to accounting adjustments arising from certain intragroup off-market loans.

- There is additional guidance to address the consequences of accounting for intragroup off-market loans. In accordance with FRS 102 (and IFRSs), these are recognised initially at fair value rather than face value. The guidance deals with the nature of the difference in value and subsequent interest income and expense under the law and for distributable profits.

- The guidance on retirement benefit schemes has been completely rewritten on a simplified basis because the previous material was mainly concerned with transition from SSAP 24 to FRS 17.

- New paragraphs 2.47C-2.47E have been added to draw attention to the very considerable doubt concerning the operation of Companies Act 2006 s.843's special rule for long term insurance business, in relation to accounts for years ending on or after 1 January 2016, as a result of Solvency II. ICAEW understands that the Government is actively considering changing the law to address this issue.

- The guidance on deferred tax has been reorganised. It has been clarified that, unless it is the reversal of a realised loss, a deferred tax credit, which results in the recognition of a deferred tax asset, will generally be an unrealised profit. This is because a deferred tax asset does not usually meet the definition of qualifying consideration.

The draft guidance deals with some issues about the interpretation of the current law. To this extent, the draft guidance should be regarded as having immediate effect. This applies in particular to the guidance concerning the definition of a distribution and its application to intragroup off-market loans.

3. PAYE and employment

3.1 Exclusion from the NIC employment allowance – one person companies

The Government has finalised its regulation on the exclusion of an employer body corporate from the NIC employment allowance where all the payments of earnings it pays in a tax year are paid to, or for, the benefit of one employed earner only who is also a director of the company at the time the payments are made.

It appears that no changes to the originally issued draft regulations have been made, despite the CIOT's comments that the exclusion as drafted could be relatively easy to avoid. The explanatory memorandum does, however, mention that these concerns were raised during consultation.

The employment allowance permits an employer meeting the required conditions to deduct the allowance from its class 1 NI liabilities. The allowance will increase from £2,000 to £3,000 with effect from 6 April 2016.

www.legislation.gov.uk/uksi/2016/344/pdfs/uksi_20160344_en.pdf

3.2 Construction industry scheme

With effect from 6 April 2016, contractors will be required to submit construction industry scheme monthly returns electronically. This is required by SI 2016/348, subject to limited exceptions. It also lowers the turnover limit for those contractors who can register for gross payment status from £200,000 to £100,000.

www.legislation.gov.uk/uksi/2016/348/pdfs/uksi_20160348_en.pdf

3.3 National minimum wage rates

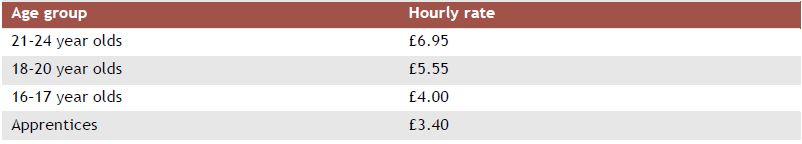

The Government has accepted the Low Pay Commission's recommendation that, with effect from 1 October 2016, the adult hourly rate for the national minimum wage should be:

Note that the national minimum wage applies to those under 25 years of age, whereas the new national living wage (currently £7.20 per hour) applies to those aged 25 and over.

3.4 Termination payments

In the case of Mr Phillips, the First-tier Tribunal (FTT) has held that a termination payment in connection with a compromise agreement made in 2012/13 and to which the individual was entitled in that tax year, was taxable in full in that tax year, notwithstanding that part of the payment related to a payment in lieu of a notice period that crossed over into the next tax year.

In contrast to the employer's assertion that the whole of the payment was subject to income tax, the FTT held on the facts of the case that the £30,000 exemption for termination payments in ITEPA 2003 s.403(1) applied.

www.financeandtaxtribunals.gov.uk/judgmentfiles/j8929/TC04950.pdf

4. Business tax

4.1 Persons with significant control (PSCs) register

Businesses required to keep a register of persons with significant control should closely examine their rules around their management and control to determine whether or not they have captured all those relevant to the requirement to record and report those who are PSCs. Many shareholder agreements or LLP agreements may include terms that permit individuals to have significant control over aspects of a business. Such agreements should be reviewed in assessing who qualifies as a PSC.

From 6 April 2016, LLPs and UK companies will be required to keep a register of PSCs. From 30 June 2016 onwards, existing LLPs and companies will be required to send their PSC register information to Companies House with their confirmation statement, which replaces the annual return. Newly incorporated LLPs and companies will need to provide similar information on incorporation.

The two conditions most businesses are likely to consider first in determining whether a person has significant control are whether they have the right, directly or indirectly, to share in more than 25% of the assets or the right to more than 25% of the voting rights.

There will be a person with significant control in the following situations:

- where an individual has the right to exercise significant influence or control over a company or LLP; And

- where an individual has the right to appoint or remove the majority of the Company's board, or the LLP's management.

Having the right to exercise these powers may be included for protective purposes in LLP agreements, articles of association or side letters to these documents, and may not generally be actually used. The definition of a PSC with respect to these requirements does not, however, appear to make a distinction between the situation where in practice the power is rarely used and the alternative where it clearly is.

5. VAT

5.1 Missing trader intra-community fraud (MTIC)

The Upper Tribunal (UT) has reviewed decisions by the First-tier Tribunal (FTT) concerning allegations of MITC fraud in two cases, one concerning Citibank NA, the other concerning E Buyer UK Ltd. In both cases, the UT decision went against HMRC's view and demonstrates the difficulty HMRC has in putting forward sufficient evidence to withhold VAT repayments legally from those involved in MTIC transactions, but who have not yet been proved to have been fraudulently complicit.

The UT overturned the FTT decision concerning E Buyer and the denial of a refund of input VAT of £6.7m related trading in white goods, resulting in directions for both E Buyer and HMRC to disclose more information before a rehearing at the FTT.

The case of Citibank NA concerned an assessment to recover £9.9m of input VAT relating to EU emission allowance trading. The UT confirmed the FTT decision that HMRC could not both allege Citibank knew of the fraudulent nature of its transactions in advance of those transactions and at the same time not allege that Citibank had acted dishonestly in pursuing those transactions.

The problem that has arisen in MTIC litigation is that fraud is frequently alleged against third parties, such as other companies in a supply chain. These could be, for example, hauliers, agents, warehouse-keepers, and even banks. In these circumstances, HMRC has been resistant to the obligation to plead, prove and disclose the case for dishonest behaviour by the intermediary supply chain entity from whom they have withheld VAT. This resistance has led to complications in litigation.

The Court of Appeal's judgement in the case of Mobilx and others ([2010] EWCA Civ 517), the most senior decision to date, makes it clear that the requirement to plead and prove fraud is unchanged merely because the case involves an MTIC fraud and involves complex allegations.

As generally permitted by the FTT, the most recent cases involve a pleading in which HMRC generally allege that all parties in a supply chain were part of an organised fraud, but of which HMRC maintain they are unable to prove the scope, and cannot be compelled to do so. In the cases of E Buyer and Citibank, there was confusion as regards whether or not an allegation of dishonesty was directly made against the appellant taxpayers themselves.

It is helpful to see how the UT has ruled in the taxpayers favour in the case of E Buyer and Citibank. Interlocutory battles of this type are nevertheless an additional and significant expense to appellant taxpayers, meaning that only selected cases can gain the advantages of knowing with any clarity the cases against them. Only time will tell if HMRC adopt the guidance set out in this case.

www.tribunals.gov.uk/financeandtax/Documents/decisions/E-Buyer-and-Citibank-v-hmrc.pdf

To continue reading this update, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.