Vietnam is making a concerted attempt to drive foreign interest and investment to the country. This includes participating free trade agreements, such as the Trans Pacific Partnership, which was signed on 4 February 2016 to promote economic growth and productivity among 12 pacific rim countries; as well as new investment and enterprises laws that came into effect on 1 July 2015.

The aim of the new laws is to create a favourable business environment for foreign investors to operate in; significantly reducing administrative procedures, as well as shortening the timeline required to set up foreign owned companies. Businesses operating in sectors such as agriculture, education and supporting industries also benefit from greater tax incentives and rental exemptions.

Although the laws have improved the regulatory framework for investors, practices can still differ between each provincial authority.

The changes in the Law on Investments and Law on Enterprises are as detailed below:

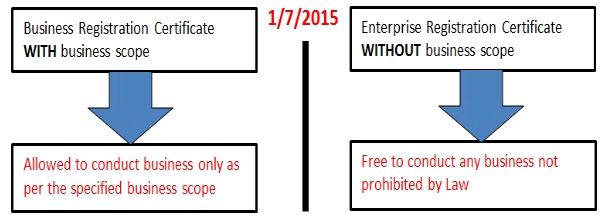

- Freedom on doing business in Vietnam

- Shorten licensing timeline for foreign investors. Instead of 45 days, the licensing time for green field projects only takes 18 days; 15 days for the Investment Registration Certificate and three working days to obtain the Enterprise Registration Certificate.

- Numbers of legal representatives. A Limited Liability Company and Joint Stock Company can appoint two or more legal representatives; at least one legal representative must permanently reside in Vietnam.

- Charter capital requirement. Charter capital (paid-off capital) must be contributed within three months of the Enterprise Registration Certificate issuance date.

- Option of company seal quantity. Businesses can freely determine the number of company seals they require. Upon determination, the company seal must show the company name and the code. The licensing authority must then be notified for posting this information onto the national business registration online portal.

- Tax incentives. New investment projects on manufacturing supporting industry products, which are on the list of industrial products of prioritised development, will be entitled to tax incentives. They include textile and garment, leather (footwear), electronics, automobiles manufacturing and assembling, manufacturing engineering and industrial products supporting high technology industries.

The changes clearly impact both existing local and foreign businesses; the latter is affected more greatly:

- Existing foreign-owned companies are required to post their business information onto the national business registration online portal at the relevant provincial licensing authority.

- If there is any change of the enterprises' business information, the current investment certificates of existing foreign-owned companies are occasionally required to be divided into two certificates, for example, Investment Registration Certificate and Enterprise Registration Certificate. Then, the official seals of these existing foreign-owned companies must be changed in accordance with the new Enterprise Registration Certificate.

- Existing foreign-owned companies operating under limited liability and joint stock models which have the legal representative who does not reside in Vietnam are required to appoint a new legal representative who is a physical resident of Vietnam, or to appoint a physical resident as a second legal representative.

Although the required administrative work may affect business or back office operations, most investors are positive about the change as they will benefit from an overall reduction in administrative procedures plus gaining additional incentives on tax and land lease costs. However, it is important to note that the interpretation of laws between each of the local licensing authorities may differ.

TMF Group understands local rules and regulations. We have the expertise to help investors stay compliant and avoid unexpected costs while doing business in Vietnam.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.