Tax law changes will take effect in Hungary from 1 January 2016, following the November passing of amendments by the country's Parliament.

The main purpose of the amendments is to support the Hungarian Government's aims in connection with economic growth and stability of the state budget. The changes are therefore small compared to the more structural law adjustments of previous years – and they are specifically focussed on decreasing the administrative burden on taxpayers, and showcasing Hungary's business 'friendly' Tax Authority.

The most important changes can be summarised by the following tax types.

Act on the Rules of Taxation

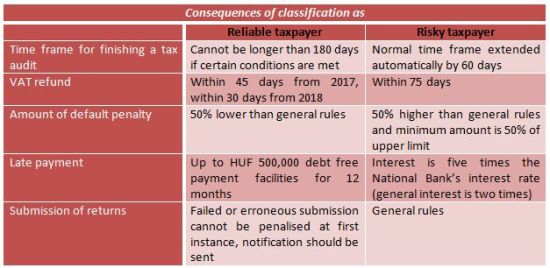

From 1 January 2016 the Tax Authority will categorise taxpayers on a quarterly basis as 'reliable', regular and 'risky' according to legal criteria set in the Act. While the consequences of being a reliable taxpayer will be beneficial, risky taxpayers are set to 'gain' the Tax Authority's special attention and can expect a strict approach during tax audits.

In order to qualify as reliable taxpayer a number of criteria must be met:

- at least three years of continuous operation or being registered for VAT

- total net tax debt (overdue amount) at the end of the quarter cannot be higher than HUF 500,000 (approx. €1,600)

- the taxpayer is not classified as a risky taxpayer

- default penalties in the previous two years did not exceed 1% of the tax performance of the year in question.

Further, in the year in question and in the preceding five years:

- the tax arrears assessed as a result of a tax audit cannot be more than 3% of the tax performance of the year in question

- the taxpayer is not under liquidation, bankruptcy or foreclosure

- there was no need for forced cancellation, or the suspension or cancellation of the taxpayer's tax number.

The Tax Authority will classify a taxpayer as risky if:

- it is not under liquidation procedure or forced cancellation

- it is publicly listed in the Tax Authority's website as a taxpayer employing unreported workforce or having either high tax debt (late payment by at least 180 days and HUF 100 million) or high tax arrears

- it has not been sanctioned repeatedly by store closure within one year.

The risky taxpayer classification applies for one year, but can be cancelled upon settlement of tax debt and tax arrears from the subsequent quarter.

Corporate Income Tax (CIT)

As a result of adopting IFRS in the accounting, several new tax base modifying items will be introduced in Corporate Income Tax effective from next year. Due to the complex nature of these specific rules, the relevant details are not listed here but referred to in a separate article dealing with the consequences and requirements of IFRS adoption.

In addition, there is an interesting amendment that came into effect on 25 June 2015 called Tax Credit for Growth. Basically, this is a possibility for a two-year tax payment deferral: the CIT arising on that part of the pre-tax profit that exceeds five-times the pre-tax profit of the previous year can be settled during the two following fiscal years, instead of paying it in advance in the current year.

This credit is subject to certain conditions such as restrictions of any kind of transformation (merger or demerger, etc.) in the preceding three tax years, which also implies that the taxpayer is supposed to be subject to CIT for at least three years before the application, i.e. the rule may not be applicable to start-ups. Although the required growth rate is quite high, if achieved, this amendment is clearly beneficial.

Local Business Tax (LBT)

Apart from the amendments in connection with IFRS accounting that cover the majority of changes regarding LBT, municipalities now have the discretion to offer a new tax incentive with regard to R&D expenses. The incentive consists of a deduction in the LBT amount of 10% of direct expenses for basic research, applied research or experimental development. This incentive comes in addition to the already existing incentive of allowing the total amount of R&D costs as a tax base decreasing item.

Value Added Tax (VAT)

Deduction right

According to present rules VAT can be deducted anytime within the limitation period. VAT audits, however, established the misuse of this right in several cases. Consequently, from 2016 on, taxpayers can only exercise their right for VAT deduction for decreasing their payable VAT in the same period when the deduction right arises or in the following one calendar year. Furthermore, deduction of self-charged VAT (intra-community purchase or import) will only be possible in the period in which the VAT was charged.

This rule does not mean that right for deduction will be lost should the taxpayer not be in a position to deduct the VAT accordingly, but can only be exercised by means of self-revision within the limitation period.

Invoicing

Foreign taxable persons supplying the following to a non-taxable Hungarian person will be exempted from the obligation to issue an invoice, unless specifically requested by the purchaser of the service:

- electronically supplied services

- telecommunication services

- radio and audio-visual media services

- VAT exempt air passenger services

Periodically supplied services

The date of supply (point of VAT) in case of periodically settled services – including transactions subject to successive statements of account or successive payments and services for a specific period of time – will be the last day of the period concerned. Although this general rule is in compliance with the EU VAT Directive, based on common invoicing patterns used in the past we can state that in practice, the two exceptions will be used most of the time. These are as follows:

- the date of supply should be the due date of payment if this date is after but within 60 days of the last day of the period – this implies that once the due date is out of the 60 days, then the date of supply is the 60th day counted from the last day of the period

- the date of supply should be the invoice date (date of issue) if both the due date and the invoice date is before the last day of the period concerned.

This rule must be adhered to periods beginning after 31 December 2015.

Personal Income Tax (PIT)

The most important change from the business entities' point of view is that the flat rate of PIT will be reduced by 1% - from 16% to 15%. The decrease in personal income tax will also affect the employer's burden on benefits in kind which is now decreased by 1.19%.

Another favourable change which has been in effect since 1 August 2015 is that parents with children attending pre-school or nursery care can use their car for commuting instead of public transport, and be reimbursed for this by a tax-free reimbursement of HUF 9 / km even if they live within the administrative boundary of their workplace. This tax-free reimbursement is mandatory for those employees who are living outside the border of the workplace.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.