The recent English Court of Appeal decision in Wilson and Sharp Investments Ltd v Harbour View Developments Ltd provides some judicial guidance on the interpretation of Section 111(10) of the Housing Grants, Construction and Regeneration Act 1996 (as amended) ("the Act"). This is an English Court of Appeal decision and so while not binding in Scotland it could be taken into account by Scottish courts.

Statutory background

The Act provides that a payment provided for in a construction

contract is generally to be paid on or before the final date for

payment – the Act includes an exception to this rule where

the payee has become insolvent. Section 111(10) of the Act

sets out the insolvency related exception.

Section 111(1) and (10) of the Act (introduced by the Local

Democracy, Economic Development and Construction Act 2009) provide

as follows:

"(1) Subject as follows, where a payment is provided for by a construction contract, the payer must pay the notified sum (to the extent not already paid) on or before the final date for payment."

"(10) Subsection (1) does not apply in relation to a payment provided for by a construction contract where:

- (a) the contract provides that, if the payee becomes insolvent the payer need not pay any sum due in respect of the payment; and

- (b) the payee has become insolvent after the prescribed period

referred to in subsection (5)(a)."

Subsection (5) (a) of the Act provides that a pay less notice must be given not later than a prescribed period before the final date for payment.

The case

The relevant fact of the case are:

- 2012/2013: The parties entered into two contracts for the construction of student accommodation in Bournemouth which were subject to the terms of the JCT Intermediate Building Contract with Contractors Design (2011) Edition ("JCT Contract").

- August/September 2013: certain interim certificates were issued with final dates for payment in August/September 2013. No pay less notices were issued by the Employer.

- November 2013: over £1m remained unpaid to the contractor from the interim certificates.

- July 2014: sums still remained unpaid to the contractor and the contractor became insolvent.

It was decided that:

- The JCT Contract included a standard form clause that complied with Section 111(10).

- Section 111(10) of the Act and the relevant JCT clause applied such that, upon the insolvency of the contractor, the employer was no longer required to pay to the contractor the amounts under the interim certificates – even although the contractor became insolvent many months after the final date for payment of the relevant amounts and no pay less notices had been issued by the employer.

Commentary

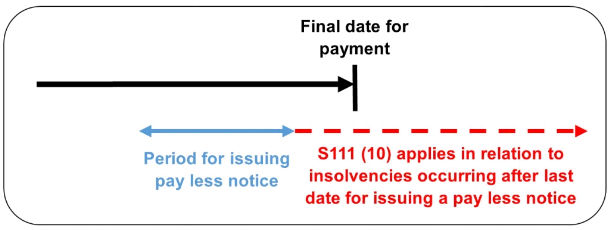

Some commentators have suggested that Section 111(10) would (i) only apply in respect of insolvencies occurring in the period between the last date when a pay less notice can be issued and the final date for payment, and (ii) not apply in respect of insolvencies occurring after the final date for payment. The decision in this case quite clearly gives Section 111(10) a broader interpretation such that it would apply in respect of insolvencies at whatever point they occur after the last date on which a pay less notice could have be issued (including insolvencies occurring after the final date for payment).

As is described in this case, Section 111(10) was introduced to the Act in response to the House of Lords decision in Melville Dundas Ltd (in receivership) and others v George Wimpey UK Limited and others. Section 111(10) can be seen, in respect of construction payments, to serve the same purpose as the insolvency law rules on the balancing of accounts on insolvency. Balancing of accounts on insolvency was referred to and explained by Lord Hope in the Melville Dundas case – the common law rule has the effect that a creditor of a person who has become insolvent is entitled to set-off illiquid debts against an insolvent debtor's claims; the purpose being to prevent the hardship of the debtor who is also a creditor being forced to pay in full, when he will come in only as a creditor for a dividend for his debt as a result of ranking on an equal footing with the ordinary creditors. In other words it would mean that a solvent employer would not be forced to make payment in full to an insolvent contractor when the solvent employer will effectively have no chance of making a recovery from the insolvent contractor of sums that are due to the solvent employer from the insolvent contractor.

Key Observations

- The case suggests that Section 111(10) will apply in respect of insolvencies at whatever point they occur after the last date on which a pay less notice could have been issued.

- The relevant standard JCT clause was held to be compliant with section 111(10) – the position is perhaps less clear with the NEC3 suite of contracts.

- Employers should make sure that a clause complying with section 111(10) is included in all construction contracts they enter into – to protect against contractor insolvency.

- Main contractors should make sure that a clause complying with section 111(10) is included in all sub-contracts they enter into – to protect against sub-contractor insolvency.

- Funder's carrying out due diligence should make sure that main contracts entered into by borrowers contain a clause complying with Section 111(10).

- Insolvency Practitioners should (a) check for a valid clause complying with Section 111(10) before allowing an employer/contractor to set-off against construction payments that would otherwise be due by them to an insolvent contractor/sub-contractor, and (b) in the absence of such a clause (as is required by the Act), consider carefully to what extent the rules on balancing of accounts on insolvency will apply for the benefit of a solvent employer/main contractor in respect of construction payments that are due by them to an insolvent party.

Disclaimer

The material contained in this article is of the nature of general comment only and does not give advice on any particular matter. Recipients should not act on the basis of the information in this e-update without taking appropriate professional advice upon their own particular circumstances.