1 GENERAL NEWS

1.1 Scottish land & buildings transactions tax

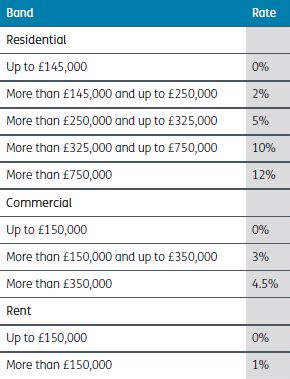

A draft Scottish statutory instrument has been published setting out the Land & Buildings Transaction Tax (LBTT) rates and bands, as noted below, that come into effect on 1 April 2015.

www.legislation.gov.uk/sdsi/2015/9780111026359/pdfs/sdsi_9780111026359_en.pdf

1.2 Consultation on land transaction tax in Wales

The Welsh Government is asking for responses by 6 May 2015 to a consultation on replacing SDLT in Wales with a land transaction tax (LTT). The target date for replacement of SDLT in Wales by the Welsh LTT is April 2018.

In 2013/14 Wales accounted for 4.1% (51,600) of the SDLT returns submitted in the UK for transactions over £40,000, excluding exempt transactions, generating 1.5% (£145m) of the revenue. The average house price in Wales is £162k compared to £181k in Scotland and £242k for the UK.

The consultation asks for input on a number of areas, including:

- Rates, including whether the 15% rate for acquisitions by non-natural persons (eg companies) should apply to Welsh transactions;

- the definition of a residential property;

- whether non-residential rates and method of application should be similar to that used in England;

- whether the system for dealing with partnerships and trusts for SDLT should be changed for LTT;

- whether or not SDLT reliefs should be provided under LTT (the suggestion is a sub sale relief similar to the 'pre-completion contract' provisions for SDLT should be provided);

- whether anti-avoidance rules similar to FA 2003 s.75A should have a motive test;

- whether there should be a general anti-avoidance rule or a general anti-abuse rule and how narrowly it should apply.

http://wales.gov.uk/consultations/finance/land-transaction-tax/?lang=en

http://wales.gov.uk/docs/caecd/consultation/150210-land-transaction-tax-en.pdf

1.3 POTAS conduct and monitoring notice regime - legislation and guidance

Two statutory instruments have been issued clarifying the requirements for the conduct and monitoring notice regime for promoters of tax avoidance schemes (POTAS – previously referred to as high risk promoters), one excluding certain businesses from the definition of 'promoter' for this purpose, the other refining the threshold conditions which might lead to the issue of a notice. HMRC has also published guidance on the operation of the POTAS regime.

SI 2015/130 specifically excludes with effect from 17 July 2014 certain 'promoters' from the definition of a 'promoter' for the purposes of the FA 2014 regime for issuing conduct and monitoring notices in relation to tax avoidance schemes. Relevant arrangements are those with a main purpose of enabling any person to obtain a tax advantage.

Those 'promoters' excluded are:

- An in-house company carrying on a

business of a promoter, provided the following conditions are

met:

- the business service is provided to companies in the same group (group companies being 51% plus subsidiaries); and

- the company has not provided these services to anyone other than a group company within the last three years.

- A person who is responsible to any

extent for the design of the proposed arrangements or proposals,

if:

- the person does not provide tax advice in connection with the proposed arrangement(s); and

- the person could not reasonably be expected to know that the proposed arrangement is a relevant arrangement/proposal.

www.legislation.gov.uk/uksi/2015/130/pdfs/uksi_20150130_en.pdf

SI 2015/131 comes into force on 2 March 2015, amending FA 2014 Sch34. It defines the type of professional misconduct of a member of a professional body that meets the threshold condition as one which a professional body describes as misconduct, or that is a breach of their rules and relates to the provision of tax advice or tax-related services, as follows:

- It defines the prescribed actions of

a professional body that can meet the threshold conditions as those

which result in any claim being referred to:

- a disciplinary process, which determines the seriousness of misconduct and penalty imposed; or

- a conciliation, arbitration or similar settlement process (however described), which determines the seriousness of the misconduct and the level of any penalty to be imposed.

- It sets out the professional body

penalties relevant for the threshold conditions as one or more

of:

- a fine of more than £5,000;

- a condition or restriction on, or attached to, a certificate or licence required to practice under the professional body;

- suspension, withdrawal or non-renewal of a certificate or licence required to practice under the professional body; or

- suspension, expulsion or exclusion from membership of the professional body, whether temporary or permanent.

- It adds the Chartered Institute of Tax and Chartered Accountants Ireland to the list of professional bodies.

- It prescribes a relevant sanction by

a regulatory authority for the purpose of the threshold conditions

(FA 2014 Sch34 para 9) as:

- a fine or financial penalty;

- a suspension of an approval issued by the regulatory authority to perform any related function;

- the imposition of limitations or other restrictions in relation to the performance of any related function;

- the imposition of any conditions in relation to any approval issued by the regulatory authority; or

- a regulatory authority publishes a statement of misconduct by that person.

www.legislation.gov.uk/uksi/2015/131/pdfs/uksi_20150131_en.pdf

HMRC has issued 93 pages of guidance on the FA 2014 'promoters of tax avoidance schemes' legislation.

2 PRIVATE CLIENT

2.1 Online tax summaries available for SA taxpayers

HMRC has confirmed that those taxpayers who filed their 2013/14 self assessment (SA) tax return electronically by the 31 January deadline can now access their HMRC online tax summary. These summaries satisfy part of the Government's transparency agenda, by setting out how much tax and National Insurance the taxpayer paid in the tax year, and how those payments contributed to public expenditure.

The online summaries, available to over 8 million SA taxpayers can be viewed by logging onto HMRC online services and selecting the 'View your 2013 to 2014 tax summary' option.

Those who file their return late will have access to the summaries once their return has been submitted. As mentioned in Update last year, HMRC has also been gradually posting paper summaries to non-SA taxpayers, who are in the PAYE system. The remaining summaries will be dispatched once the remaining PAYE taxpayers' 2013/14 tax affairs have been finalised.

For those neither in SA nor PAYE, HMRC has developed the 'HMRC App' available from the Apple App Store or the Google Play Store, which will enable taxpayers to estimate their tax bill and see how it contributes to public spending.

2.2 World Bank pension income and its liability to UK income tax

The Upper Tribunal (UT) has overturned the First-tier Tribunal (FTT) and concluded that a World Bank pension paid to a UK resident former employee (Mr Macklin) of the World Bank was exempt from UK income tax, under the terms of the UK/US double tax agreement. The case considered in detail how the words 'established in' should be interpreted in the context of where the relevant pension scheme was established.

Article 17 of the UK/US double tax agreement (DTA) provides that a pension beneficially owned by a resident of one of the contracting states shall only be taxable in that contracting state. Notwithstanding that, if the pension income from a pension established in the other contracting state would be exempt for a resident of that other contracting state, it will also be exempt in the first mentioned contracting state.

Despite a communication from the IRS that the pension scheme was not organised in the US, the UT considered the HMRC's expert witness' evidence (which the FTT had considered in reaching its conclusion) was inadmissible. The UT determined the pension income was exempt from UK income tax, concluding:

- 'established in' refers to a pension scheme's physical location;

- a pension scheme need not necessarily

be 'generally exempt from taxation' as such; and;

That conclusion is consistent both with the ordinary meaning of 'established in' and the fact that the DTA nowhere states that a 'pension scheme' must be established 'under or in conformity with the relevant contracting state's tax legislation relating to pension schemes' or generally exempt from income taxation 'as a pension scheme'.

www.tribunals.gov.uk/financeandtax/Documents/decisions/Macklin-v-HMRC.pdf

To read this Update in full, please click here.

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice. You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents. © Smith & Williamson Holdings Limited 2015