In this Tax Flash, we aim to provide you an overview of the current practice on exchange control in China and highlight the common exchange control issues encountered by foreign investment enterprises operating businesses in China.

1. CURRENT ACCOUNT ITEMS

1.1. International Trade

In theory, RMB is freely convertible for all current account items. No specific approval by the local administration of foreign exchange would be required. Commercial banks in China could review the relevant documentation and arrange settlement of imports by remitting RMB or converting RMB into USD for remittance out of China; or arrange receipt of RMB or USD funds receipts and in respect of exports settlement. In practice, stringent control is still imposed on cross-border settlement. Before mid 2012, foreign investment enterprises ("FIEs") are required to have its exports out of China be collected within 180 days in general. Otherwise, they would be considered as not in compliance with the foreign exchange rules and no VAT export refund claim would be entertained.

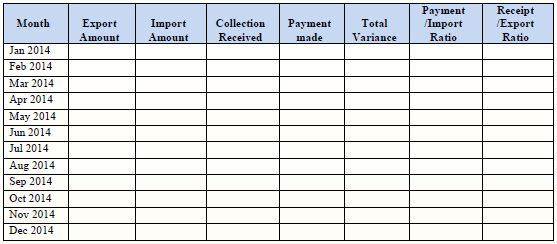

Under the prevailing foreign exchange system, there is no specific due date for FIEs to collect the accounts receivable from overseas. There is no specific due date for collection of exports sales for the purposes of obtaining export VAT refund. However, there is a foreign trade system tracking the export sales, import of raw materials, foreign currency collection and foreign currency settlement made by FIEs. The system records the following data and tracks the following indicators on a 12-month moving average.

a) Total Variance Index (12 months)

= [(Total of Import declarations + Total of Foreign Currency

Receipt) – (Total of Foreign Currency Payment + Total of

Export declarations)]

b) Payment / Import Ratio (12 months)

= Foreign Currency Payment Amount / Total of Import declaration

Amount x100%

c) Cash Receipt / Export Ratio (12 months)

= Foreign Currency Receipt Amount / Total of Export declaration

Amount x100%

In general, the system will show "red" indicators when a ratio is beyond certain reasonable range set by the government. If the ratios turn to normal within 1 to 2 months, no specific action will be taken by the government. If the ratios continue to be outside the reasonable range, an FIE's status with the local administration of foreign exchange will be downgraded and each cross-border transaction would be subject to review and verification before execution.

FIEs are required to closely monitor the above mentioned ratios in order to avoid questions/challenges raised by the local administration of foreign exchange.

1.2. International Services

On 9 July 2013, the State Administration of Foreign Exchange ("SAFE") and the State Administration of Taxation ("SAT") have jointly released "Notice on Record Filing for the Payment remittance of Trade in Services and Other Related Items". On 18 July 2013, the SAFE further released "Foreign Exchange Administrative Guidelines and Implementing Rules for Trade in Services" which will greatly simplify the foreign exchange administration procedures for trade in services. Both circulars took effect from September 1, 2013. The details are highlighted as follows:

- For services trade transactions below or equal to USD50,000, banks would not be required to review the related transaction documents;

- For services trade transactions (payment and collection) above USD50,000, banks should verify the transactions and keep the relevant supporting documents;

- For payment of services trade transaction (single payment) above USD50,000, banks should also verify whether the domestic company has properly filed the tax registration with the respective tax bureau; and

- FIEs may retain the services trade proceeds in overseas countries, subject to certain conditions.

The above Notice prescribes a new tax recordal filing system to replace the existing advance tax settlement certificate system. For each covered remittance that exceeds USD50,000, the Chinese payor needs to perform a tax recordal filing with its in-charge state tax bureau. The reporting package submitted by the Chinese payor for the initial remittance includes the executed contract or other legal documents evidencing the relevant transaction. Once the tax bureau confirms the completeness of the relevant documents submitted, it would stamp the tax recordal form, and the Chinese payor would then take the stamped form to the designated forex remittance banks to process the outward remittance. For any subsequent remittance related to the same transaction, the taxpayer only needs to provide an updated tax recordal filing form reflecting that particular remittance.

The types of remittances that fall within the scope of the Notice include income derived by non-residents from services, intangible licensing, finance lease, real estate transfer, equity investment (e.g. dividend), foreign loan (e.g. interest), guarantee, and various current transfer items.

According to the Notice, the tax bureau would review the details of the form, together with the relevant documents submitted by the Chinese payor within 15 days upon receiving the form. Should the tax bureau find that not enough tax has been paid on outward payments, the tax bureau can require the Chinese payor to make up the under-payment and impose late payment surcharges as well as a penalty.

2. CAPITAL ACCOUNT ITEMS

2.1. Conversion of Capital

The relevant foreign exchange control regulations and measures require FIEs to provide proper documentation (either business contracts or proper tax invoices) to their banks for review and verification before USD capital injected amount can be transferred to USD current account or RMB current account. However, based on our experience, many PRC commercial bank officers (and officers of local administration of foreign exchange) do not read China law and regulations at all and insist having proper PRC tax invoices before USD capital injected amount can be converted/transferred to current accounts for use. Offshore RMB capital and loan injected amount would be subject to the same stringent requirements.

FIEs are required to have many face-to-face meetings with the bank officers, providing them with the relevant PRC foreign exchange regulations and measures, "educating" them the proper interpretation of the relevant regulations and measures before capital conversion/transfer to current accounts can be arranged.

2.2. Overseas Loan

FIEs can make loans to its overseas affiliates. The major applicable circulars for the aforementioned loan arrangement are HuiFa[2009]No.24 ("Circular 24") , HuiFa[2012]No.59 ("Circular 59") and HuiFa [2014] No. 2 ("Circular 2").

According to Circular 24, Circular 59 and Circular 2, the following requirements should be met for the application to the SAFE local Branch:-

a. The lender and the borrower have to be incorporated in accordance with the relevant laws and regulations in the respective jurisdictions, and their registered capital have been fully contributed;

b. The lender and the borrower have not violated any foreign exchange law and regulations, and have not violated the relevant annual foreign exchange inspection requirements in the recent 3 years;

c. The cumulative amount of loan made available to the foreign affiliate by a PRC company should not exceed 30% of the Lender's net asset value/shareholder's equity (special approval is required in case this threshold is triggered);

d. If the lender has existing outbound investment projects (e.g. outbound direct investment, foreign loan to overseas entities, etc.), these outbound investment projects should be approved by the relevant government authorities, and registered with the SAFE, and ranked as grade B or above in the recent annual outbound investment inspection;

e. If the lender has an existing foreign loan to its overseas affiliates, such foreign loan arrangement should be in compliance with the prevailing laws and regulations.

According to Circular 24, Circular 59 and Circular 2, the general application procedures are as follows:

Step 1. Submission of application documents to the SAFE local Branch (please refer to the below for the general application documents).

Step 2. The SAFE local Branch will review the application, in general, the review would take approximately 1 month.

Step 3. Upon the review, if the application is approved, the SAFE will issue approval and the approved total amount of the foreign loan.

Step 4. The lender upon receiving the approval from the SAFE, can proceed the foreign loan arrangement with its bank.

The whole process will take 1-2 months to complete, depends on the experience of the officers in charge of the SAFE local branches.

General application documents

According to Circular 24, Circular 59 and Circular 2, the following application documents should be submitted to the SAFE:-

a. Application letter, including but not limited to the following information:

- Basic information of the lender

- Basic information of the borrower

- The amount of loan

- Source of funding of the loan

- Foreign loan commitment letter (including information such as those indicating that the use of the loan should be in compliance with the applicable laws and regulations in the relevant jurisdiction; the principal and the interest of the loan should be repaid on time according to the loan agreement, etc.)

b. Application form;

c. Loan agreement;

d. The latest auditor's report of the lender;

e. The latest auditor's report of the borrower;

f. Updated business Licenses of the lender after annual inspection; and

g. Any other information required by the SAFE.

3. OUR OBSERVATIONS

China is not required to keep increasing its foreign exchange reserve. Instead, China government aims to maintain a break even situation on her current account items (cross-border trade and services). This could help to alleviate international pressure on RMB appreciation. For capital account items, promotion of outbound investment by PRC enterprises could help to better use the foreign currency reserve of China.

Internationalization of RMB is a key strategy to effectively reduce the reliance of USD in China's international balance of payment accounts. If most imports and exports of China enterprises are denominated and transacted in RMB, the fluctuation of USD (against RMB and other foreign currencies) would not be a major concern to PRC enterprises having most of its operating costs settled in RMB. As far as outbound investments by PRC enterprises are concerned, it is still recommendable to invest in USD. This could help to use up part of the huge foreign currency reserve of China (USD3,820 trillion as of Dec 31, 2013). Transactions conducted by offshore RMB centres in Hong Kong, Singapore, London and other countries are growing. It will take years before a healthy circulation of offshore RMB into and out of China can be set up. By then, more countries would consider keeping RMB as their reserve currency and China will play a more important role in formulating and monitoring international trade and finance policies.

We consider the exchange control imposed on foreign direct investment and loans into China shall be further relaxed. Besides formulating new regulations and measure, it is advisable for the SAFE to provide more formal training sessions to the officers of SAFE local branches as well as the officers of the commercial banks so that they could better understand the overall objectives of exchange control and avoid creating unnecessary burden to FIEs.

With China's extensive double tax agreement network and further relaxation of foreign exchange control, we anticipate more multi-national corporations will consider using their FIEs in China to be investment vehicles in Asia or even globally. To achieve this, the corporate income tax rate of 25% in China may not be a major concern but the stringent foreign tax credit system may need to be adjusted.

RSM Nelson Wheeler's dedicated and experienced tax specialists can:

- Advise on tax efficient holding and operational structures for new cross-border investment, including the formation of Hong Kong and Chinese business entities

- Review existing cross-border investment structures, advise on identified deficiencies, quantify any potential exposure from such deficiencies, and further advise on restructuring approach and procedures

- Assist clients to discuss and clarify matters with tax officials, including transfer pricing and advance rulings

- Act as client's representative in tax audits and tax investigations

- Provide transaction support services on mergers and acquisitions, including tax due diligence, deal structure advice, tax health checks, related human resources arrangements and other tax compliance and consultation services

- Advise on human resources and structuring employment arrangements in a tax-efficient manner

- Advise on tax equalization schemes

- Provide tax compliance services for individual and corporate clients in Hong Kong and China

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.