UK real estate, particularly prime property in London, has always attracted significant international investment.

Investment in UK real estate must be structured carefully in order to mitigate UK tax. Taxes may be levied on rents, development profits and capital gains, and there are also stamp taxes and inheritance taxes to consider.

We consider a number of common investment scenarios below, and particular structures which will help to shelter the investments from UK tax.

This guide is divided into four parts:

- Individual Investments

- Collective Investments

- UK Property Development

- High Value Residential Property

A) Individual purchase of one or more UK properties

Many of our clients are simply looking to purchase a single UK property, perhaps to use as a London base, whilst others wish to develop a portfolio of properties under single ultimate ownership. Many of these properties will be rented on the open market.

It should be mentioned at the outset that, at the time of writing, a non-resident is not subject to UK tax on capital gains, even where derived from UK assets. This includes a non-resident individual, partnership or company*. The Government has indicated, however, that it wishes to bring gains on all UK residential property sales into the charge to UK tax from 1 April 2015. Presently, investment properties can be sold on at a gain without attracting capital gains tax, (although note below that there may be a different treatment where a property is acquired, developed and sold on in a relatively short period of time).

Special tax considerations apply to the purchase of residential property with over £2 million. These are considered later in the briefing.

A private use property will not be subject to any taxes on (deemed) income in the UK whilst the owners remain non-resident for UK tax purposes. On the other hand, profits deriving from UK rental receipts are taxable in the UK in all cases, on the following basis:

- Non-resident individual owner: at a rate of between 20% and 45% on income depending on the level of profits

- UK resident company: 23% on income and gains

- Non-resident company: 20% on income only

It can be seen from the above that it is often preferable for the investment(s) to be made through a non-resident company, preferably in a low tax jurisdiction. Investors should nevertheless monitor the Government consultation process regarding the introduction of CGT for non-residents from 1 April 2015 and professional advice should always be taken.

An overseas landlord is required to register with HMRC under the Non-Resident Landlord Scheme. Strictly, 20% tax must be withheld by the tenant or agent from net rents. However, approval can be obtained from HMRC for rents to paid gross, providing an annual tax return is filed and tax paid on time.

In order to reduce net rents chargeable to UK tax, it is often advisable for the shareholder to loan the company funds to purchase the property. Interest is then paid as an allowable deduction from rents. The loan should be secured on the property in order to obtain a maximum deduction on arm's length principles under the UK transfer pricing legislation. There must also be a commercial level of equity contribution and a suitable interest rate.

Planning should be undertaken to ensure the interest paid has a non-UK source, to avoid UK withholding tax.

In many cases the shareholder advancing the loan will be a second BVI company which will not be chargeable to tax on its interest receipts.

A further advantage in using a non-UK company is that it eliminates exposure to UK inheritance tax (IHT). UK IHT is levied on all UK-situated assets on the death of the owner, regardless of residence or domicile status. The tax is levied at a rate of 40% above a threshold value of £325,000. By using a non-UK company (note that the requirement is for a non-UK incorporated company, not merely a non-UK resident one) the assets comprised in the estate on death are shares in a foreign company rather than the UK real estate. Such shares are exempt from IHT for a non-UK domiciliary.

B) Collective Investment Schemes for UK Real Estate

Although there are many individual private investors in London real estate, a collective investment scheme or fund is often required to generate sufficient purchasing power and / or leverage. As such they have become popular over the last ten years at both the public and private level. Note that such schemes are also subject to the new charges which came into effect from April 2013 if they invest in high value residential property and further advice should be sought in this regard.

Authorised Funds with Diversity of Ownership

At the public level, the UK introduced the Real Estate Investment Trust (REIT) in 2006. The REIT is a listed (although this can now include an AIM listing) fund undertaking a property rental business and is thus applicable to both retail and institutional investors. The advantage of a REIT is that income and gains are not taxed at REIT level, although withholding taxes often apply on distributions to investors and there is an annual requirement to distribute up to 90% of property income profits. Due to the listing requirement a REIT is not suitable in structuring a private property fund.

As an alternative to the REIT, the Property Authorised Investment Fund (PAIF) regime was introduced to allow a tax-favoured property fund to be formed without a listing requirement. The tax benefits are broadly similar to the REIT, but again withholding taxes will often be levied on distributions from the fund. Despite the reduced scale of the PAIF, there is still a rigorous "diversity of ownership" requirement, meaning that smaller groups of investors will still not be able to benefit.

Private Property Fund Vehicles

As a result of these restrictions Verfides has been active in developing non-UK based fund structures which are able to provide similar, or more extensive, tax advantages without the ownership restrictions placed on UK-based schemes.

In particular, the Cyprus Private Fund or ICIS is ideally suited as a private collective investment scheme for UK property. It combines the benefits of an EU-regulated fund which, when effectively structured, can achieve very low tax UK and overseas tax leakage. Cyprus funds are a good on-shore alternative to the traditional unit trusts established in Jersey, Guernsey or the Isle of Man, or may be combined with a traditional tax-efficient offshore investment structure.

Carefully structured financing, in accordance with UK transfer pricing principles, can reduce the UK tax charge significantly, whilst the profits received in Cyprus as dividends are not subject to tax. Dividends and / or interest can then be paid out to the ultimate investors free of withholding tax.

Simple Co-Ownership Structures

A group of investors looking to come together to invest in a particular project may consider forming a UK Limited Partnership, typically where they are not looking to attract further funds in the future from other investors. Each partner contributes funds to the partnership and takes an interest in the underlying partnership assets and income as a limited partner. As a limited partner, liability is limited to the sum invested and undrawn profits.

The partnership is transparent for UK tax purposes so that only income (not gains under current rules) arising in the UK will be taxable on the members. An unlimited partner, often an offshore company, is appointed to manage the assets but has no interest in underlying income or capital.

The advantage of a limited partnership structure is its flexibility, in that relations between partners are governed by a partnership agreement which can be altered at any time by agreement. The disadvantage is that the structure is relatively illiquid, unlike a fund where units or shares may be traded more easily. Care must be taken in structuring borrowings to reduce the UK tax charge, as there are restrictions applicable to partnership structures.

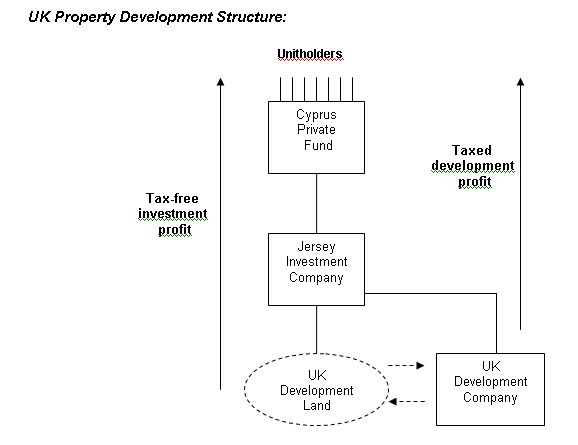

C) Planning for UK Property Developments

The UK property development market is also picking up again and has been a popular investment choice for non-residents.

A site is typically acquired, developed and then sold on at a profit in a relatively short period of time. Such an activity is considered a trading activity in the UK, subject to income taxes on trading profits. As such the amount of tax at stake is often considerable and careful planning is required.

Short-term developments may avoid UK tax altogether when the developer is a company based in a jurisdiction with which the UK has a suitable tax treaty. The treaty should state that a building site does not constitute a permanent establishment (PE) until the expiry of 12 months. This has typically involved the use of companies in Jersey, Guernsey or the Isle of Man.

Most developments last longer than 12 months and therefore a PE in the UK is unavoidable. In such cases, planning can be undertaken to ensure that only profits directly attributable to the PE come into charge to UK tax. With careful planning, significant pre-development profits, such as increases in value on securing planning permission, can be kept out of the UK tax net.

Such an offshore development vehicle is particularly attractive when combined with a Cyprus private fund, allowing a bespoke group of investors to collectively finance a development. There will be no further tax on the dividends received in Cyprus from the Jersey company, as they derive from a trading activity.

D) Ownership of High Value UK Residential Property

Recently the UK government introduced legislation that made major changes to the taxation of high value residential property, particularly those acquired or held by companies or other non-natural persons (NNPs):-

- The 2012 Budget introduced the 15% rate of stamp duty land Tax (SDLT) on acquisitions of single dwellings valued at more than £2m held by companies and certain other non-natural persons;

- The 2013 Budget introduced the Annual Tax on Enveloped Dwellings (ATED) which came into effect from 1 April 2013 and UK capital gains tax (CGT) was extended to certain disposals of high value residential property with effect from 6 April 2013.

Please find below a summary of the main points of the ATED and CGT legislation affecting high value residential properties.

Annual Tax on Enveloped Dwellings (ATED)

ATED is the new term for what was previously known as the "annual residential property tax".

The ATED will be applied to certain NNPs owning residential properties valued in excess of £2 million, from 1 April 2013. The rates are:

The NNPs which may be taxable under the ARPT are restricted to:

- Companies, where that company has a beneficial interest in such a property (i.e. not where it acts as mere nominee for an individual);

- Partnerships, where one or more partners is a company; and

- Collective Investment schemes.

Trustees (including corporate trustees) are not subject to the ATED where they hold property directly.

Capital Gains Tax (CGT)

With effect from 6 April 2013 the CGT rules were extended to impose a new CGT charge on certain non-natural persons when they dispose of UK residential property. The charge is again restricted to the sale of residential property worth in excess of £2 million. The rate of CGT applicable to disposals will be 28%.

Where the property was purchased before 6 April 2013 but disposed of after that date, the CGT charge will only apply to the part of the gain which accrued on or after 6 April 2013.

Trustees are not within the charge to CGT on direct disposal of such properties: the definition of NNP used for CGT purposes is the same as that used for the ATED.

Exemptions

Exemptions from the 15% SDLT rate, the ATED charge and the extended CGT charge include:

- Property development businesses

- Properties let out as part of a property rental business where let out to third parties on a commercial basis (in most cases this will exempt properties acquired as "buy-to-lets")

- Farmhouses and properties held by trading companies for the use of employees

Alternative Structures

Whilst some pre-April 2013 structures have been restructured, some have decided to retain these arrangements and accept the ATED charges. This is particularly where a corporate structure continues to provide significant protection from UK Inheritance Tax (IHT) or where there would be a high tax cost in restructuring.

For new purchases, there are a number of options to consider where the new property will not qualify for one of the exemptions from ATED.

It will be important to ascertain the goals of the investor in choosing a property ownership structure. In our experience, the main considerations are:

- Confidentiality/non-disclosure of ultimate beneficial owner

- Asset protection and succession planning (particularly when combined with a trust)

- Elimination of exposure to UK Inheritance tax

- Elimination of exposure to UK Capital Gains Tax

Therefore, whilst it might appear at the outset that the natural replacement for a corporate structure is direct personal ownership, this will not be suitable for many investors who value, above all else, confidentiality.

Alternative structures include:

- Personal ownership

- Ownership through a nominee entity

- Ownership through a partnership with no corporate members, or where a corporate member has a minimal capital share

- Ownership through a trust

Full professional advice is essential when considering structuring the purchase of high value residential property.

Summary

UK real estate continues to represent an excellent investment opportunity for non-residents. Structured carefully, the UK and international tax leakage can be minimised. There are also opportunities for collective investment in UK property within tax-efficient structures.

Where an investment has been or will be made into residential property worth in excess of £2 million, further advice should be sought in the light of the further tax charges introduced from April 2013. However, a corporate ownership structure can still be beneficial provided one of the exemptions from 15% SDLT rate, the ATED charge and the extended CGT charge apply.

Investors must also consider the planned introduction of CGT for non-residents on the sale of UK residential property and professional advice should be taken.

*Note that this capital gains exemption no longer applies from 6 April 2013 for high value residential property held by certain non-natural persons (including companies).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.