Executive summary

As a result of the digital revolution, the data universe has grown exponentially, shifting the nature of competition in the process. Put simply: there is more information on consumers than ever before.

At the same time, technology has empowered consumers, enabling them to become more sophisticated in their research and informed in their choices. They have instant access to information, whether it is from the comfort of their own homes, at the office or on the move, and they are influenced by experts and enthusiasts on review sites and blogs, as well as by friends, family and like-minded people on social media platforms. In accessing this data, they create additional behavioural information for analysis.

Analytics and actionable insight have often been the key characteristics defining business success stories in the recent slow growth period. By combining internal and external data with advanced analytics, leading organisations are moving from retrospection to prediction.

Predictive analytics are making it possible to anticipate consumer's actions, enabling businesses to offer consumers what they want, when and how they want it – and ahead of competitors.

To compete it is critical for consumer-focused businesses to transform and align their business models around insights into their consumers.

This is a huge opportunity, but there are also substantial risks, and much depends on the strategy employed to harness the data and in which areas they choose to apply the insight.

Companies must create a differentiated rather than "big" dataset. If they get it wrong they risk confusing or even alienating their consumers.

Trust is the key. Gather data in an appropriate manner and use it sensibly and ethically and consumers will want to share more data with your business.

The forthcoming introduction of the government's midata initiative will make it compulsory for brands to give consumers access to the data they hold on them, yet many businesses do not have a strategy for dealing with this.

For businesses to grow and retain their consumer base, they need to build a robust consumer analytics strategy. As the key issues will vary from business to business, so will the appropriate solutions. Analytics can positively impact almost every area of business, and executives must ensure the right organisational structure is in place to support key drivers of insight and implementation.

Deloitte's survey of leading industry players highlights varying levels of adoption, even among industry leaders, who use around 35 per cent of the data they generate to support decision making. There is a lot to play for and there is still an opportunity for consumer businesses to differentiate and compete through their analytics strategies.

Big data, big opportunity?

In a challenging economic environment, data is the only dimension for many businesses that is expanding. While today's technologies allow businesses to collect more information about their consumer, the practical question remains: how can businesses unlock the value of consumer data to gain a competitive advantage and grow market share?

The big data revolution

The depth and volume of data generated by and about the consumer is staggering. Even more incredible is the insight it can deliver when integrated and analysed with other seemingly unrelated resources, such as geospatial data.

'Big data' refers to the continuous increase in the volume of internal and external data. The data is either structured, for example in respect of transactions, or unstructured, which means generated from non-traditional sources and in near real-time, such as social media conversations, audio or video.

In this context many consumer-focused businesses are under increasing pressure to exploit big data to generate and protect revenues. But many simply do not appreciate the real cost – in terms of money and time – and very few understand that the strength and quality of consumer engagement lies beyond merely collating and capturing data about consumer behaviour.

Building a lean and differentiated dataset can help organisations focus on the data needed to genuinely connect with consumers and inspire their loyalty and trust. Moreover, where a company shares data with consumers to help them better understand their shopping patterns and make better choices it can encourage a more permissive consumer, more likely to consent to sharing.

But big data is not without risk. Focussing too much on acquiring large volumes can create more confusion. Similarly, using the depth of data to target consumers in a way that is too personal can alienate and elicit a negative response.

The case for analytics

The growing consumer footprint

A recent Deloitte UK survey on consumers' attitudes to data-sharing shows the extent of a typical consumer's data footprint. Some 80 per cent of the population holds at least one loyalty card and 70 per cent claim to have one or more online shopping accounts (Figure 1).

Online accounts and loyalty cards generate a vast amount of detailed transactional and demographic data.

However, not only are consumers producing large amounts of data, they are also accessing this data more often and becoming reliant upon it. One in four people research products and services online on a weekly basis before making a purchase (Figure 2).

Adapting to changed consumer expectations

A fundamental change has occurred in the consumer sector: the old way of building consumer conversion is breaking down, and consumer churn is increasing. From a steady cycle of product initiation to conversion, the sector has moved to a cycle of initiation followed by disruption and fragmentation, where consumers have taken more control over the conversation and are demanding more value.

In a market where more information has often created a more complex decision-making process, empowering consumers will be mutually beneficial for consumers and businesses.

Whether information is accessed by the consumer or pushed towards the consumer by the organisation the result is the same: more grounds to make the right decision as to what product or service will meet their needs. For a business, the higher the level of engagement and interaction with the consumer, the better position it is in to direct the right next best offer to the consumer . This more open and transparent relationship, enabled by digital and mobile technologies, is transforming the operating model of many consumer-focused businesses.

Identifying sources of profitable growth

Many businesses have in the recent period focused on cost reduction and now recognise that demand – certainly in Europe – is going to be weak for some time. Competitive markets have become less profitable places to do business, and as growth slows competition intensifies. Today a very important way for a business to grow is to win market share from the competition.

The increasing pressure to improve performance is leaving many consumer-focused organisations fighting for survival, and the need to identify areas of growth and to remain competitive has compelled businesses to consider investments in analytics. While advanced

analytics are currently seen as a commercial advantage, they will quickly become the norm as more companies compete on insight.

Capitalising on a big opportunity

A survey of leading industry players

To better understand the maturity level of consumer analytics capabilities within consumer businesses, Deloitte UK recently interviewed some of the leading players in the consumer sector.

Across the sample, management of analytics varies considerably. One organisation has a central analytical group that closely coordinates activities across the enterprise, while the majority have uncoordinated pockets of analytical activity or localised analytical capabilities that are just starting to share tools, data and people. The majority of businesses said they used around 35 per cent of the data they generated to support decision-making.

The business area that has made most analytics investment is marketing, followed by sales and finance. Looking more specifically at consumer intelligence and insight analytics capabilities, only a third of companies interviewed said they have reporting and predictive tools with prescriptive alerts such as data mining visualisation, targeted marketing or price optimisation .The majority have basic reporting tools with limited predictive capabilities.

Data capture and storage is focused first on transactions, followed by consumer surveys, social media, consumer demographics, loyalty cards and web browsing. The data is used mainly for segmentation and clustering analysis as well as for targeted marketing and assessing experience performance.

New ways of doing business

Managing big data through embedded consumer analytics capabilities leads to commercial opportunities. Integrating consumer data insight into business strategy can produce better returns through the development to innovations that get to market faster and are more relevant to consumers.

Before businesses invest time and money to acquire even more data, they need to assess the issues involved in serving their consumers:

- low up-take of targeted offers and recommendations, pointing to lack of relevance;

- consumer fatigue with traditional loyalty schemes, which they feel lack relevance; and

- concerns around data security and privacy.

Transforming the business through insight

Data alone is not enough. The key to success lies in the insights derived from it. Many companies need to make the strategic choices to manage the various risks associated with having too much data, whilst aligning their business models to act on the insight gained from the right level of data. A disciplined approach to the management and exploitation of data is required to focus investment where value lies (Figure 3).

It is estimated that the average British business has insight into one-fifth of its data. Companies need to stop focusing on data inputs and more on outcomes. All of the investment in big data and analytics is wasted if decision makers receive erroneous insights, or receive correct insights but do not have the skills or competencies to convert them into business decisions (Figure 4)

Choosing the right analytics solution

Hand in hand with the proliferation of consumer data, has come an expansion in the range of consumer analytics techniques, and methodologies, which makes selecting the right one to match a specific businesses need the key next step in developing a consumer analytics strategy. In the following section we look at examples and case studies of ways in which analytics can impact your business.

Achieving cross-sell through a single view of the consumer

Data from different consumer touch points, transactions and references can be used to create a single consumer view (SCV) and data file.

A leading UK retail chain needed a flexible and future proof SCV solution to allow the integration of traditional data sources such as electronic point of sale, EPOS and insurance feeds with new sources such as social media, email and IP addresses. The solution allowed the analysis of grocery shopping baskets to cross-sell into non-grocery and financial services, especially during significant events in the life of the consumer such as the birth of a child or house move.

New segmentation models

The practice of using consumer analytics to drive margins will intensify through more sophisticated consumer segmentation. A more disrupted and fragmented consumer journey requires a new approach. Understanding the decision-making process and most influential communication channels and areas of risk will help ensure brand communications are available and effective in the right channel, at the right time and for the right person.

The challenge for brand owners and marketers is to map this new journey and provide interventions – or means for consumers to provide their own interventions – along the way. Data analysis forms the backbone of this approach, with consumer segmentation, real-time decision-making and data analytics providing platforms for creative strategies.

Advanced market segmentation can provide a consumer-centric view which, when connected to the portfolio, can identify new innovation opportunities, service extensions or market developments.

Targeted offerings in real-time can also help increase profitability and consumer loyalty. In the gaming industry, for example, established consumers expect a tailored and personalised journey across channels; online, in-store, over the phone and via mobile.

Dealing with unstructured data

Social media initiatives are not achieving desired levels of consumer interaction, as businesses struggle to act on data collected. As Twitter and Facebook feeds become integrated, targeted offers via social media channels can be informed by multiple data points and cross-channel transactional history. This will deliver a more relevant and rounded message, demonstrating to the consumer that the business understands and values the relationship.

For example, one of the world's largest grocery retailers has recently launched a new recommendation engine which connects consumers' Facebook posts and tweets to a database of products sold by the retailer and sends them personalised product recommendations. The campaign resulted in a 10 to 15 per cent improvement in the probability of completing a sale. Similarly, many consumer businesses analyse social data to incorporate consumer feedback and drive product improvement.

Developing accurate consumer relevance models

Many businesses are currently using big data in a way that alienates consumers, and there is a real gap between consumer-focused organisations' data ambitions and their ability to obtain consumers' consent to share data. Deloitte UK research shows that 55 per cent of UK consumers opt out of receiving marketing materials from companies when providing them with their personal details. Another 24 per cent have a separate email account which they use when they think they are likely to receive spam (Figure 1).

Companies need to act more transparently, engaging with consumers more openly, giving data back and using it to achieve better relevance for consumers. Encouragingly, Deloitte UK research shows that a majority of UK consumers (52 per cent) have voluntarily registered to receive information about products, offers, sales and so forth by email (Figure 1).

Still, while 42 per cent of UK consumers claim to receive targeted communications at least on a weekly basis, only 11 per cent of those claim to complete a purchase as a result within the week they received the offer, while 27 per cent claim to complete a purchase as a result within three months, leaving the majority to complete a purchase within six months (47 per cent) and 16 per cent not considering a purchase at all (Figure 2).

A real opportunity exists to better measure and understand the inflection point when, faced with an offer, a consumer shifts from rejection to engagement (see Figure 5).

There is a direct relationship between 'relevance' and consent to share data. A certain degree of relevance needs to be achieved to reach the tipping point where consumers switch from negative to permissive attitudes and consent to their data being used to serve their needs.

Social engagement

Advanced analytics can help achieve a higher level of consumer engagement by identifying what drives consumer relevance from both internal and external data sources. To achieve a full and rich picture of the consumer, businesses need to capture and aggregate the full social engagement data set (Figure 6).

Appropriate use of real-time analytics will optimise what, how and when to contact consumers to ensure there is a positive response to engagement, rather than a rejection of what the consumer considers spam.

Real-time tracking of the effectiveness of campaigns and offerings allows businesses to adjust and continuously improve, to provide a consistent consumer experience across the lifecycle.

A move to real-time analytics means that organisations will have a range of sales, service, loyalty and brand campaigns which are not just sent to consumers when they are eligible for a campaign but are constantly available and delivered to consumers when the message is most relevant.

Rewarding the most valuable consumers

One way to obtain consent is based on offering the right level of rewards and benefits in exchange for data. There is a high correlation between relevance and benefits, as appropriate incentives and a well-executed relevance strategy can help overcome opposition resulting from data privacy issues and drive higher participation and retention.

A higher degree of relevance and obtaining consumer consent to share data depend on whether organisations clearly demonstrate to consumers the benefits gained from data collected and allow them to control whether they opt in or out (C2B models). Benefits to consumers and businesses must be mutual or weighted to the consumer or risk having the opposite effect than the one intended (i.e. supporting a decision that is in favour of the business).

Benefits to consumers and businesses must be mutual or weighted to the consumer or risk having the opposite effect than the one intended.

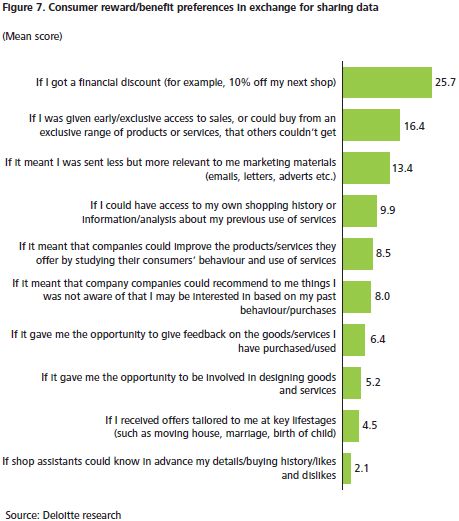

Deloitte UK research shows that receiving a financial discount is the preferred consumer reward for sharing data. It is followed by getting early or exclusive access to sales or a unique range of products or services (Figure 7).

Agile insight and data visualisation

With the explosion of data, the traditional data warehouse has become cumbersome and slow. For businesses, and retailers particularly, new technologies have enabled large volumes of data to be analysed and interrogated quickly and clearly. Without these advances, the amount of data and processing power required to provide insight would be overwhelming. Some retailers are already using:

- database analytics solutions to analyse massive data volumes generated through consumer transactions;

- inductive analytics techniques to allow the data to guide the analyst as to the opportunities and threats. These approaches can help identify consumers of similar behavioural traits based on purchases, demographics and online activity that may be missed using traditional hypothesis-led analysis; and

- 'in-memory' analytics to provide rapid data modelling and analysis in the hands of buyers, merchandisers, marketers and the supply chain.

Retailers are increasingly looking at agile sandbox type approaches to quickly identify opportunities for cost savings through SKU rationalisation, markdown and price optimisation. There are several new analytic architectures that enable this rapid development which do not rely on costly, long-term data warehousing programmes.

Data visualisation in the form of graphical representations of products, seasons, store layouts and even virtual shelving is replacing traditional text-rich reports, helping communicate sales and performance metrics with more impact. As organisations become more accustomed to the use of infographics in the media, retailers are looking to tools such as Qlikview, Tableau and RoamBI to provide relevant, timely and visually stimulating data, often delivered through mobile and tablet devices.

Optimising price

The rise of internet shopping, price comparison websites and the uncertain economic climate contribute to the difficulty, but also to the importance, of setting appropriate prices. These changes, however, are as much an opportunity as they are a threat.

One of the markets where pricing is crucial and challenging is the computer game market, where the vast majority of sales occur in the first week after release. Setting too high or low a price in that crucial period can mean the difference between the game being a financial success and not recovering its production costs.

Another critical challenge in this sector is the determination of price in the weeks following release. The price sensitivity of consumers increases systematically with time from release: consumers buying a game immediately after its release are relatively price-insensitive, while those who buy a game later in its lifecycle are usually much more responsive to price changes. Setting a high release price and successively lowering the price as time passes will use this pattern to ensure that high prices are offered to those consumers who are willing to pay, and that more price conscious consumers are given the opportunity to buy the game later. Doing this reliably requires meshing raw transaction data with an accurate model of product demand.

A large game publisher was looking for an analytics solution to help use its data to meet these challenges. Data on the current and past performance of games was used to build a predictive price optimisation tool. The tool allowed the business to experiment with different price scenarios, and to see their effect on demand and profit throughout the lifecycle of a game. It also computed an optimal pricing schedule.

Different but equally important challenges are faced by clients in more traditional consumer goods markets. A business in the premium spirits market was seeking to develop a more systematic approach to planning promotions. The organisation was faced with a challenge stemming from changing consumption and regulatory patterns, which disrupted established pricing structures and lowered margins through more intense price competition between retailers. Facing this threat to profitability, the business needed to understand the price dynamics of products, and how to best exploit them through an effective promotion structure.

The solution was designed to estimate the optimal frequency, length and extent of promotions, taking into account the products' own-and cross price effects and the dynamics of consumer stockpiling. To assist with this, data was analysed using a statistical demand model, which helped extract key information on consumer behaviour. The analysis suggested that optimising prices and reducing the average length of promotions, while increasing the promotional price discount and the volume sold at the promotional price, would lead to an estimated annual increase in gross profit of €830,000.

The right marketing mix

Having determined target segments and relevant propositions, businesses must decide how to communicate. Traditionally businesses focus on measuring the effectiveness of marketing and advertising spend. How much to spend and in which mix of media channels is still not widely understood. However, advances in data tracking, supporting technologies and advanced analytical methods are coming together to provide the tools to assess where to invest.

To acquire consumers, businesses should identify the right proposition, relevant message and optimal media mix for each segment. Data-driven market and consumer insight is important to achieve accurate targeting, whilst real-time analytics and social media management help connect with the audience at the right time.

Most consumer-focused organisations have looked at econometric modelling to help isolate the impact of marketing spend on sales, determine spend levels and optimise media mix. The outputs are often inconclusive and at too high a level to inform marketing planning and spend at a more granular level. However as the consumption of digital media increases - driven by a younger demographic but also through the wider adoption of smartphones and tablets – so does the marketers ability to track and record the impact of marketing spend.

Digital media tracking allows businesses to deliver a data-driven strategy, and a more accurate planning and budgeting process.

Adapting to changing regulations

With the proliferation of data analytics, regulators are starting to demand deeper insight into the risk, privacy implications and likely public response to businesses integrating consumer data into the way they operate. New legislation will impact how personal data can be stored, tracked or shared.

Among the UK government's initiatives to open up public data, the midata programme was launched in 2011.1 Midata aims to give consumers more control of and access to their personal data. The government perceives that consumers are at a disadvantage, since technology has allowed businesses to understand their needs and buying patterns to an unprecedented degree, while they do not have the ability to use that data. The midata programme aims to redress that imbalance.

European Union regulations expected to become effective in 2015, will usher in a new era in data protection. The regulations will introduce significant changes for data processors and controllers, including explicit and informed consent being required and the 'right to be forgotten'.2

Overcoming data security concerns

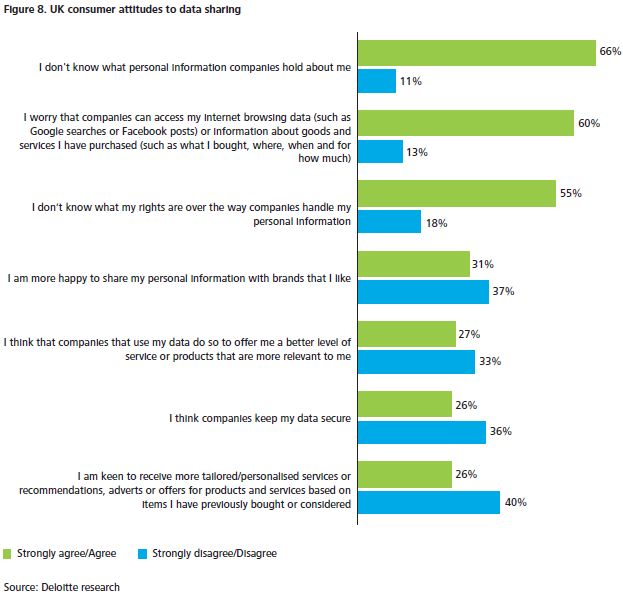

Concerns about data security and privacy are rising, suggesting the degree to which data is collated and analysed could irritate consumers and harm businesses (Figure 8).

The increased use of analytics has sparked a renewed debate about privacy and the responsibilities of government and business. With organisations enhanced ability to process vast quantities of data comes increased responsibility about when and how insights are used. Just because organisations can exploit data to target people better does not mean they should do so indiscriminately.

An example that achieved considerable coverage and notoriety was an online travel company which offered more or less expensive travel alternatives depending on whether accessed through a PC or a Mac. This case serves to highlight the challenges for firms in navigating the new boundaries around the acceptable use of consumer data. While the online travel agent's recommendation policy was designed to improve its profitability through better targeting of offers, it was met with a negative response from consumers.

It is possible that we will see the emergence of new ethical 'red lines' around the use of data and analytics, with self-imposed or voluntary codes introduced.

While some will struggle to get to grips with the issue, others will make the most of 'ethical analytics' by putting the power of data back into the hands of consumers, and in so doing turn conventional service delivery on its head.

Client imperatives

For businesses to grow and retain their consumer base, they need to build a robust analytics strategy, starting with identification of the key issues they need to address. They must pick analytics solutions which act as enablers to deliver actionable insights.

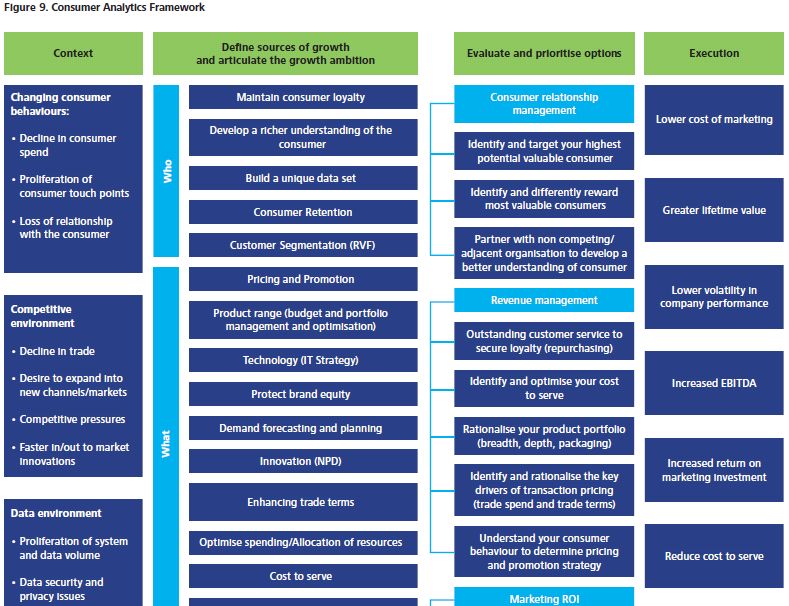

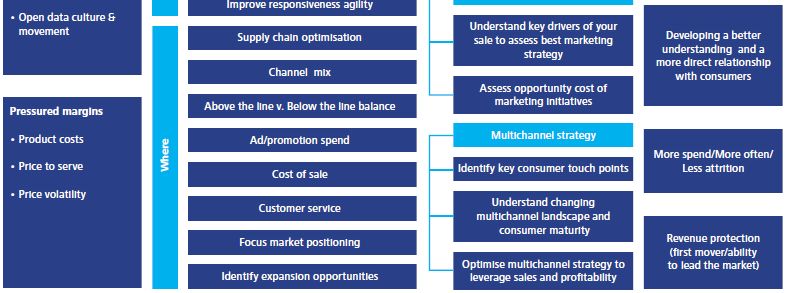

Building a consumer analytics strategy

The ultimate aim of consumer analytics is to ensure that a data driven insight informs every business decision. It needs to be ingrained in the culture of the business, not seen as just another element of the marketing toolkit. However in this report, where we focus on the consumer dimension, this is often talked of in the context of getting the right offer to the right consumer through the right channel – and the perfectly coordinated occurrence of these three dimensions at the same moment in time.

We have already established that tools exist to unleash the power of data and transform businesses' ability to make the right decisions. But how best to use them?

Applied consumer analytics can help businesses achieve growth by identifying the right sources of expansion in terms of:

- which consumer will growth come from?

- what are the right products or services and the right prices to achieve growth?

- in which channel will the growth occur?

- which media can be used to target growth?

In developing their analytics strategy, businesses have to deal with competition for financial and physical resources and different commercial imperatives, which means that they need to understand where the most difference can be made.

The following action points select some of the key areas where companies should look to concentrate as they evaluate how best to incorporate analytics into both the operational strategy and the culture or their organisations to become more fully consumer orientated businesses.

Evaluating the priorities

1. Improving consumer relationship management

- Future proofing the single consumer view: understand consumer value and behaviour to createa mutually beneficial relationship leading to longterm loyalty.

- Managing demand through multi-dimensional segmentation:minimise the risks attached to largestrategic investments by providing a clearerindication of future demand.

2. Optimising the marketing return on investment

- Marketing media optimisation:use models to simulate the most effective mix of media, channels and campaign sequencing, ensuring they put every element of the marketing spend to work.

3. Designing a multichannel strategy

- Maximising opportunities at every touch point: target consumers with appropriate campaigns andoffers at every point of contact through theconsumer lifecycle, based on real-time assessmentof consumer behaviour.

- Response in real-time:leverage data analytics and consumer insight to predict the most relevant next best action for a consumer so the right message is delivered to the right consumer at the right time.

4. Managing revenue

- Enabling agile insight and improving data visualisation:to identify consumers of similar behavioural traits based on purchases, demographics and on-line activity which may be missed using traditional hypothesis lead analysis and to communicate sales and performance metrics with more impact.

- Delivering dynamic pricing and promotions: experiment with new sources of data to moreclosely tailor offers and prices to consumers.

In developing their analytics strategy, businesses have to deal with competition for financial and physical resources and different commercial imperatives.

The Deloitte Consumer Tracker

Q3 2012

Key points

- UK consumer sentiment is its strongest since Q3 2011.

- Sentiment around the level of disposable income improved by ten percentage points in the past 12 months.

- The rise in consumer confidence has been underpinned by job security and consumers' focus on reducing debt.

- Defensive spending behaviours lessen as fewer consumers trade down and bargain hunt.

- Looking ahead to 2013, consumers remain concerned about rising prices and plan to continue to save and rebuild their finances.

Improved sentiment points to a likely upturn in consumer activity

This quarter's Deloitte Consumer Tracker points to a reduction in the stress on households, with consumers more positive about their income and employment and working hard to reduce debt.

UK consumer sentiment is at its strongest since the third quarter of 2011. Concerns around levels of disposable income have eased by ten percentage points in the past year to 33 per cent in Q3 2012. Consumers are also more positive about their debt levels, with the net balance down to minus 10 per cent, from 16 per cent a year ago.

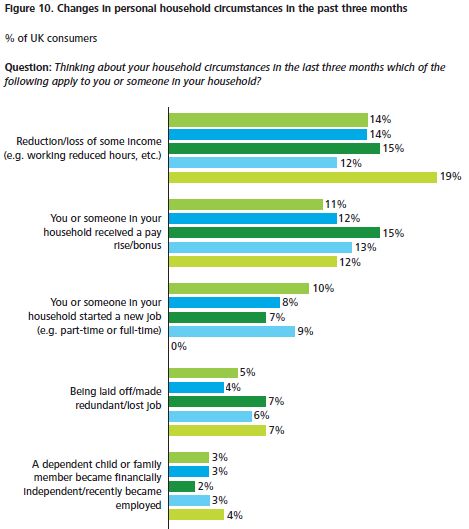

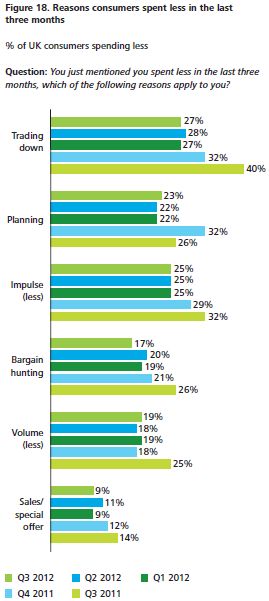

Consumer confidence around job security has helped underpin improved sentiment. Fewer households experienced some reduction or loss of income in the last quarter, compared to a year ago. In addition, the proportion of people claiming that someone in their household has started a new job was at its highest level since this survey began at 10 per cent. Defensive behaviours have declined. Trading down has dropped to 27 per cent, from 40 per cent a year ago, while bargain hunting has fallen from 26 per cent to 17 per cent and simply buying less is down from 25 per cent to 19 per cent.

Shifts in behaviour reflect recent official data highlighting a general improvement in the consumer market. However, consumers remain cautious, and there is no evidence yet of a significant loosening of purse strings. Whether recent signs of growth in consumer spending will continue will only become clearer when the Tracker picks up a pronounced shift towards greater discretionary spending and an upward trend in consumers' expansionary behaviours such as trading up.

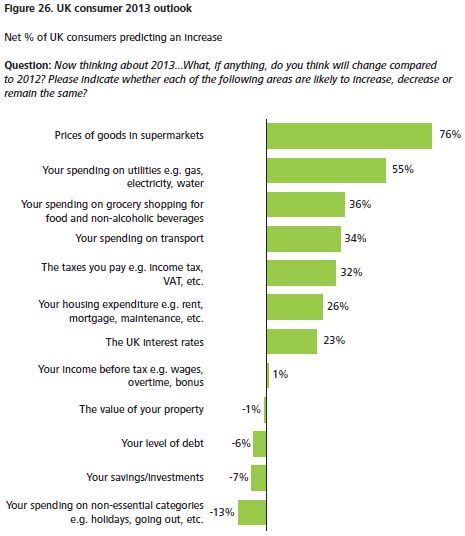

Looking ahead to next year, caution still prevails, with consumers saying they are concerned about rising prices. A majority anticipate higher grocery bills while 59 per cent expect spending on utilities to increase and 42 per cent think the cost of transport will rise. By contrast, levels of debt will continue to fall. The number of people thinking their debt will decrease (22 per cent) is higher than those expecting an increase (16 per cent).

Household disposable income

UK consumer sentiment strongest since Q3 2011.

- The Deloitte Consumer Tracker has recorded an improvement in most of the household circumstances that impact consumer sentiment around spending compared with a year ago.

- Fewer households have experienced some reduction or loss of income; 14 per cent this quarter compared with 19 per cent a year ago.

- There is a rise in the number of people claiming somebody in their household has started a new job this quarter.

- These trends confirm official data which shows the labour market has remained unexpectedly strong, with employment rising over the past three years as job growth in the private sector has outstripped public sector job losses.

- Relatively low unemployment is helping support consumers and the UK unemployment rate today is well below the peaks seen in milder recessions in the 1980s and 90s.

Consumer confidence

Negative sentiment regarding disposable income fell by ten percentage points in the past 12 months.

- Household disposable income remains the main area of concern for consumers but, encouragingly, concern around levels of disposable income continues to decline since we launched the Tracker in Q3 2011, showing a ten percentage point fall compared to a year ago.

- Sentiment improved this quarter on all measures monitored by the Tracker.

- Sentiment surrounding debt levels significantly improved from -15 per cent this quarter.

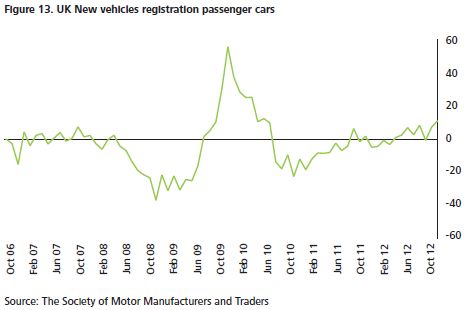

- Consumers seem to be more confident, as highlighted by the UK new car market, which continues to grow, with registrations rising more than 12 per cent in October.

- Consumer resilience is partly driven by a favourable financing environment, with record low interest rates and falling inflation.

- Sharply lower inflation − CPI inflation has halved in the past year to 2.2 per cent − should lend additional support to consumer spending power.

Economic outlook

The UK's double-dip recession has come to an end but growth is expected to remain weak until the end of this year.

- Most economists believe, at least for now, that the worst is over for the UK economy. All 37 independent forecasting groups that provide GDP forecasts to the Treasury expect UK growth to recover only in 2013.

- Still, consensus forecasts for UK GDP growth for 2013 have dropped from 1.8 per cent to 1.3 per cent in the past four months – a weak rate for an economy accustomed to growing at 2.5 per cent a year.

- Consumer spending has started to rise.

Spending behaviour in the last quarter

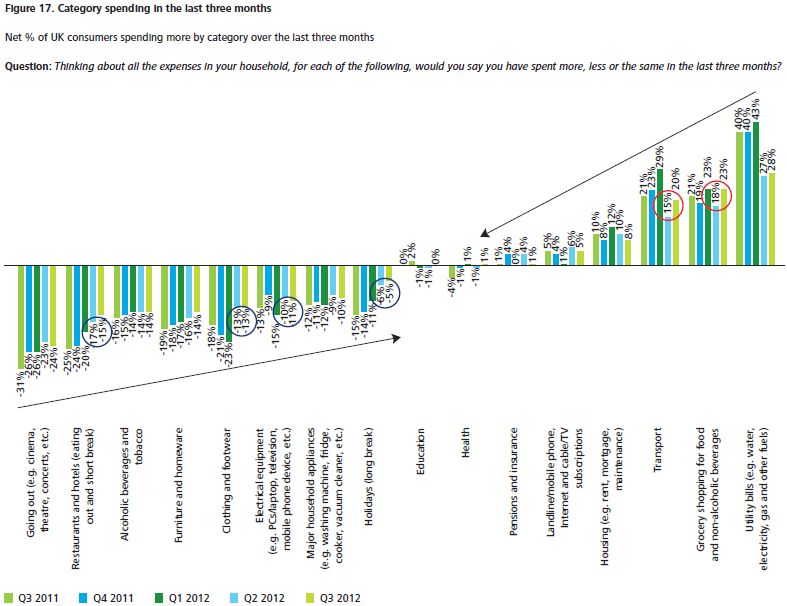

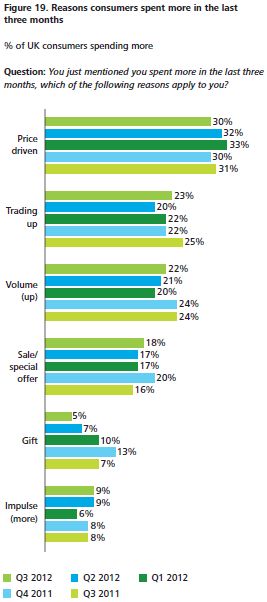

Defensive spending behaviour fell as fewer consumers traded down and bargain hunted.

- With the squeeze on real incomes over the past five years consumers have adjusted their discretionary spending. The economy has been hampered for two years by high inflation that outstripped wage growth and constrained consumer spending. With continued falls in inflation, especially in the more essential categories such as utilities, pressures are easing and spending is increasing in more discretionary categories.

- As consumers spent relatively less on essentials in Q3 2012, they were able to spend more on discretionary categories such as going out and holidays. But our data shows a net increase in spending on groceries

- Although defensive spending strategies were stable compared with the previous quarter, they directionally continued to ease over the past year with consumers consistently reducing trading down, bargain hunting and buying on special offers.

- Expansionary behaviours improved slightly on three out of six measures monitored by the Tracker. But overall consumers remained cautious.

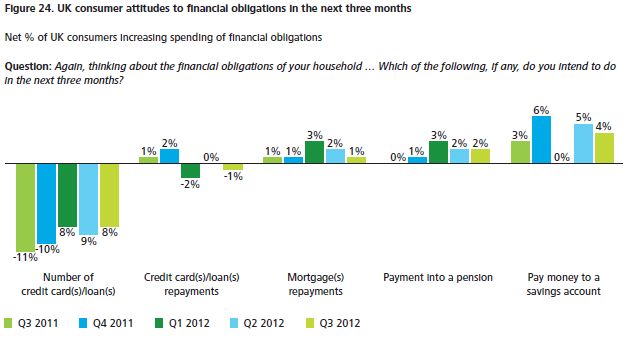

- The Tracker shows an increase in the number of people claiming to be making repayments on a loan and a decline in the number of people claiming to have an outstanding balance on credit cards.

- While the percentage of consumers saying that they paid into a savings account each month fell in Q3 2012, the net balance of those paying more in versus those paying less improved.

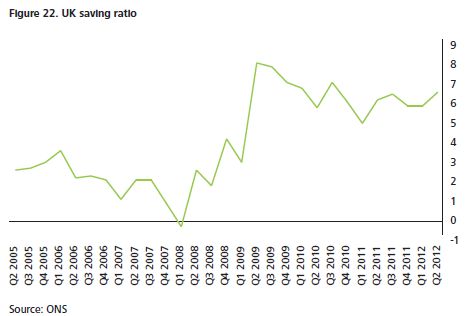

- In the past five years consumers have focused on consolidating debts. Continuing that trend, personal savings in the UK increased to 6.7 per cent in May of 2012 from 6 per cent in February 2012, according to the Office for National Statistics, UK.

Consumer spending outlook

Looking ahead to 2013, consumers remain concerned about rising prices and plan to continue saving and rebuilding their finances.

- In anticipation of the winter months, consumers expect to spend more on utilities and less on long-break holidays.

- Consumers intend to continue to reduce the number of credit cards loans in the next three months – a metric that has consistently dropped over the past year.

- Beside intentions to buy a car or a major piece of furniture being consistently up since the beginning of 2012, there was virtually no movement in the intention to spend on big tickets items in the next three months.

- Looking ahead to 2013, the majority of consumers anticipate grocery prices and spending on utilities and transport will go up. A higher number of people expect to save less and spend less on non-essentials.

- Consumers anticipate a net decline in their debt levels, suggesting a low level of confidence in the economy.

Footnotes

1 Midata – access and control your personal data, http://www.bis.gov.uk/policies/consumer-issues/consumer-empowerment/personal-data September 2012.

2 http://www.publications.parliament.uk/pa/cm201213/cmselect/cmjust/572/57205.htm

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.