1 Introduction

Over 1,000 international companies have operations in Ireland. These companies are involved in a wide range of activities and sectors including technology, pharmaceuticals, biosciences, financial services and manufacturing. The attraction of Ireland as an investment location can be attributed to the positive approach of successive Irish Governments to the promotion of inward investment, its membership of the European Union (EU), a very favourable corporate tax rate and a skilled and flexible labour pool.

The purpose of this Guide is to provide an introduction to the major commercial and legal issues to be considered by international companies establishing business operations in Ireland and it provides general observations and guidance to the many questions we have encountered from clients. Particular businesses or industries may also be subject to specific legal requirements and specific advice may be required in these circumstances.

2 Why Invest in Ireland?

In 2010, Forbes ranked Ireland 1st in the eurozone as 1 of the best countries for business. Ireland has succeeded in attracting some of the world's largest companies to establish operations here. This includes some of the largest companies in the global technology, pharmaceutical, biosciences, manufacturing and financial services industries.

They are in Ireland because Ireland delivers:

- low corporate tax rate - corporation tax on trading profits is 12.5% and the regime does not breach EU or OECD harmful tax competition criteria;

- regulatory, economic and people infrastructure of a highlydeveloped OECD jurisdiction;

- benefits of EU membership and of being an English-speaking jurisdiction in the eurozone;

- common law jurisdiction, with a legal system that is broadly similar to the US and the UK systems;

- refundable tax credit for research and development activity and other incentives; and

- extensive and expanding double tax treaty network, with almost 60 countries, including the US, UK, China and Japan.

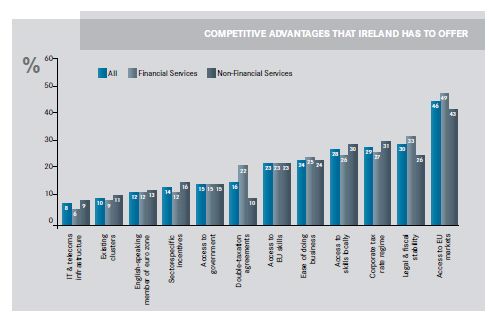

Our experience and research carried out in 2011 by the Economist Intelligence Unit on behalf of our firm, indicates that it is the unique combination of these factors, and not 1 specific element, which attracts investment to Ireland. For example, while other countries may be competitive in some of the areas highlighted above, Ireland's ability to create the most compelling suite of both tangible factors (such as taxation and the regulatory framework) and more intangible elements (such as a "can do" attitude to business) is generally cited as central to its ability to attract investment over other EU countries.

3 Ireland: An Overview

Some of the largest companies in the world have located in Ireland, including:

The Economist Intelligence Unit report on "Investing in Ireland: a survey of foreign direct investors", commissioned by Matheson Ormsby Prentice, examines the key factors that bring foreign investment to Ireland. The report identified 4 key cornerstones to Ireland's FDI offering:

- access to the EU internal market

- the overall taxation infrastructure

- the ability to supply a skilled pool of labour

- a stable legal and fiscal framework

Population

The population of Ireland now exceeds 4.2 million people.

Geography

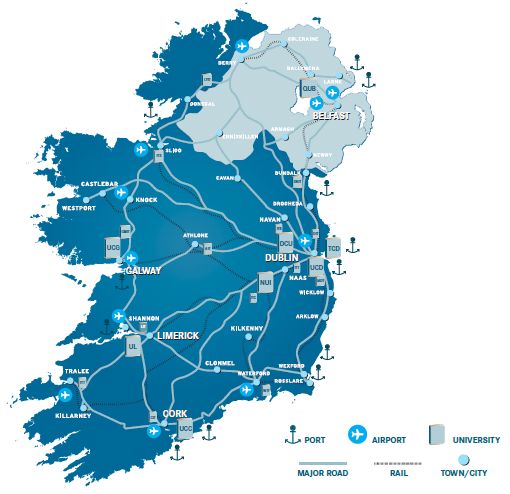

Ireland is an island situated off the north west of the European continent. Dublin is on the east coast, is the capital city, and has a population of over 1 million people. It is 1 hour by air from London and 90 minutes from Paris and Brussels.

Language

English is the main language, making Ireland the only eurozone country in which English is the principle language.

Political and legal system

Ireland is a stable parliamentary democracy with a written constitution and 2 houses of parliament. While the President is the constitutional Head of State, the powers and functions of the Presidential office are largely ceremonial. The Government is elected for 5-year terms and controls the legislative and political process. Ireland is a member of the EU and the United Nations. Irish law is based on common law legislation, the Irish Constitution and EU law and Ireland has a very similar legal system to the UK and the USA. Northern Ireland, as part of the UK, operates in a separate political and legal system which is not addressed in this Guide.

Economy

The currency of Ireland is the euro. Over the past decade, economic growth rates in Ireland have been consistently among the highest of OECD countries (countries in the Organisation for Economic Co-operation and Development). Irish Government policy has been and continues to be directed towards the creation of a stable economic environment that is supportive of the needs of business. Over the last 10 years, the number employed in industry and services has increased significantly and expansion has been particularly rapid in the areas of computer software/ hardware, electronic engineering, food, pharmaceutical, healthcare and consumer products.

Transport Infrastructure

International and internal transport services are well developed. The island of Ireland has a number of large ports and there are international airports in Dublin, Belfast, Derry, Shannon (near Limerick) and Cork. There are also regional airports in Donegal, Galway, Kerry, Knock, Sligo and Waterford (which operate some international routes). Most European cities are accessible within 2 to 3 hours flying time. Ireland has a developed public transport infrastructure and has an excellent network of main and secondary roads linking the major population centres.

Financial Infrastructure

Ireland has a very well developed and sophisticated banking and financial services infrastructure with established experience in handling the requirements of international companies. The banking sector is regulated by the Central Bank of Ireland. Over half of the world's top 50 banks and 50% of the top 20 insurance companies have operations in Ireland.

Pro-business Infrastructure

Ireland is recognised as 1 of the most attractive locations for international companies to access the EU internal market. The 2011 World Bank "Doing Business" report ranks Ireland in 10th position - the highest position of any eurozone country - while the 2010 World Bank "Investing across Borders" report states that Ireland is:

- among the most open to foreign equity ownership (of high-income OECD companies); and

- has "1 of the simplest and shortest processes" to establish a foreign-owned limited liability company (among high-income OECD countries).

4 Grants and Other Fiscal Incentives

The Irish Government actively encourages international companies to choose Ireland as a European base. Part of the incentive package offered can be the availability of state financial assistance, in the form of grants, to defray startup or other costs. The Industrial Development Agency (IDA) and Shannon Development are the primary grant-awarding bodies. The IDA is the primary state-sponsored agency with responsibility for the promotion and development of foreign investment into Ireland. Shannon Development grants are confined to projects in the Shannon region. A third body, Údarás na Gaeltachta, is responsible for encouraging investment in the Irish (Gaelic) speaking areas of Ireland. Each proposed investment is assessed by the relevant grant authority against a number of criteria. The level of grant payable is generally determined through negotiation. Further information can be obtained by visiting the websites of the IDA (www.idaireland.com ) and Shannon Development ("www. shannondevelopment.ie" )

What type of grants are available from the IDA ?

A variety of grants are available and can be specifically tailored to meet the needs of each company. Cash grants do not have to be repaid save in certain agreed circumstances. In certain "regions" approved by the EU for Regional Investment Aid (aid based on the geographic location of an investment), aid may be given in the form of capital grants for the acquisition of fixed assets (that is, site purchase and development, buildings and new plant and equipment). In certain cases, aid may also be available for the acquisition of intangible assets such as patent rights, licences and know-how. The subsequent disposal of grant-aided assets is invariably restricted by agreement. Alternatively, regional aid may also be granted in the form of employment grants which are linked to the amount of each fulltime and permanent job created and will vary depending on the location of the project and the activities to be undertaken.

What is the application procedure for IDA grants?

The process can take a number of weeks and involves the preparation and submission of a formal business plan to the IDA, together with subsequent meetings and negotiations between the applicant and the IDA. In order to be considered for grant incentives, an applicant must satisfy the IDA that the financial assistance is necessary to ensure the establishment or development of the operation and that the investment proposed is commercially viable and will provide new employment. If the application is approved and an incentive package is agreed, a grant agreement is then entered into between the IDA, the Irish entity and/or its promoter/parent company. This contract sets out the terms on which the grant aid is given and will vary from case to case.

How and when is the grant aid paid?

Grants are paid once the relevant expenditure is incurred. When a claim for a grant payment is received by the IDA, it is assigned to a designated executive in their grants administration department who liaises with the client company to make sure that the grant is paid as quickly and efficiently as possible. In order to claim grants, the company is usually obliged to provide certain specified information to the IDA including, for example, copies of signed employment contracts confirming the appointment of full-time permanent staff for the payment of employment grants. An auditors' certificate is also usually required to support all claims for the payment of grants. It is important for the company to maintain adequate records to facilitate this process.

5 Establishing in Ireland

Setting up a Company

What type of companies are available under Irish law?

The 2 main types of company in Ireland are private companies and public companies. The vast majority of companies registered in Ireland are private companies limited by shares. They are by far the most popular form of business entity for inward investment projects. The shareholders of a private limited company have limited liability. Public limited companies are typically used where securities are listed or offered to the public.

What is the procedure for incorporation and how long does it take?

To incorporate a private company limited by shares, certain documents must be publicly filed with the Irish Companies Registration Office (CRO). These include details of the proposed name of the entity, the shareholders, directors and company secretary. The completed documentation together with the memorandum and articles of association (the constitution and bye-laws) are filed with the CRO.

Under an express incorporation scheme, it is possible to incorporate a company within 5 working days. Outside of the express scheme, it can take approximately 2 to 3 weeks for a company to be incorporated.

Can we choose any name we want for an Irish company?

Not necessarily, as there are restrictions on the choice of company name. The CRO may refuse a name if it is identical to, or too similar to the name of an existing company, if it is offensive or if it would suggest State sponsorship. Names which are phonetically and/or visually similar to existing company names will also be refused by the CRO. This includes names where there is a slight variation in the spelling. It is generally recommended that company names include extra words so as to create a sufficient distinction from existing names.

Registration does not give the company any proprietary rights in the company name. As well as searching the Register of Companies, it can also be important to check any proposed name against the names on the Irish Business Names Register and Irish and EU Trade Marks Registries (and any other registers, depending on where it is proposed to carry on business). This is to ensure that the proposed company name does not conflict with an existing business name or trade mark, since the person claiming to have a right to that name or mark could take legal action to protect its interest.

It should also be noted that certain names cannot be used unless approved by relevant regulatory bodies. By way of example, the words "bank", "insurance", "society" and "university" cannot be included in a company name unless prior permission is obtained from the relevant regulatory authority.

Can we reserve a company name in advance?

Company names may be reserved for a period of up to 28 days in advance of incorporation.

Is the company obliged to carry on an activity in Ireland?

A company will not be incorporated in Ireland unless the company will, when registered, carry on an activity in Ireland. A declaration confirming this must be completed and filed with the incorporation documents at the CRO.

Corporate Governance

What is the management and governance structure of an Irish company?

The management of a company is nearly always delegated to the board of directors. All companies must have at least 1 secretary and a minimum of 2 directors, 1 of whom is required to be a resident of the European Economic Area ("EEA"). The secretary may also be 1 of the directors of the company. A body corporate may act as secretary to another company, but not to itself. A body corporate may not act as a director. The directors of a company have wide responsibilities under Irish law. They are obliged to act in the best interests of the company and to ensure that the company acts in compliance with Irish company law. Directors should familiarise themselves with their duties under Irish law. The Office of the Director of Corporate Enforcement has published an information booklet on the subject entitled â€ÜThe Principal Duties and Powers of Company Directors', and a copy is available to download from their website at www.odce.ie.

Are there residency requirements for directors?

At least 1 of the directors of an Irish company must be a resident of a Member State of the EEA. In so far as it is the person's residence in Ireland that falls to be determined, a person must have been present in the State for a period amounting in aggregate to 183 days or more during the 12 months or 280 days over the 24 months (excluding 30 days or less in any 1 year) preceding the date of incorporation of the company in order to qualify as "resident".

An EEA resident director is not required where the company posts a bond in the prescribed form, to the value of â,¬25,395. The bond provides that, in the event of a failure by the company to pay a fine imposed in respect of an offence under company law or a penalty under tax legislation, an amount of money up to the value of the bond will be paid by the surety in discharge of the company's liability. The bond facility is available from a number of insurance companies in Ireland and the (nonrefundable) premium payable for a 2 year bond is approximately â,¬1,600.

In addition, a company is not required to have an EEA resident director (or a bond in lieu) where the company holds a certificate from the CRO confirming that the company has a real and continuous link with 1 or more economic activities that are being carried on in Ireland. This option is only open to companies post-incorporation.

What are the post-incorporation obligations?

Set out below is a brief summary of the principal obligations. Further details can be provided on incorporation. Fines and other sanctions can be imposed on a company and any officer of a company where the relevant obligations are not met.

Maintenance of statutory registers

Various statutory registers and books of account must be maintained by a company under Irish company law. The registers required include: register of members, register of directors and secretaries, register of directors' and secretaries' interests in shares and debentures, and a register of debenture holders. A company is also obliged to keep minutes of its general meetings and the directors are also under an obligation to keep minutes of directors' meetings. Certain registers are open to inspection by members of the general public.

In addition, Irish company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the company and of the profit or loss of the company for that period. In preparing those financial statements, the directors are required to:

(a) select suitable internationally recognised accounting policies and then apply them consistently;

(b) make judgements and estimates that are reasonable and prudent; and

(c) prepare the financial statements on a going concern basis, unless it is inappropriate to presume that the company will continue in business.

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the company. The directors must ensure that the financial statements are prepared in accordance with either International Financial Reporting Standards (IFRS) or with accounting standards generally accepted in Ireland. The consolidated financial statements of EU listed companies that are incorporated in Ireland or elsewhere in the EU must be prepared in accordance with IFRS.

Auditing Financial Statements

The annual financial statements of Irish companies are required to be audited by a registered auditor, subject to limited exceptions. The audit includes an examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgements made by the directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the company's circumstances, consistently applied and adequately disclosed. There are exemptions from audit for certain smaller companies that are not part of a group of related companies.

Irish legislation requires auditors to report to the relevant authority certain instances of their clients, or officers, committing indictable offences under Irish company law and to report any suspicions of theft, fraud or money laundering in their client companies.

Annual return filing

Companies must deliver an annual return to the CRO at least once a year. The annual return contains details of the company's directors and secretary, its registered office, details of shareholders, share capital and the auditor registration number. The annual return is required to be made up to the company's annual return date (ARD) and filed with the CRO within 28 days of that date. A company's first ARD is the date which is 6 months after its incorporation. It is possible to change, and in some cases extend, a company's ARD.

A company's audited financial statements must also be annexed to a company's annual return except the first annual return. Smaller companies may file abridged financial statements that provide less information than the annual financial statements prepared for the shareholders. In addition, an Irish company that is a subsidiary of an EU parent may file the consolidated financial statements of the parent instead of its own financial statements, provided that the EU parent company guarantees the liabilities of the Irish subsidiary. A further optional exemption to the consolidation obligation applies where the Irish company is itself a subsidiary of another undertaking established outside the EEA (so, for example, an Irish holding company whose parent in turn is a listed US company). Where certain conditions are satisfied, the non-EEA parent company's group accounts (together with the Irish company's stand-alone accounts) can be filed as an alternative to the Irish company filing consolidated accounts. The filing of audited financial statements does not apply to certain categories of private unlimited companies.

Obligations to publish company name and directors Details

A company must ensure that its name, registered address and registered number are mentioned on all business letters of the company and on all cheques, invoices and receipts of the company. For private limited companies and public limited companies this information must also be displayed on the company's website and certain electronic communications (for example, email, letters and electronic order forms). The names of directors and their nationality (if not Irish) must be included on all business letters on or in which the company's name also appears. A company is also required to paint or affix its name in a conspicuous place, in legible letters, on the outside of every office or place in which its business is carried on.

Business name

Where a company uses a business name that is different from its company name, the business name must be registered by that company with the Irish Registrar of Business Names at the CRO.

Setting up a Branch

Any foreign company trading in Ireland that has the appearance of permanency, an independent Irish management structure, the ability to negotiate contracts with third parties and a reasonable degree of financial independence is considered a branch under Irish company law. There are certain procedures set down for the registration of branches in Ireland involving the submission and authentication of the memorandum and articles of association of that company and, in certain situations, the filing of annual accounts for that entity.

In some cases, it may make sense from a tax perspective to establish a foreign branch in Ireland, rather than incorporate a separate legal entity. If trading losses are likely to arise following the initial establishment in Ireland, such losses may be capable of being offset against the profits of the parent company in the parent company's home state. If it is envisaged that the operations in Ireland would continue to be loss-making, then a branch may be preferable until such time as the operation becomes profitable. The most advantageous structure will only be identified after careful consideration of the proposed business, its relationship with the business of the foreign parent company and the projections for the profitability of the business in the future.

Place of business in Ireland

A foreign company carrying on business in Ireland from a fixed address, not being a branch, must file a copy of its constitutional documents, together with a list of directors of the company and the address of its established place of business in Ireland, with the CRO.

New Irish Company Law Regime

New Irish company law legislation is in advanced draft form. This marks a significant development in the strategic reform of Irish company law and represents a strong desire on Ireland's part to ensure that we have a modern company law regime in place that will further enhance Ireland's attractiveness as a place to do business.

We have been actively involved in the progression of this new legislation. We have placed a particular emphasis on those issues we have discussed with many of our clients and which often have a critical bearing on the feasibility of various strategies or restructurings that have been undertaken in the past.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Content now on a feed.