4.1. Route 1: The Client approaches a Broker – the Broker route

Swiss defered annuities and life insurance are often arranged through an insurance broker who advises the policyholder, insured person and beneficiaries. He liaises between the contractual parties. Brokers are remunerated with a commission paid by the insurance company. In Switzerland brokers must be licensed and registered to carry on their business. However, the licensing requirement only applies to sale of policies to Swiss citizens resident in Switzerland. There is no licensing or registration requirement to broker a policy for a non-resident, non-Swiss national. Hence, an asset manager or other intermediary (Lawyer, Accountant, Trust Company) can mediate a policy for international Clients. In this case the intermediary may be entitled to the commission normally paid to the broker. The point is often misunderstood, non-Swiss nationals do not need a broker to set up a Swiss or Liechteinstein insurance policy.

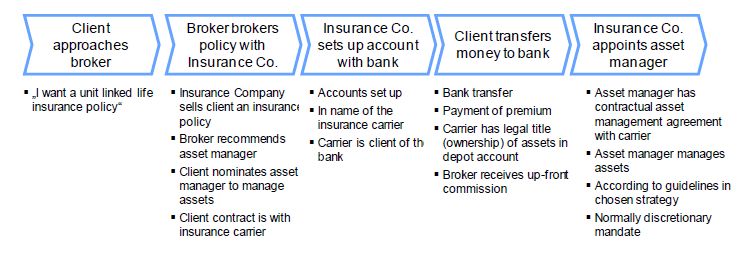

The broker brokers the policy with the insurance company and often recommends an asset manager to manage the assets1. In Switzerland the broker often works closely with the asset manager with often a long relationship between the two. The brokers formal role is to broker the policy with the insurer, he has no other role. He may do some advisory and customer care but there is no contractual relationship between broker and Client. In many cases the broker adds real value to the client when he brings specific knowledge, expertise or capabilities. In other cases the broker may add no value whatsoever. In fact his value-add can be negative as the commission he receives from the insurance company is later deducted from the Client account. The figure below illustrates the broker route.

There are three contractual agreements necessary between the participants to enable the legal construct:

Contract 1: Asset Management Agreement

Is a contract between Insurer and asset manager

Insurer has legal title to the assets – is the owner

Insurance Carrier appoints asset manager to manage assets on its behalf

Contract 2: Power of Attorney between Insurer and Asset Manager issued by Custodian Bank

Asset manager receives a Power of Attorney from the Insurance Carrier to manage assets on behalf of Insurance Carrier

Contract 3: Intermediary Agreement between Insurer and Broker

The Broker has an agreement with the Insurer to represent the Insurer and sell the Insurers products

The usual process from the Clients perspective is illustrated in the figure below. The Client perceives process, not structure.

The Client comes to the insurance broker and says: I want a fund linked life insurance policy". The broker brokers the policy with an insurance carrier, the insurance carrier sells Client a policy, creating a contractual relationship between policyholder and insurer. In the policy, the Client nominates an asset manager - often on the brokers recommendation - or the Client states specifically I want asset manager XYZ to manage my money". The Client contracts with the insurance carrier, who sets up an account for that policy with the custodian bank, the Client then transfers money to that account. Legal title to the assets is transferred to the Insurer as part of the terms and conditions of the insurance policy. The insurer is now the beneficial owner of the assets2. The asset manager manages the assets wrapped" in the insurance policy as a discretionary mandate according to guidelines agreed in the chosen investment strategy.

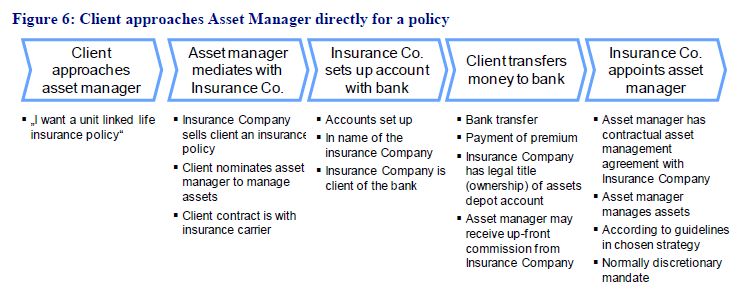

4.2. Route 2: The Client approaches the asset manager directly to set up the policy

This is normally the most efficient, cost effective way of setting up a policy. The Client approaches the asset manager, who approaches the insurance company and mediates the policy. Often the Client is already a Client of the asset manager, the only real change for the Client is his planning is costing him 0.5% -1.2% more per year for the insurance carriers administration fees. Often the assets are even managed to much the same strategy as before. The figure below illustrates direct Client comes to asset manager route.

There are only two contractual agreements necessary:

Contract 1: Asset Management Agreement

Contract 2: Power of Attorney between insurer and asset manager issued by custodian bank

The process illustrated in the figure below is almost identical to the broker route described above.

The Client nominates "his" asset manager as the asset manager of the assets, the insurance company formally "hires" or gives the asset manager a power of attorney over the assets.

One big advantage of this route is that many asset managers waive most or all of both the upfront fee and the trailer fee. For the asset manager, his rationale is, "he is my Client already, nothing has changed, it would be unethical". In the case of a new Client, the rationale may be "this is my Client locked in for the next 20 years, I have a fixed mandate to manage his assets, I earn 1% p.a. on the assets over that period, plus any kickbacks on products. It's not fair to hit the Client with even more charges". It is simple to set up, efficient and quite cheap. The broker's costs are also removed from the picture3.

For the asset manager, the Client is effectively "locked in" for the term of the policy, if he was already a Client of the asset manager, the only real change for the asset manager is that legal title or beneficial ownership of the assets has passed from the Client to the insurance company. Set-up can require some work, the asset manager provides a service for which he should be compensated. So we tend to see the asset manager taking an up front fee of 0.5% – 1.0% to set the structure up. This is disclosed to the Client and is generally reasonable. Rather less reasonable is when the asset manager elects to receive a full upfront fee and/or trailer fees from the insurance company in addition to his asset management fee, thereby doubly profiting on the same assets. This is rarer, but does happen.

The Client may also approach the insurance company directly. This is rarer at the high end as the Client often is looking for advice or already has an asset manager.

Footnotes

1 In practically all jurisdictions this works fine. Germany once again just has to be the exception to the rule. It is illegal for the broker or the Client to nominate or specify in any way the asset manager. The Client must accept the asset manager chosen by the insurance company. In practice, given the obvious lunacy of implementing this on a national level – the conflicts of interest and the intriguing by asset managers with insurers competing for the volume of revenue this would engender - the Client can have quite a lot of say in just who manages his money.

2 This is a critical point; the insurer now has legal title to the assets, not the policyholder.

3 Once again, in most places this works fine. Some jurisdictions however require a broker by law, for example certain countries in the Middle East and Singapore. What often happens is that the Client approaches the intermediary or insurance company, who is required to bring a broker on board. The broker then receives his commission - generally 2-5% - for doing nothing. Further adding to costs to the Client without providing value.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.