ECONOMIC HIGHLIGHTS

a. The Maltese economy

Revenue from direct and indirect taxation is expected to reach €2.5 billion, while €419.20 million consists of revenue from other sources. Recurrent expenditure is expected to increase by €92.6 million over that forecast for 2011.

b. Employment

Gainfully employed persons increased by more than 2.5%. Unemployment stands at 6.6%, which is 3.1% less than the EU average.

c. Rate of Inflation and economic growth

In the twelve months ending September 2011, the rate of inflation reached 2.7%. In 2012, economic growth is expected to be approximately 2.3% with inflation expected to reach 2.1%.

d. Cost of Living Allowance

The cost of living increase for 2012 shall be that of € 4.66 per week.

e. The Deficit

Malta remains committed to lowering the country's deficit to €181.7 million by the end of 2011, or 2.8% of GDP. Government deficit for 2012 is expected to go down to 2.3% of the GDP.

INITIATIVES AND MEASURES FOR 2012

Industry incentives

The 2012 budget is allocating €14.2 million for incentives to industry, an increase of €5 million on that of 2011.

Government is investing three million euro over a three- year period in fiscal incentives to those industries which consume more than 2Gwh per year and which invest in energy-saving measures and in systems which produce energy from clean sources.

Works have started on BioMalta Campus, the industrial park with a €30 million investment which will provide the necessary infrastructure for research and industrial innovation in the pharmaceutical and life sciences fields. This project involves the participation of the company Sulatan Scientific which is set to launch the 200 million euro Global Medi-Science Fund based in Malta. This fund will invest in projects based in the Bio Malta Campus or joint projects on an international level.

Innovation

Throughout 2012 Government will embark on an awareness campaign on innovation and economic growth with an investment of a quarter of a million euro. The amount of funds allocated to the Malta Council for Science and Technology for research shall be increased to €1.6 million euro.

Government will also be creating a new Fund to assist in the internalisation of research and innovation.

Funds will also be allocated to assist researchers to participate in the European Union's FP7 Programme. Government will be investing €3.5 million in building an Interactive Science Centre.

Small and Medium Sized enterprises

Businesses participating in the MICROINVEST scheme benefitted from a reduction in tax of 40% of the investment value and 60% in the case of Gozitan enterprises. Maltese business invested almost €13 million and created around 200 new jobs under this scheme. The scheme is being extended for another year.

MicroGuarantee Scheme

Government is launching another scheme guaranteeing bank loans intended to incentivise business and the creation of jobs in small businesses. Under this scheme €20 million in bank guarantees on loans for viable projects by micro businesses, whether existing or new will be made available. Government may increase this amount in the future after evaluating the scheme.

The micro guarantee scheme, which will be administered by commercial banks on commercial terms, applies to firms employing up to 20 persons and to loans for investment or working capital. The scheme guarantees loans of between €2,500 and €100,000 from commercial banks and the Government will be guaranteeing up to 90% of the loans, with the remaining 10% being guaranteed by the borrower.

Persons qualifying for these loans will be asked to pay a premium on interest rates on the amount of the loan or the remaining balance.

Call for European Regional Funds

The fourth call for European Regional Funds will be launched, totalling €8 million, with the aim of assisting firms to improve operations, explore foreign markets, invest in alternative energy and e-business and carry out research and innovation.

Financial services

The financial services sector in Malta is growing at an exponential rate. Government will be increasing the allocation to Finance Malta to €500,000.

Tourism

Government is increasing MTA's budget by €1 million to €36 million. It is allocating €3 million to marketing and €4.5 million to the opening of new routes.

An investment of €4.2 million for further projects such as the Aquarium in Qawra and Pembroke Gardens shall be allocated in 2012.

An investment of €4.2 million will be made in archaeological sites in Malta and Gozo .

Government shall be allocating €10 million as further aid to tour operators for the improvement of tourist projects and marketing and competitiveness initiatives.

Other schemes which were successful and will continue to be implemented in 2012 include:

- Assistance to the public and parastatal sectors to attract conferences to Malta;

- A human resources training programme; and

- Granting of soft loans to tour operators.

The Creative Economy

During the coming year Malta will be hosting the European Film Academy Awards. This will help Malta further consolidate its reputation in the industry. A sum of €250,000 is being allocated to further the development of the Maltese film industry.

An added incentive to cultural education is being introduced. Parents whose children attend courses organised by institutions operating in the cultural and creativity fields will benefit from a €100 tax reduction against income on costs related to courses provided by licensed and accredited institutions/teachers.

New companies operating in the cultural and creativity sectors will benefit from an exemption from the payment of the registration fees and on their annual payments to MFSA for three years.

Digital Games

The Government will continue to invest in the expansion of the digital games sector as follows:

The Malta Games Fund will be established with an investment of €150,000 in order to develop the expansion of the local game industry through projects related to digital games.

A tax credit scheme to Maltese companies wishing to commission educational or promotional digital games, which tax credit will be given on the expenditure incurred on the development of the game subject to a maximum expenditure of €15,000.

The Government is also extending the 15% flat income tax rate to international professionals such as game directors and game designers as well as academics and researchers in the research and development sectors.

The Government is also offering an innovative scheme to self-employed persons registered as authors, composers, visual artists and performing artists, film artists and design artists to operate from creative clusters working in the City of Valletta. Other schemes will also be introduced to encourage more creative activity in our capital city.

Initiatives to Encourage More Women to Enter the Labour Market

In this budget, Government will be increasing expenditure related to such initiatives to €1.3 million, to open three new centres. Further incentives and subsidies will be granted, intended to help render this service increasingly affordable to the general public.

An important tax measure within this remit aimed at attracting parents to the working world is the introduction of a new 'parent computation', besides the single and joint computations. This tax computation will be available to parents supporting children in their custody until they reach 18 years of age. In the event that children are still attending tertiary education, the age limit will be extended to 21 years.

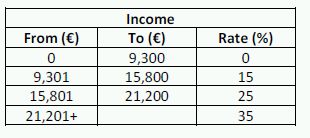

Tax rates for parent computation

This new fiscal measure results in married couples with children saving between €150 and €840 in income tax payments each year.

Maternity Leave

Government believes that maternity leave should be increased from 14 to 16 weeks as from next year and by a further two weeks in 2013. The extra weeks will be payable from public finances with a fixed weekly rate of €160.

Part-time Tax Rules

Amendments to the part time tax rules will be introduced. These amendments are geared towards removing a number of anomalies which were having a negative impact on pensioners and certain Government employees. At present pensioners working on part-time basis with the Government are not entitled to the 15% tax rate available to those working on a part-time basis in the private sector. This distinction will no longer exist, and all pensioners will now be able to avail themselves of a beneficial 15% tax rate on their part-time work.

Furthermore, in the case of public sector employees, the definition of 'same employer' will be extended as it is currently considerably limiting the said benefit. Government will no longer be considered as 'same employer' where the entities involved are in fact separate. This will enable more workers to benefit from the 15% tax rate on part-time work.

The deadline for the payment of the 15% tax on part-time work is being extended from the 15th February to the 30th June in order to give people more time for the payment of tax due.

Strengthening the Fiscal Environment

Government will launch a scheme having a limited time-window, whereby those having VAT payments in arrears will be able to regularize their position. Persons under an obligation to file a VAT return by the 15th October 2011 who failed to do so, or who have VAT arrears to pay, will be given until the 15th January 2012 to send the missing returns. The arrears due can be paid until the 15th January 2013, with a reduction in the amount of fines and accumulated interest, according to the length of the period of time during which the payment of arrears will be made. The details of this scheme will be announced in the pertinent Legal Notice, still to be issued.

The scheme will only be applicable to the arrears accumulated until the 14th November 2011. One of the conditions to be satisfied under the scheme is that the returns due as from the 15th November 2011 onwards, shall be sent in time and with payment in full.

Customs and Excise

Customs duty on fuel in the case of ship bunkering outside territorial waters will increase to €5 per tonne. This will not affect in any way the price of fuel sold in Malta. Customs duty on cement will increase by €3 per tonne. The minimum excise duty on cigarettes will increase by 5.8% on each packet of 20 cigarettes. Excise duty on other tobacco products will increase by 8.5%. With regards to mobile telephony, excise duty will remain unchanged but the basis on which this rate is calculated will change from tariff to volume.

Deduction against taxable income for children attending private schools

This deduction will increase as follows:

From €1,200 to €1,300 for children attending day care, reception and kindergarten;

From €1,200 to €1,600 for children attending primary level;

From €1,600 to €2,300 for children attending secondary level.

The Social Sector

Childrens' Allowance minimum rate is increased to €350 a year for each child.

A widow or widower who remains entitled to a fixed rate of the widow's or widower's pension after remarrying will not lose this pension after having been remarried for more than five years.

There are major advances in the disability sector. These include:

As from next year, severely disabled persons who are entitled to a severedisability pension will be able to work for a salary up to the minimum wage and still receive their full pension.

Severely disabled persons who get married will not forfeit their pension, regardless of the spouse's income (this scheme currently applies to the first five years of marriage).

The Housing Sector

The Housing Authority is introducing a scheme whereby it will permit homeowners to register their properties which they wish to offer for rent with the Authority. The rental income earned will be subject to a preferential rate of final withholding tax of 10%.

The Elderly

The following measures will apply to the elderly:

- Full cost of living increase will be given to pensioners.

- Each year the Government will give a grant of €300 to every elderly person over 80 years living in their own home or with their family.

- VAT on private nursing and home help offered by the private sector to the elderly in their private homes will be removed as from 1st January 2012.

- An income tax exemption of €2,500 will be offered to the relatives helping their elderly parents live in a private nursing home.

- Elderly persons who are tax exempt and who pay 15% withholding tax will start receiving refunds of tax paid without completing a tax form.

Incentives for Cleaner Private Vehicles on our Roads

Government will be introducing a new measure whereby the Euro standard will be rendered applicable to private vehicles. Registration tax will start to be calculated on the Euro standard, carbon dioxide, particulate matters, length and value of the car.

With effect from 1st January 2012, the registration tax on emissions for vehicles Euro 1 to 3 and older, which pollute more, will increase. Cars of Euro 4 and Euro 5 standards will continue to pay the same rates currently in force.

An incentive will be granted to those individuals who buy a new car, which causes less harm to the environment, while at the same time scrapping the old car. The incentive will amount to 15.25% of the car value according, up to a maximum of €2,000. The car needs to be new and with a Euro 5 engine or better with a low level of emissions of up to 150g/km and a length not exceeding 4,460mm.

The scheme will enter into force as from 1st December 2011 and will remain in force for one year or until 3,000 persons have benefitted from it.

Vehicle Licenses

Government will be introducing a scheme whereby persons having licenses fees or administrative payments relating to vehicles in arrears can regularize their position.

Investment in Cleaner Systems of Electricity Generation and the use of Alternative Energy

The Government schemes aimed at assisting persons to invest in photovoltaic panels and solar water heaters are being extended. In addition to the said schemes, a new scheme is being introduced for anyone who wishes to invest in roof insulation and double glazing. Government will be issuing a grant of 15.25%, up to a maximum of €1,000 to whoever undertakes this investment, with an allocation of €400,000 to this end.

Scheme Encouraging the Restoration and Renovation of Scheduled Properties and those in Urban Centres

Government is introducing a number of incentives related to restoration and conservation works to scheduled buildings in Grades 1 and 2, as well as properties in UCAs. These mainly consist of:

1. An Exemption from Duty on Documents on transfers between heirs in order to facilitate the consolidation of property ownership, with this concession closing on 31st December 2013.

2. A scheme for private individuals wishing to restore their property, whereby a rebate of 20% will be given on restoration costs up to a maximum of €5,000.

3. A concession, for individuals or companies investing in the restoration of qualifying properties to sell or rent, as follows:

- Final withholding tax of 10% on income from rental for residential purposes, and 15% on income from rental for commercial purposes; and

- Final withholding tax of 10% in the case of a sale or the payment of 30% tax instead of 35% on the gain; and

4. A tax credit of 20% on qualifying expenditure for restoration of property to be used for the commercial purposes of the company. This will increase to 30% in the case of Grade 1 and 2 scheduled properties.

One ought to note that this benefit applies when the property is being restored and renovated. The benefit does not apply should the property be demolished to be rebuilt.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.