As of January 1, 2012, persons that offer securities in the Netherlands making use of an exception or exemption from the requirement to publish an approved prospectus1 are required to include a uniform warning in the form of a pictogram (also referred to as the "wild west sign"2) in each advertising document and other document containing or announcing an offer to indicate that they are not supervised in the Netherlands.

This "wild west sign" requirement does not apply where offerings of securities in the Netherlands are made solely to qualified investors. Qualified investors include3, inter alia:

- companies that hold a license or are otherwise regulated to be active on the financial markets, including banks, investment funds, investment companies, insurance companies and pension funds;

- companies whose only corporate object is to invest in securities, including hedge funds;

- national or regional governmental bodies, central banks, international or supranational financial organisations or other similar international institutions.

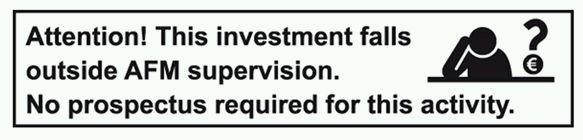

In case the "wild west sign" requirement applies, the following pictogram must be included in offer documents and advertisements:

The "wild west sign" requirement also applies to offerors of participation rights in an investment fund in the Netherlands making use of an exception or exemption from the requirement to obtain a license.

The "wild west sign" requirement does not apply where offerings of participation rights in the Netherlands are made solely to qualified investors.

In addition to the license requirement, the obligation to publish an approved prospectus in principle also applies to certain offerors of participation rights in investment funds. In case the offer is excepted or exempted from both the license requirement and the prospectus requirement (other than offers made solely to qualified investors) a different pictogram should be used which makes clear that no license and no prospectus are required.

The AFM has laid down detailed rules regarding the size and manner of inclusion of the prescribed pictogram. One of these rules is that if the offer document or advertisement consists of multiple pages, the pictogram must be included on the first page thereof.

Violation of the applicable Dutch regulatory laws, such as the "wild west sign" requirement may result in measures imposed by the regulator, such as fines.

Footnotes

1. e.g. EEA selling restriction

2. The term "wild west sign" is introduced by the Dutch legislator in order to emphasize the unregulated character of the offer.

3. The definition of qualified investor will - in keeping with the European Prospectus Directive - be amended, most likely as per July 1, 2012.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.