The Government recently approved several changes to the existing tax regulations as part of a new plan to change property tax rates for the next two years. These changes are part of a government effort to increase supply for residential apartments and to enable affordable apartments for those who wanted to buy but could not afford to.

Following are the new changes that will take effect as of February 21st 2011 and up to December 31st 2012 with an option for extension:

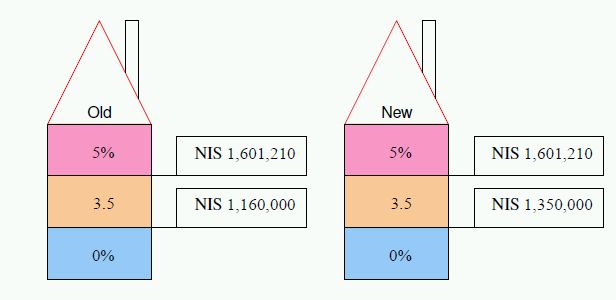

1. Purchase tax for first apartment – increasing sum of tax exemption

The exemption from purchase tax for the first apartment was updated to 1,160,000 Shekels on January 15th 2011. Following the new regulations, the exemption is now on a purchase of up to 1,350,000 Shekels. For amounts between 1,350,000 Shekels and up to 1,601,210 Shekels, a 3.5% purchase tax will apply while any amount over 1,601,210 Shekels will be subject to purchase tax at the rate of 5%.

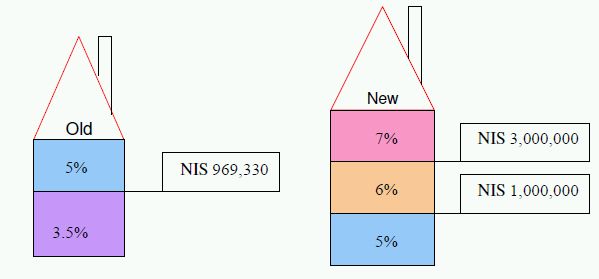

2. Purchase tax rate changes for second apartment and more

The purchase tax rate for a second apartment, which was recently updated to 969,330 Shekels at a rate of 3.5% has now been changed and is calculated as follows: For the first 1,000,000 Shekels the purchase tax is 5%.

For amounts between 1,000,000 - 3,000,000 Shekels tax at the rate of 6% will apply. A tax rate of 7% will apply on all amounts over 3,000,000 Shekels.

3. New exemption for sellers from Capital gains tax

This new exemption will be effective as of January 1st 2011 until December 31st 2012 (unless otherwise extended). To date, sellers were required to wait four years between sales of apartments in order to benefit from a full tax exemption. The new regulations allow a seller to benefit from two tax exemptions, in addition to the abovementioned exemption, with no need to wait between sales. According to the new rules, in the next two years, one may sell two apartments and receive a full exemption from tax if the price of each apartment does not exceed 2,200,000 Shekels. If the consideration is higher than 2,200,000 Shekels for each apartment, capital gains tax will apply on the difference.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.