Introduction

Nuclear power is increasingly being seen as the energy of the future. Most established nuclear markets have considerable nuclear new build plans. Recent statistics from the International Atomic Energy Agency (IAEA) indicate that 60 states have expressed an interest in or are actively planning to introduce nuclear power.1 Almost every state in the Middle East and North Africa (MENA) region is included on this list.

This guide provides an update on the status of the most advanced nuclear power programmes in MENA.

Why are the MENA states interested in nuclear power?

Given that the MENA region has a substantial percentage of the world's oil and gas reserves, it is important to examine the key drivers behind this region's interest in developing nuclear power. These drivers give an important context in which to consider each individual programme, bearing in mind that not every MENA state is rich in oil and gas and that motivations differ from state to state.

Factors driving an interest in nuclear power in MENA include:

- growing energy demand;

- desire to diversify electricity supply;

- ability to sell hydrocarbons more profitably in international markets;

- demand for desalinated water;

- concerns over security of supply (particularly for countries that are not oil and gas rich);

- interlinking electricity grids, with subsequent ability to trade electricity;

- volatility of fossil fuel prices; and

- global climate change issues.

Challenges for nuclear new build in MENA

While all the nuclear power programmes in MENA are at different stages of development, they share the important characteristic that nuclear new build in each state will be nuclear new build for the very first time. Each state must develop the infrastructure needed for a nuclear power programme entirely from scratch. This is a complex task, with significant challenges to be overcome.

Key challenges for MENA states developing a nuclear power programme:

- demonstrating that they are responsible 'international nuclear citizens' in a politically sensitive arena;

- adopting and complying nationally with international treaty obligations;

- developing a comprehensive national legislative and regulatory infrastructure;

- developing a nuclear safety culture;

- establishing a national nuclear regulatory authority and development corporation;

- developing local human resources and attracting scarce internationally experienced human resources;

- selecting and procuring the appropriate reactor technology;

- attracting and securing the international nuclear supply chain and developing capacity of potential local supply chain members;

- developing the physical infrastructure to support the introduction of nuclear power; and

- obtaining finance and insurance for the nuclear power project.

United Arab Emirates

Government nuclear power policy

The United Arab Emirates (UAE) regards nuclear power as an energy source that is a 'proven, environmentally promising and commercially competitive option which could make a significant base-load contribution to the UAE's economy and future energy security' (Policy of the UAE on the Evaluation and Potential Development of Peaceful Nuclear Energy, 2008) (the Policy).

With demand for electricity over the next 10 years forecast to grow at a rate of 9 per cent per year, nuclear power has become a key component of the UAE's long-term energy strategy.

Six key principles that underpin the UAE's nuclear development programme (as set out in the Policy):

- operational transparency;

- non-proliferation;

- safety and security;

- working directly with the IAEA and conforming to its standards when evaluating and establishing a peaceful nuclear energy programme;

- developing its peaceful domestic nuclear power capability in partnership with governments of responsible nations, as well as with the assistance of appropriate expert organisations; and

- approaching its peaceful domestic nuclear power programme in a way that best ensures long-term stability.

National nuclear power programme

The UAE's nuclear power programme is developing at an unprecedented pace. The contract to supply and construct the first four reactors (of a planned 14) was awarded to a South Korean consortium, led by KEPCO, in December 2009. The UAE's first commercial nuclear power plant is expected to be operational by 2017.

Law and regulation

On 4 October 2009, UAE Federal Law No. 6 of 2009 concerning Peaceful Uses of Nuclear Energy (the UAE Nuclear Law) was passed. The UAE Nuclear Law provides a framework for developing a civil nuclear power programme in the UAE. Significantly, the UAE Nuclear Law establishes the state's nuclear regulatory authority, the Federal Authority for Nuclear Regulation (FANR), and gives it powers to regulate the nuclear sector in the state. FANR is supported by the Korean Institute for Nuclear Safety and is expected to draw on the experience of the US Nuclear Regulatory Commission.

The UAE Nuclear Law prohibits any enrichment or reprocessing facility from being designed, constructed, developed or operated in the state. This provision gives domestic legal effect to the UAE's Section 123 Agreement with the US, pursuant to which it agreed not to carry out these nuclear fuel cycle activities.

Three key government entities:

- Federal Authority for Nuclear Regulation (FANR): independent federal agency responsible for regulating and licensing nuclear energy activities in the UAE;

- Emirates Nuclear Energy Corporation (ENEC): Abu Dhabi government-owned corporate entity responsible for developing nuclear power plants in the UAE; and

- Independent Advisory Board: provides independent oversight and assessment of the UAE's nuclear programme.

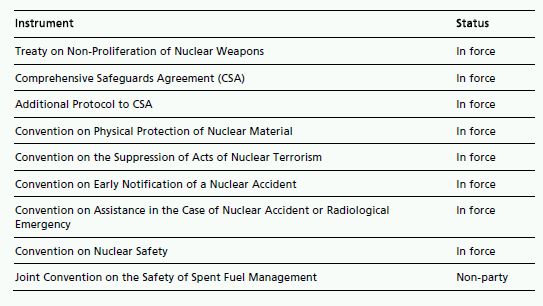

The table below shows the status of the adoption of international nuclear instruments in the UAE.

Procurement and construction

- Prime contractor – the KEPCO-led prime contractor is backed by a consortium of the key nuclear power companies in South Korea. Financing is to be provided by the South Korean Export Credit Agency, KEXIM.

- Technology – ENEC has chosen KEPCO's APR1400 as the reactor technology for the first four reactors. Shin Kori 3, under construction in South Korea, is the reference plant.

- Site – the preferred site for the first four reactors is at Braka, in the western region of the Emirate of Abu Dhabi, on the Arabian Gulf and approximately 53km west-south-west of the city of Ruwais.

- Licences – FANR has approved the following licences:

- Site Preparation Licence, UAE Nuclear Power Plants Units 1, 2, 3 and 4 – allowing ENEC to conduct site preparation activities that are not related to nuclear safety; and

- Limited Construction Licence to Manufacture and Assemble Nuclear Safety-Related Equipment, UAE Nuclear Power Plants Units 1, 2, 3 and 4 – allowing ENEC to manufacture various parts of the nuclear power plants, including the reactor pressure vessel, steam generators, pressurisers and coolant pumps.

The Construction Licence Application for UAE Nuclear Power Plants Units 1 and 2 was submitted to FANR on 28 December 2010.

Human resource development

The Gulf Nuclear Energy Infrastructure Institute (GNEII) – which will be associated with the Khalifa University of Science, Technology and Research – is an example of Abu Dhabi's early planning to develop human resources. GNEII will be supported by the US Sandia National Laboratories and the Nuclear Security Science and Policy Institute at Texas A&M University, as well as by ENEC and FANR.

Jordan

Government policy

Jordan imports approximately 95 per cent of its energy needs. The state's plan to introduce nuclear power calls for nuclear energy to generate 30 per cent of the country's electricity by 2040. Central to this plan is making use of Jordan's natural uranium assets and using nuclear energy for water desalination.

Nuclear power programme

Jordan has made substantial progress with its nuclear power programme, through both the Jordan Atomic Energy Commission (JAEC) and the Jordan Radiation and Nuclear Regulatory Commission (JNRC). JAEC, the development corporation, expects to start building a 750-1100MW nuclear power plant in 2013, to begin operating in 2018. A second plant is to begin operating in 2025. A further four nuclear power plants are planned.

Nuclear law and regulation

National nuclear legislation in Jordan is contained in two primary laws:

- Nuclear Energy Law No. 42 of 2007 relating to the jurisdiction of JAEC; and

- Nuclear Safety and Security Radiation Protection Law No. 43 of 2007 establishing JNRC.

These laws set out the respective competencies of JAEC and JNRC. Neither of these laws provides a comprehensive legislative framework for bringing nuclear power into Jordan and it is understood that JNRC is in the final stages of drafting a new law. A series of implementing regulations is also being drafted.

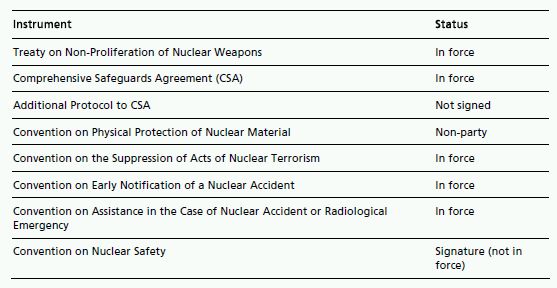

The table below sets out the current status of international instruments in Jordan.

In September 2009, JAEC contracted Tractabel Engineering, a subsidiary of GdF Suez, to undertake a two-year siting study near the Gulf of Aqaba. JAEC recently announced that the site of the first plant may be moved to the centre of the country, approximately 40km north-east of Amman. Water for reactor cooling will reportedly be supplied from the Khirbet Al-Samra waste water treatment plant.

In late 2009, JAEC appointed Worley Parsons as the technical adviser for Jordan's programme, tasked with choosing the technology for the first nuclear plant.

Three reactor vendors and designs were shortlisted in May 2010, as shown in the table below.

A consortium comprising Korea Atomic Energy Research Institute and Daewoo Engineering and Construction will build a 5MW nuclear research reactor at the Jordan University of Science and Technology.

Egypt

Government nuclear power policy

Egypt has been considering developing a civilian nuclear power programme for approximately 60 years. Egypt set up its Atomic Energy Authority (AEA) in 1955. It had plans in the 1970s to build 10 nuclear power plants by 1999. Egypt's refusal to ratify the Treaty on the Non-Proliferation of Nuclear Weapons until 1981 meant that these ambitious plans were never realised. Egypt anticipates that it needs more than 57GW of power by 2027 and has developed an energy policy that includes nuclear and renewable energy.

National nuclear power programme

Following a feasibility study in 2006, the decision was taken, by presidential decree in October 2007, to proceed with a national nuclear power programme. The programme involves building four nuclear power plants by 2025. The Egyptian Nuclear Power Plants Authority (NPPA) is the development corporation.

Law and regulation

In March 2010, Egypt passed a national nuclear law (the Egyptian Nuclear Law). The Egyptian Nuclear Law sets out a framework for introducing and regulating nuclear installations and nuclear-related activities.

The Egyptian Nuclear Law establishes the Nuclear and Radiation Control Authority (NRCA) and transfers existing functions and employees from the AEA to the NRCA.

The provisions on civil liability for nuclear damage broadly follow the Vienna Convention on Civil Liability for Nuclear Damage and the Joint Protocol on the Application of the Vienna Convention and Paris Convention.

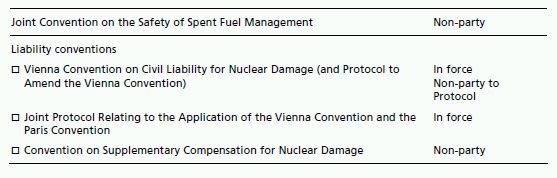

The table below sets out the status of international nuclear instruments in Egypt.

Procurement and construction

In June 2010, Egypt's NPPA signed a management contract with Worley Parsons in relation to the country's first nuclear power plant. Under the contract, Worley Parsons is responsible for selecting the reactor technology, choosing the site for the plant, training personnel and giving technical support.

There are five possible sites for the plants under consideration. An early site permit for the El-Dabaa site is expected to be issued in six months.

The NPPA was expected to launch the formal tender to supply and build the first nuclear power plants by the end of 2010. The first plant is expected to be operating by 2019.

Saudi Arabia

Government nuclear power policy

Fast-growing demand for power in Saudi Arabia is forcing the Kingdom to look at all possible sources of energy. In August 2009, Saudi Arabia formally announced that it was considering implementing a nuclear power programme. This announcement was followed in April 2010 by Royal Decree No. A/35 dated 3/5/1431 AH Concerning the Establishment of King Abdullah City for Nuclear and Renewable Energy (the Decree), which states that 'the development of atomic energy is essential to meet the Kingdom's growing requirements for energy to generate electricity, produce desalinated water and reduce reliance on depleting hydrocarbon resources'.

National nuclear power programme

The Decree sets out plans to establish the King Abdullah City for Atomic and Renewable Energy (KA-CARE), designed to develop alternative energy sources, including nuclear power, by 'setting and implementing the national policy of nuclear and renewable energy'.

Key objectives of KA-CARE (as set out in the Decree):

- propose national policies on nuclear and renewable energy, set the necessary implementation plans and strategies, and draft the relevant rules and regulations;

- implement scientific research programmes and encourage research projects in the private sector and universities;

- grant scholarships and implement training programmes in the Kingdom to develop domestic expertise in the field of nuclear and renewable energy;

- act as the regulatory body for the nuclear and renewable energy industry; and

- act as the competent agency responsible for treaties on nuclear energy signed by the Kingdom, including representing the Kingdom before the IAEA and other relevant international organisations.

A 13-member Supreme Council will oversee the development of KA-CARE. The departments concerned with nuclear and renewable energy that are currently within the King Abdulaziz City for Science and Technology will be transferred to KA-CARE.

Under the Decree, KA-CARE will have an independent annual budget and will be exempt from tax and custom duties for the equipment and machines it imports for its scientific activity.

Law and regulation

The Pöyry consultancy firm is to draft a renewable and nuclear strategy for KA-CARE. The legal and regulatory infrastructure will need to be developed.

The table below sets out the status of international nuclear instruments in Saudi Arabia.

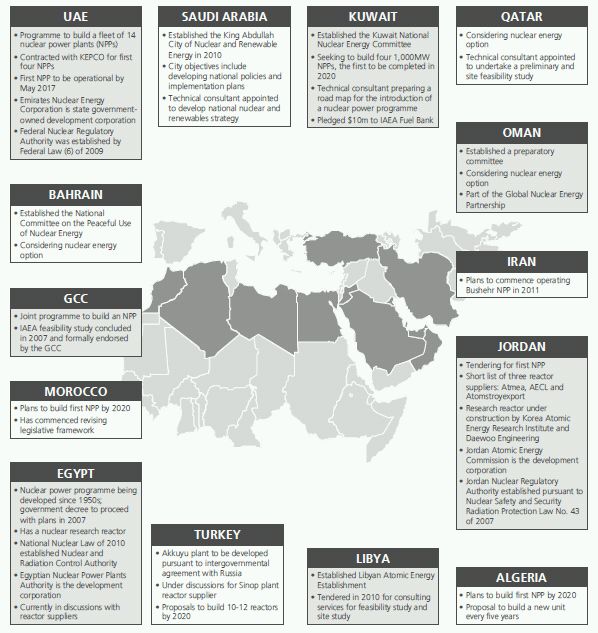

Nuclear power programmes in the MENA region

As the summary below shows, in addition to the states overviewed in this briefing almost every other state in the MENA region is developing a nuclear power programme.

Footnote

1 Nuclear Technology Review, IAEA, 2010.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.