David Whitestone is a partner, Tom Reynolds is a Senior Policy Advisor and Paolo Mastrangelo is a senior public affairs advisor in Holland & Knight's Washington D.C. office

The Top Line

The U.S. House of Representatives passed the Fiscal Year (FY) 2018 budget on Thursday, Oct. 26, 2017, clearing the congressional path for tax reform legislation and providing a procedural victory for President Donald Trump and Republican leadership. The Senate first approved an identical version of the bill on Oct. 19, 2017.

This House and Senate "reconciliation" of the FY 2018 is important for two reasons. First, it is drafted such that it allows for a future tax bill to be approved in the Senate with 50 votes rather than the usually required 60, i.e., a reconciliation. Second, it contains a "placeholder" to account for future budgetary impacts from tax cuts. Federal budgets are "concurrent resolutions" that do not require the President's signature. As such, they do not carry the force of law but do instruct Congress on the budgetary path forward.

Finally, discussions with policymakers suggest that tax legislation is taking form and will likely not be revenue-neutral, meaning that revenue generated from the elimination and limiting of tax breaks will not cover revenue lost from other tax cuts.

The Details

- Carried Interest: Gary Cohn, director of the White House's National Economic Council, has noted that President Donald Trump "remains committed to ending" the deduction. Several Republicans on the House Ways and Means Committee and Senate Finance Committee have similarly commented. We do not, at this point, anticipate a full end to the deduction but are hearing that it may be limited.

- Corporate Interest Deductibility: Initial reports suggested a possible elimination of corporate interest deductions to generate additional revenue. However, corporate America has pushed back on this fairly strongly, and it looks now like interest deductibility will be scaled back but not eliminated. This will continue to be a moving target depending upon how big the revenue hole becomes.

The Timing

There is a lot of pressure to complete tax legislation by the end of the calendar year, which seems ambitious in our opinion. Congress likes natural deadlines, such as the holidays, and we believe that getting tax legislation off the House and/or Senate floor can possibly be done by then, but that a conferenced product signed by the President would be an impressive feat.

Did You Know?

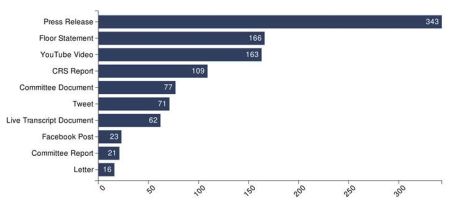

Since the recession, the term "private equity" has been mentioned in Congress more than 1,000 times? The chart below shows the counts per type of congressional "mention."

Source: Quorum Analytics

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.