On September 10−11, 2017, Florida was pounded by Hurricane Irma. It appears that only northwest Florida was spared the wrath of this storm. Landfall occurred near Cudjoe Key in south Florida and for the next 24 hours the storm crawled across the state causing destruction from high winds, rain and storm surge. The resultant flood waters will gradually recede over a period of weeks.

As can be expected, a storm of this magnitude will generate a high volume of claims from residential and commercial policyholders, along with a significant number of fraudulent claims making it imperative that insurers stay vigilant during the claims investigation process.

Prior to Hurricane Irma's arrival, public adjusters, plaintiffs' attorneys, roofing contractors and water restoration companies were gearing up for the storm. Published messages on social media feeds advised policyholders to refuse to take no for an answer − asserting that claim denials were only the beginning of the process.

Fighting False & Inflated Claims

The wake of Hurricane Irma is generating yet another storm of which insurers must be aware − the storm of false or inflated claims. However, there is potentially a silver lining when it comes to these claims. The assignment of benefits (AOB) crisis that has loomed over Florida in the past actually may provide some help. Briefly, the AOB crisis concerns the claims and litigation generated not by the insureds but by contractors that have persuaded insureds to file claims and then assign the claims to the contractors. The abuse of the assignment of benefits has skyrocketed claims and litigation and driven up property insurance rates across the state. The AOB claims, especially those from roofing contractors and water mitigation companies, and previous wind and water damage claims by policyholders may provide a photographic benchmark of the conditions of various properties as they existed prior to Hurricane Irma. These benchmarks may prove highly effective in allowing more accurate assessments of the damage to property directly caused by Hurricane Irma.

Interesting opportunities also may lie with the numerous open AOB and prior wind and water damage claims. It is highly likely that the insured properties would have suffered additional damage as a result of Hurricane Irma, and this may provide an opportunity to resolve both claims − an opportunity that should not be ignored. At a minimum, the photographic benchmark of the pre-hurricane condition coupled with the hurricane deductible should make the exposure for these claims considerably less than if the prior claim did not exist. Further, since the insured is not eligible for two new roofs and is facing the hurricane deductible, which is usually more significant than the all-perils deductible, policyholders may be incentivized to resolve both claims, and that can be beneficial to insurers.

Recent Law

Additional positives also may be found in a careful review of the applicable policies. At the forefront of the minds of most insurance adjusters is the Sebo v. Am. Home Assurance Co., 208 So. 3d 694 (Fla. 2016) decision that essentially held that concurrent causation and not efficient proximate cause is the law of the land in Florida. It is important to remember that the same decision seemed to indicate, albeit in dicta, that anti-concurrent causation provisions are valid. Therefore, careful review of the insurance policy may reveal anti-concurrent causation language that may be helpful to the insurer.

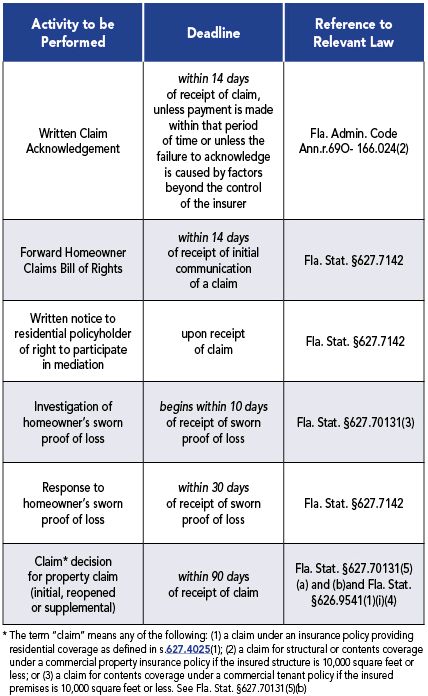

As a reminder, Florida Law requires that certain activities be completed timely. The table below lists some of those activities and the respective deadlines. Please note the following pursuant to §626.913(4), Fla. Stat:

(4) Except as may be specifically stated to apply to surplus lines insurers, the provisions of Chapter 627 do not apply to surplus lines insurance authorized under §§626.913 – 626.937, Fla. Stat, the surplus lines law.

What is certain is that Hurricane Irma will present a high volume of claims. There are a multitude of tools that should be used strategically to best adjust these claims, and Wilson Elser is well positioned to assist insurers in their use. For more on the subject, please contact either Nyasha S. Seale or Susan B. Harwood.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.