While the media has been focused on the stay of the new federal overtime exemption classification rules in Nevada v. U.S. Department of Labor, U.S. District Court for the Eastern District of Texas, No. 16-cv-741, and the Department of Labor's appeal of the stay, New York employers need to beware! New York State's proposed rules are poised to go into effect, possibly on December 31, 2016.

On October 19, 2016, in anticipation of the federal FLSA modifications going into effect on December 1, 2016, the NYDOL published a proposed Wage Order that would increase the minimum salary requirements for executive and administrative employees to be exempt from overtime (unlike the federal rules, the New York Wage Order does not set a minimum salary requirement for professional employees). The public comment stage for the NYDOL proposed Wage Order ended on December 3, 2016. The state legislature can now enact the rules, and these changes could go into effect as early as December 31, 2016.

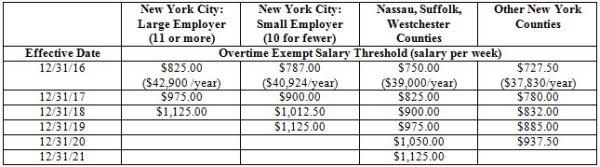

The proposed New York Wage Order increases the minimum salary requirement necessary for executive and administrative employees to be exempt from overtime. The proposed schedule of exempt salary requirements for administrative and executive employees would be as follows:

The proposed Wage Order also calls for yearly increases to the uniform maintenance allowance (a sum paid to employees in addition to the applicable minimum wage) also potentially beginning on December 31, 2016. These increases would vary by the employee's total weekly hours worked, employer size, and location within the state.

Reminder: New York's Minimum Wage Increase Has Already Been Enacted and Will Be Effective December 31, 2016.

On April 4, 2016, as part of New York's 2016−2017 budget, Governor Cuomo signed legislation gradually increasing the minimum wage until it reaches $15.00 throughout the state by December 31, 2021.

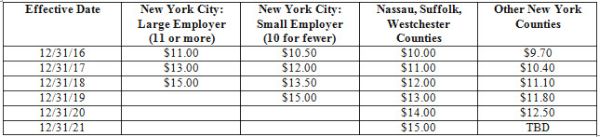

The schedule of minimum wage increases is as follows:

After the increase to $12.50 per hour on December 31, 2020, the minimum wage for workers outside New York City, Nassau, Suffolk and Westchester will continue to increase according to an indexed schedule. The Director of the Division of Budget in conjunction with the New York Department of Labor will set the minimum wage until it reaches $15.00 per hour.

Fast Food Workers

The current minimum wage for fast food workers is $10.50 per hour in New York City and $9.75 per hour in the rest of the state. The schedule of minimum wage increases for fast food workers is as follows:

Tipped Employees

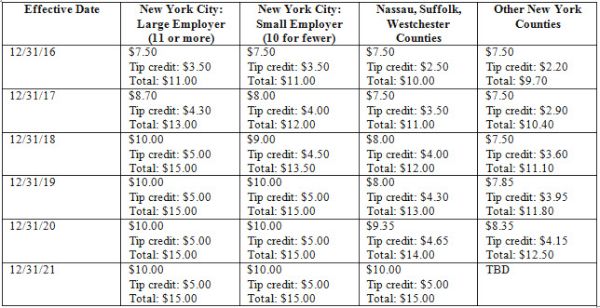

The current cash wage for hospitality industry tipped employees is $7.50 per hour and the maximum tip credit is $1.50. The cash wage for all other tipped employees, except building service employees who are not entitled to tip credits, is $7.65 (if tips are at least $1.35 per hour) and $6.80 (if tips are at least $2.20 per hour). The cash wage increases for tipped employees is as follows:

After the increase to $8.35 per hour on December 31, 2020, the cash wage for tipped employees outside New York City, Nassau, Suffolk and Westchester will continue to increase according to the Division of Budget's analysis of the effects of the gradual wage increases.

Conclusion

The federal and state wage and hour laws are in dramatic flux. Employers need to closely monitor these rapidly changing developments to stay in compliance with the law. Wilson Elser's team of dedicated attorneys is available to help you keep abreast of the changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.