On June 27, 2016, the Securities and Exchange Commission (the "Commission") proposed amendments to the definition of "smaller reporting company" (SRC) that would expand the number of companies that have this status. These proposed amendments reflect a number of discussions relating to the Commission's scaled disclosure requirements following the creation of the "emerging growth company" category by the JOBS Act. The amendments are intended to promote capital formation by reducing the burdens on SRCs without significantly altering the total mix of information available to investors. The Commission is also proposing amendments to the definitions of "accelerated filer" and "large accelerated filer."

Currently, SRCs are registrants, other than asset-backed issuers, investment companies, and majority-owned subsidiaries of non-SRC parent companies, with:

- Less than $75 million in public float as of the last business day of their most recently completed second fiscal quarter; or

- A public float of zero and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available.

SRCs are eligible for a number of disclosure accommodations under Regulation S-K and Regulation S-X. The proposed amendments do not affect the scope of these existing scaled disclosure requirements. The Commission will review the scaled disclosure requirements as part of its Disclosure Effectiveness Initiative.

Under the proposed amendments, registrants with a public float of less than $250 million would qualify as SRCs. A registrant would assess its status by calculating its public float as of the last business day of its most recently completed second fiscal quarter.

A registrant filing its initial registration statement under the Securities Act or the Exchange Act would calculate its public float as of date within 30 days of the filing date.

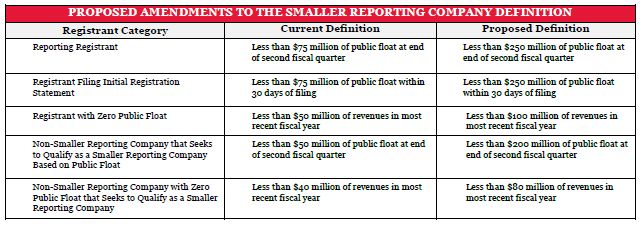

A registrant with a public float of zero would qualify as an SRC if it had annual revenues of less than $100 million during its most recently completed fiscal year. The Commission's proposing release includes the following summary table:

Accelerated Filer and Large Accelerated Filer Definition

The public float thresholds for qualifying as an accelerated filer or a large accelerated filer would remain the same. The Commission has proposed amendments to eliminate the provision in the definition of each category that specifically excludes registrants that are eligible to use the SRC requirements under Regulation S-K for annual and quarterly reports.

Request for Comment

The Commission requests comment on whether the higher thresholds for SRC eligibility will promote capital formation. The analysis accompanying the amendments estimates an additional 782 registrants would qualify as SRCs under the revised standards. Of course, the reduced compliance costs and lower disclosure burdens may also encourage more companies to become SEC registrants.

The Commission's proposed amendments retain the public float and revenue tests. Comment is requested as to whether the two thresholds should be maintained. Alternatively, the Commission asks whether a market capitalization threshold would be appropriate. Given that research analysts and institutional investors focus largely on market capitalization, it may make sense to further consider a market capitalization trigger.

Conclusion

The proposed amendments, which take into account recommendations made by the Commission's Advisory Committee on Small and Emerging Companies and the Commission's Government-Business Forum on Small Business Capital Formation, are a useful step forward. If meaningful changes to scaled disclosure requirements were to result from the Disclosure Effectiveness Initiative, that would result in substantial compliance and regulatory cost savings. These changes would have to be accompanied by additional changes intended to revive (or reinvigorate) the ecosystem for smaller public companies. Too many smaller public companies lack meaningful research coverage and suffer from thinly traded stocks. These companies often see their financing options limited to transactions that result in significant dilution and fail to achieve broader, more dispersed ownership or any institutional investor following.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved