Global Fixed Interest

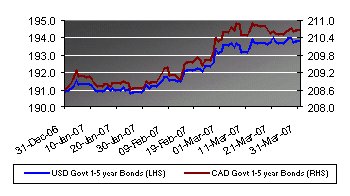

Bond markets have fared better in the US than those in Europe or the UK, as renewed fears of stalling economic growth suggest that the Federal Reserve may be forced to ease monetary policy as soon as this summer. More robust data this side of the Atlantic has seen further tightening in monetary policy as both the European Central Bank and the Bank of England continue to search for the elusive ‘neutral’ official interest rate.

Recent movements in the US have been driven by the fall-out seen in the sub-prime mortgage market and stalling of the housing market, both in terms of transaction volumes and actual house prices. The result has been increased volatility in equity and bond markets and expectations for easier monetary policy brought forward, as measured by the yield curve and money market derivatives. The Fed, while noting that the risks to economic slowdown have increased, remains concerned with price stability and inflation. The question therefore arises as to whether the Fed is being prudently cautious on inflationary risks, or whether the fall-out in sub-prime mortgages is likely to spread to the broader loans market and ultimately the economy.

The increase in delinquency rates of sub-prime mortgages in itself is not of great concern, apart from to those who have direct exposure to companies and loans where viability depends upon the mortgage payments being met each month. However, the wider implications of tighter lending criteria, falling residential property prices, the weakening employment market for industries associated with property markets, and a fall in consumer confidence, do have a potential impact on the broader economy.

While we do not foresee the ‘doomsday’ scenario that some market commentators are currently speculating upon, there are certainly enough headwinds facing the consuming part of the US economy to justify some easing in monetary conditions from the Fed later in the year. At present, the Fed are correct to maintain their stance on inflation, but as headline inflationary pressures are anticipated to ease through the year, we would not rule out the potential for official interest rates to be cut. Such a scenario is likely to support valuations of investment grade debt through the summer months. We will continue to remain clear of lower-grade debt however, believing that credit spreads are likely to widen in the months ahead.

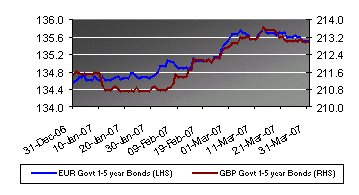

Turning to the UK, bond markets appear to be paying little attention to a potential slowdown in the US. As anticipated, the Monetary Policy Committee has increased interest rates by another 25 basis points over the quarter. Recent movements have been detrimental to the performance of Sterling denominated bonds and, we see current levels as a relatively good opportunity to build positions. Inflation has surprised on the upside over recent months, although there is a firm expectation at the Bank of England that it is likely to fall back towards the target level of 2% during the summer months. In addition, it is fair to assume that a potential slowdown in the US economy would also be felt in the UK. With this in mind, we expect that the Bank of England will limit further monetary tightening to just one additional 25 basis point move during the next quarter. This therefore makes a market that is pricing in a total of 50 basis points of tightening relatively attractive.

European bond markets have posted steady returns over the last quarter, with yields unchanged across the yield curve, despite the European Central Bank increasing the Main Refinancing Rate from 3.5% to 3.75% at the beginning of March. The move was expected and fully priced into bond yields, reflecting the fact that the ECB appears to be improving its communication with the market in terms of the direction and timing of monetary policy changes.

Looking forward, there appear to be some conflicting reports as to the magnitude of additional policy tightening in the Eurozone. We have maintained a relatively defensive position in the market since the ECB first started raising rates at the end of 2005 and we shall continue to do so in the coming months. Recent commentaries have focused upon our expectation that an economic slowdown in the US will weigh heavily on European economic prospects. However, there appears to be increasing evidence that the EU economy is decoupling from that of the US, and will be able to fare better than previously anticipated in the event of a US slowdown. In particular, employment remains buoyant on a historical basis and is likely to feed through to wage settlements in the coming months.

With increasing inflationary pressures in Europe, it is predicted that the ECB may continue to push interest rates higher than had previously been anticipated. To date, this may not be fully reflected in bond yields. We shall therefore be remaining short of duration in this market until such time that there is greater evidence that the ECB is reaching the top of the current monetary cycle.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.