After almost forty years, the IRS has updated the section 482 regulations governing intercompany services (Temp. Reg. § 1.482-9T). The New Regulations improve upon regulations proposed in 2003 (the "Proposed Regulations") that encountered serious criticism from the business community. Since most multinational businesses entail some cross-border intercompany services – and since the New Regulations are quickly effective, beginning January 1, 2007 for calendar year taxpayers – the new rules require close immediate attention.

Services Cost Method – A Must-Read Feature

The most dramatic improvement from the Proposed Regulations is the replacement of the much-maligned "Simplified Cost Based Method" (SCBM) with the "Services Cost Method" (SCM). SCBM had substituted a complex, graduated-rate approach for the Old Regulations' cost-only safe harbor for "non-integral" services. The New Regulations restore the cost-only approach for a reasonably broad category of back-office services, and in some respects move past the Old Regulations' often imponderable "non-integral" requirement and the related "peculiarly capable"/"significant element" concepts.

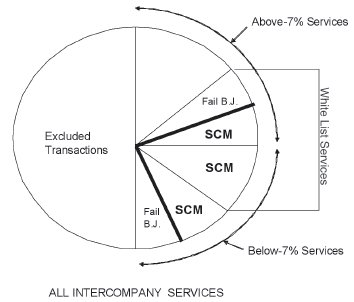

SCM applies to services that:

1. Are not "excluded transactions" (e.g., manufacturing, construction, distribution, R&D, financial transactions, and insurance);

2. Are either:

A. "Specified covered services" (a 'White List' of common support services, as specified in a published revenue procedure); or

B. "Low margin covered services" (services for which the median comparable markup does not exceed 7%);

3. Pass the 'business judgment' test – The taxpayer must reasonably conclude in its business judgment that the services do not contribute significantly to key competitive advantages, core capabilities, or fundamental risks of success or failure in one or more trades or businesses of the renderer and/or the recipient;

4. Are covered by adequate books and records.

Visually, the telescoping effect of these rules can be illustrated as follows:

Pending future modification, the White List is fairly narrow and may pose segregation issues, and the business judgment test could lead to differences of opinion on audit. But SCM is a welcome addition to the transfer pricing lexicon and surely must be carefully evaluated by all taxpayers. Moreover, to avoid any inadvertent election or rejection of the SCM, taxpayers should be very explicit – whatever their choice – in pertinent documentation.

Shared Services Arrangements ("SSAs")

SCM opens the door to a useful innovation – cost-sharing arrangements for services. Foreshadowed by the permissive "cost contribution arrangements" under the OECD Guidelines, the requirements for SSAs are relatively simple:

- There must be at least two participants

- The subject services must constitute "covered services" eligible for SCM

- All controlled taxpayers that reasonably anticipate a benefit from the covered services must participate, and

- At least one participant must benefit from each covered service (or reasonable aggregation of services).

Under an eligible arrangement, the costs of the services are allocated among the participants in proportion to their respective shares of the reasonably anticipated benefits (whether or not in fact realized). Deference is given to the taxpayer's "reasonable conclusion" as to the reliability of the measurement keys. Aggregation of covered services is permitted for allocation purposes and need not follow the same groupings used for evaluating low-margin services. The key advantages of an SSA are these liberalized tracking and allocation provisions.

Rules for Cost-Based TPMs

SCM, SSAs, comparable profit method analyses using the favored net-cost-plus profit level indicator, and other cost-based transfer pricing methodologies are based on "total services costs." Stock-based compensation is explicitly required.

Other New Provisions

These are long and detailed rules, including many examples. New concepts to be studied include:

- "Direct benefit" test for charging out headquarter services

- "Sole-effect" test for inallocable "shareholder activities"

- Inallocable "passive association" benefits

- Contingent payment arrangements

- New specified pricing methods (in addition to SCM) that parallel those for transfers of intangible and tangible property; unclear role of the residual profit split method

- Alternative approaches to pricing passed-through third-party services

Imputed Agreements – Lurking Considerations

Despite various criticisms, the New Regulations adopt the Proposed Regulations provisions that permit the IRS to review controlled parties' dealings and impute agreements between them to more accurately reflect the economic substance of their conduct, even if contrary to express contractual agreements. The IRS's preamble to the New Regulations stresses that the IRS can only impute different arrangements if the taxpayer fails to specify contractual terms or if the specified terms do not accord with economic substance. However, the IRS's authority is not meaningfully hobbled, and the potential scope and threat of its imputation powers remain.

Integrated Transactions – The Sleeping Giant

In the case of transactions which combine different elements, the New Regulations look first to whether there are sufficiently similar features in comparable transactions that can be used to evaluate the transaction as a whole. Significantly, the preamble states that "if a taxpayer structures a transaction so that it constitutes a controlled service, the transaction will generally be analyzed under the principles of" the services regulations, without regard to other provisions of the section 482 regulations. Services transactions with an intangible property element must run an additional gauntlet: any "material element" relating to intangible property must be corroborated or determined under the section 482 intangibles pricing rules.

Intangibles – Clarified Approaches

The New Regulations also address certain threshold concepts in pricing intangibles (Temp. Reg. § 1.482-4T). Despite some criticism, the New Regulations continue the rule that legal ownership of intangibles is usually the foundation for assessing appropriate transfer pricing. The restated rules stress the ability to slice up an intangible into separate items of intangible property for transfer pricing purposes, for example, (a) a trademark itself and (b) discrete license rights thereunder. The modified rules also adopt a "contribution" approach that requires payment for activities that increase the value of an intangible owned by a related party (replacing the much-debated 1994 "cheese examples"). That compensation may variously be embedded within the terms of another transaction, stated separately, or applied to reduce another payment. The IRS preamble notes "heightened deference" to taxpayers' contractual arrangements.

Effective Date Rules and Considerations – Tough Choices

The Temporary Regulations are effective for taxable years beginning after December 31, 2006, and remain in effect until July 31, 2009. Given the broad scope of the rules, the close-athand effective date affords precious little time for the necessary comprehensive review – particularly with further last-minute changes (including finalization of the White List) possible under the proposed regulation comment process.

Conclusions

The IRS has tried hard to make the services regulations more user-friendly in routine situations. Eligibility for SCM and SSAs, however, needs considerable broadening to make practical sense for many taxpayers. It seems inevitable that fewer services will be chargeable at cost than under current rules, that more "robust" economic analyses will be needed, and that taxpayers must undertake considerably more work and prepare considerably more documentation than seen in typical current levels of section 6662(e) compliance with respect to services. Advance Pricing Agreements (APAs) with the IRS deserve serious consideration as an efficient way to achieve more certainty under the new rules.

Important tips for taxpayers include:

- Move quickly to inventory, categorize, and review all intercompany service arrangements, identifying pertinent corporate objectives and using an evaluation template.

- Comprehensively review existing contracts and/or create new ones to ensure they clearly establish responsibilities, risks and intended relationships. Contract revisions may be needed on an expedited basis to support consistent foreign treatment. The importance of specific contracts cannot be overstated, as the New Regulations in key areas (intangibles, integrated transactions, and imputed transactions) rely on and largely defer to taxpayers' contractual arrangements.

- Watch for additional guidance on the New Regulations, as there are many issues that still need clarification.

- Consider providing comments for the IRS hearings if you are encountering legitimate interpretation or implementation problems.

This article is designed to give general information on the developments covered, not to serve as legal advice related to specific situations or as a legal opinion. Counsel should be consulted for legal advice.