John Dadakis is a Partner in the New York office

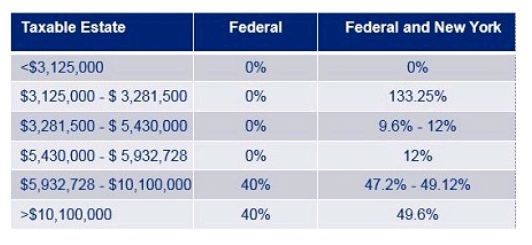

The most interesting estate tax is that found in New York. New York has the estate tax "cliff." That is where the New York Estate Tax is imposed once the value exceeds the New York basic exclusion at a rate in excess of 100%. This "cliff" tax calculation is due to the reduction of the amount of the credit provided against the New York Estate Tax.

For decedent's dying between April 1, 2015, and March 31, 2016, while the basic exclusion will be $3,125,000, if an estate has a value between that amount and $3,281,250 (105% of the basic exclusion amount), the marginal rate will be approximately 133%. This issue should be addressed by individuals who may be impacted, by modifying their estate planning documents to include a charitable donation. That way, at least the estate passing to family will not be reduced by an extra 33%.

The following table provides the marginal estate tax rates for New Yorkers:

The above estate tax rates reflect why so many individuals are moving to states with lower taxes (both income and estate taxes).

So what should New Yorkers do? Clearly, avoid the 133% estate tax on the $156,500 by providing a bequest to their favorite charity. If a person is reaching a level where the federal estate tax kicks in, proper estate tax planning would be necessary.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.