On August 6, 2015, the IRS issued Notice 2015-54 (the "Notice"),1 which states that the IRS and Treasury Department intend to issue regulations under section 721(c) of the Internal Revenue Code of 1986 (the "Code") to ensure that, when a U.S. person transfers certain property to a partnership that has a foreign partner related to the transferor, income or gain attributable to the property will be taken into account by the transferor either immediately or periodically. The rules will apply whether the partnership is U.S. or foreign.

The Notice is significant because many transactions are currently structured to use a partnership rather than a corporation to avoid application of Code section 367, which generally turns off the corporate nonrecognition provisions for transfers to foreign corporations. These rules are grounded in the belief by Treasury and the IRS that U.S. taxpayers have been using partnership structures that adopt Code section 704(c) methods, special allocations under Code section 704(b), and inappropriate valuation techniques with a view towards shifting income to their foreign affiliates. However, the regulations envisioned in the Notice will only apply when property is transferred and the amount of built-in gain for the tax year is greater than $1 million, thereby limiting its scope, although built-in losses do not reduce built-in gains.

The regulations will be generally effective for transfers occurring on or after August 6, 2015.

I. Background

Generally, Code section 721(a) provides that a transfer of property to a partnership in exchange for an interest in the partnership will be accorded non-recognition treatment. Code section 721(c) provides Treasury with regulatory authority to ignore section 721(a) if gain realized on the transfer of property to a partnership would be includible in the gross income of a foreign person. Under Code section 367(d), a U.S. person who transfers intangible property to a foreign corporation, in an exchange described in Code sections 351 or 361, is treated as having sold such property in exchange for payments that are contingent on the use or disposition of such property and receiving amounts that reasonably reflect the amounts that would have been received annually in the form of such payments over the useful life of such property. Under Code section 367(d)(2), the amounts taken into account must be commensurate with the income attributable to the intangible. Code section 367(d)(3) provides Treasury with regulatory authority to apply the rule of Code section 367(d)(2) to transfers of intangible property to partnerships in circumstances consistent with the purposes of Code section 367(d).

Because Code section 367 only applies to the transfers of property to foreign corporations and no regulations have been issued under Code sections 721(c) or 367(d)(3), a U.S. person generally does not recognize gain on the transfer of appreciated property to a partnership with foreign partners.

Code section 704(c)(1)(A) requires partnerships to allocate income, gain, loss, and deduction, with respect to property contributed by a partner to the partnership, so as to take into account any variation between the adjusted tax basis of the property and its fair market value at the time of contribution. Regulations section 1.704-3(a)(1) provides that the purpose of Code section 704(c) is to prevent the shifting of tax consequences among partners with respect to pre-contribution gain or loss. The allocations required by Code section 704(c) must be made using any reasonable method consistent with that purpose. Regulations section 1.704-3 describes three methods of making such allocations that are generally reasonable: the traditional method, the traditional method with curative allocations, and the remedial allocation method.

Under the traditional method of allocation, the "ceiling rule" may cause distortions in partnership allocations of depreciation or gain or loss to partners. The ceiling rule provides that total income, gain, loss, or deduction allocated to the partners for a taxable year with respect to a property cannot exceed the total partnership income, gain, loss, or deduction with respect to that property for the taxable year. These distortions may be corrected under either the traditional method with curative allocations or the remedial allocation method. The traditional method with curative allocations permits allocations of other partnership items of income, gain, loss or deductions to correct ceiling rule distortions. If a partnership needs to make a curative allocation, but does not have sufficient tax items of income, gain, loss, or deductions from another source to do so, it may use the remedial allocation method to eliminate distortions caused by the ceiling rule by making remedial allocations of income, gain, loss, or deduction to the noncontributing partners equal to the full amount of the limitation caused by the ceiling rule and offsetting those allocations with remedial allocations of income, gain, loss, or deduction to the contributing partner. These allocations also are reflected only in tax capital accounts and have no effect on book capital accounts. The absence in current regulations of a mandatory requirement to use the remedial method leaves open the door for tax planning.

II. The Notice

The Notice denies deferral for transfers to partnerships, domestic or foreign, where there is a related foreign partner (other than another partnership). Additional regulations will be issued under section 482 regarding transfers involving partnerships.

The Notice states that it will apply to a "Section 721(c) Partnership." A partnership (domestic or foreign) is a Section 721(c) Partnership if a "U.S. Transferor" contributes "Section 721(c) Property" to the partnership, and, after the contribution and any transactions related to the contribution, (i) a "Related Foreign Person" is a direct or indirect partner in the partnership, and (ii) the U.S. Transferor and one or more "Related Persons" own more than fifty percent of the interests in partnership capital, profits, deductions or losses. "Related" is defined by reference to Code sections 267(b) or 707(b)(1). A "U.S. Transferor" is a United States person within the meaning of Code section 7701(a)(30), other than a domestic partnership.

"Section 721(c) Property" is property, other than "Excluded Property," with "Built-In Gain." "Excluded Property" is (i) cash equivalents, (ii) any asset that is a security within the meaning of Code section 475(c)(2), without regard to Code section 475(c)(4), and (iii) any item of tangible property with Built-In Gain that does not exceed $20,000. "Built-In Gain" is tied to the property's book value; it is the excess Code section 704(b) book value of the property over the contributing partner's adjusted tax basis in the property at the time of the contribution (and does not include gain created when a partnership revalues partnership property). Presumably book value and fair market value will be the same.

1. Recognition of Gain on Certain Transfers

The Notice states that Treasury and the IRS intend to issue regulations providing that section 721(a) will not apply when a U.S. Transferor contributes an item of Section 721(c) Property (or portion thereof) to a Section 721(c) Partnership, unless the "Gain Deferral Method" is applied with respect to the Section 721(c) Property. The regulations will include a de minimis rule providing that Code section 721(a) (if otherwise applicable) will continue to apply (without regard to whether the requirements of the Gain Deferral Method are satisfied) if, during the U.S. Transferor's taxable year, (1) the sum of the Built-In Gain, with respect to all Section 721(c) Property contributed in that year to the Section 721(c) Partnership by the U.S. Transferor and all other U.S. Transferors that are Related Persons, does not exceed $1 million, and (2) the Section 721(c) Partnership is not applying the Gain Deferral Method with respect to a prior contribution of Section 721(c) Property by the U.S. Transferor or another U.S. Transferor that is a Related Person.

In order for a Section 721(c) Partnership to apply the Gain Deferral Method:

- the partnership must adopt the remedial method for Built-In Gain with respect to all Section 721(c) Property contributed to the partnership pursuant to the same plan by a U.S. Transferor and all other U.S. Transferors that are Related Persons;

- during each year in which there is remaining Built-In Gain with respect to an item of Section 721(c) Property, the partnership must allocate all items of Code section 704(b) income, gain, loss, and deduction with respect to that Section 721(c) Property in the same proportion;

- certain reporting requirements must be satisfied;

- the U.S. Transferor must recognize Built-In Gain with respect to any item of Section 721(c) Property upon an "Acceleration Event" (defined below); and

- the Gain Deferral Method is adopted for all Section 721(c) Property subsequently contributed to the partnership by the U.S. Transferor and all other U.S. Transferors that are Related Persons until the earlier of (i) the date that no Built-In Gain remains with respect to any Section 721(c) Property to which the Gain Deferral Method is first applied, or (ii) 60 months after the date of the initial contribution of Section 721(c) Property.

2. Acceleration Event

An "Acceleration Event" with respect to an item of Section 721(c) Property is any transaction that either (i) would reduce the amount of remaining Built-In Gain that a U.S. Transferor would recognize under the Gain Deferral Method if the transaction had not occurred or (ii) could defer the recognition of the Built-In Gain. An Acceleration Event will also be deemed to have occurred with respect to all Section 721(c) Property of a Section 721(c) Partnership for the taxable year of the Section 721(c) Partnership if any party fails to comply with all of the requirements for applying the Gain Deferral Method. However, there are a number of situations that might result in a transaction qualifying for an exception to the Acceleration Event rules.

An Acceleration Event will not occur if:

- a U.S. Transferor transfers an interest in a Section 721(c) Partnership to a domestic corporation in a transaction to which either Code sections 351(a) or 381(a) applies, provided that the parties continue to apply the Gain Deferral Method;

- a Section 721(c) Partnership transfers an interest in a lower-tier partnership that owns Section 721(c) Property to a domestic corporation in a transaction to which Code section 351(a) applies, provided that the parties continue to apply the Gain Deferral Method; or

- a Section 721(c) Partnership transfers Section 721(c) Property to a domestic corporation in a transaction to which Code section 351(a) applies.

If a Section 721(c) Partnership transfers Section 721(c) Property (or an interest in a partnership that owns Section 721(c) Property) to a foreign corporation in a Code section 351(a) transaction, an Acceleration Event will not occur to the extent the Section 721(c) Property is treated as being transferred by a U.S. person (other than a domestic partnership) in an outbound transfer under Regulations section 1.367(a)-1T(c)(3)(i) or (ii).

3. Regulations Regarding Controlled Transactions Involving Partnerships

The Notice states that Treasury and the IRS intend to issue regulations regarding the application to controlled transactions involving partnerships of certain rules in Regulations section 1.482-7 that are currently applicable to cost sharing arrangements.

4. Possible Regulations under Code Section 6662

Generally, Code section 6662 imposes an accuracy-related penalty to any portion of an underpayment which is attributable to one or more specified reasons, including a substantial valuation misstatement pertaining to either a transaction between persons described in Code section 482 (the transactional penalty) or a net Code section 482 transfer price adjustment (the net adjustment penalty). The Notice states that Treasury and the IRS also are considering issuing regulations under Regulations section 1.6662-6(d) to require additional documentation for certain controlled transactions involving partnerships.

5. Effective Dates

As indicated above, the Notice states that the regulations will apply to transfers occurring on or after August 6, 2015, and to transfers that are deemed to occur before August 6, 2015, as a result of a check-the-box election made on or after August 6, 2015.

The reporting requirements and the transfer pricing regulations will apply to transfers and controlled transactions occurring on or after the date of publication of the regulations described in those sections of the Notice.

The Notice states that no inference is intended regarding the treatment of transactions under current law, and the IRS may challenge such transactions under applicable Code provisions, regulations, and judicial doctrines. As an example, the Notice asserts that the IRS may challenge a partnership's adopted Code section 704(c) method under the anti-abuse rule in Regulations section 1.704-2(a)(10).

III. Conclusion

It is no surprise that the IRS is issuing the Notice. The issue has been outstanding for almost 20 years and was frequently raised in seminars and bar association reports. It is noteworthy that cash, securities, and tangible property with Built-In Gain that does not exceed $20,000 are carved out, thereby narrowing the scope of the Notice.

It is questionable as to whether the IRS will be successful in asserting an anti-abuse rule in situations where the taxpayer has not used the remedial method. The current regulations are clear that the use of the remedial method is elective.

The proposed change to Code section 482 will also be controversial. It appears that the IRS will attempt to challenge allocations, based on valuations, using Code section 482, which has not previously been used for this purpose. The Notice does not indicate whether the rules will apply whether or not the Gain Deferral Method is chosen. It is appropriate that the regulations will only apply on a prospective basis.

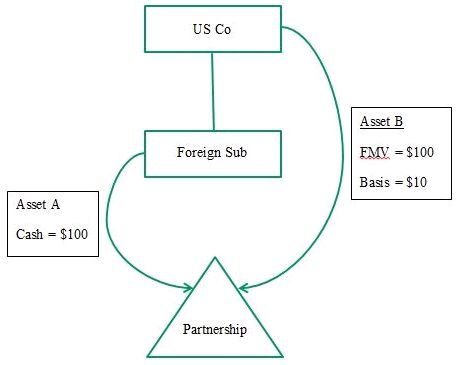

A Simple Illustration of the Notice's Impact

Pre-Notice:

The contribution of Asset B by U.S. Co does not result in gain recognition under Code section 721(a). The timing of recognition of the built-in gain in Asset B depends on the Code section 704(c) method chosen. Partnership could use the traditional method, traditional method with curative allocations, or remedial method to account for the built-in gain of Asset B in allocating items of income, deduction, gain, or loss to its partners.

Post-Notice:

To avoid gain recognition on the contribution of Asset B, Partnership must use the remedial method to account for the built-in gain of Asset B in allocating items of income, deduction, gain, or loss to U.S. Co and Foreign Sub. Use of remedial method may result in additional deprecation to Foreign Sub, but additional taxable income allocated to U.S. Co, as compared to the use of the traditional method or traditional method with curative allocations. Deductions attributable to built-in gain property cannot be specially allocated to U.S. Co.

Footnotes

1 2015-34 IRB.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.