NUMBER OF THE WEEK: 1,462. The total number of comments received by the Senate Finance Committee's five bipartisan tax reform working groups in response to the committee's request for public input on overhauling the nation's tax code. The working groups, each focused on different areas of the tax code, are expected to begin closed-door roundtable discussions with all committee members this week to flesh out options under consideration. The working groups are slated to deliver final reports to Chairman Orrin Hatch (R-UT) by the end of the month. There are some indications that the international tax working group, which many say is progressing at a faster clip than the others, may release a draft proposal for public scrutiny following the roundtable discussions.

PROGRAMMING NOTE: Starting this week, we will help you sift through some of the comment letters submitted to the Senate Finance Committee working groups. Each week, we will put the spotlight on one of the five working groups and highlight some of the more interesting submissions, particularly those from leading trade associations and business organizations with an influential voice in Washington. Please note that we are not advocating for any particular policy position as we highlight various groups' submissions.

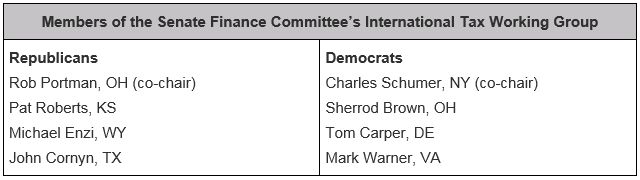

This week, let's kick off with the International Tax Working Group!

Comment Spotlight: The Business Roundtable

The Business Roundtable's (BRT) comments focused on two specific items: (1) the adoption of a 25 percent corporate tax rate and (2) a "modern" international tax system. The BRT advocates for a "territorial-type" tax system, much like those currently implemented in many other countries with which the U.S. competes in the global economy. According to the BRT, the principles of tax reform include: Promoting economic growth and competitiveness; providing a simplified, efficient, and unbiased tax system; and establishing permanence to support long-term business decisions and commitments. The full submission can be found here. Members of Congress continue to disagree about the political viability of lowering the corporate rate without simultaneously lowering the rate for pass-through businesses and other individual income tax payers.

LEGISLATIVE LANDSCAPE

Senate Finance OKs 529 College Savings Bill. A bill to improve and expand 529 college savings plans (S.335) has been approved by the Senate Finance Committee without amendments. Similar to Rep. Lynn Jenkins (R-KS) bill (H.R. 529) approved by the House in February, the Senate bill would expand the definition of qualified higher education expenses to include computer and software purchases. In addition, students receiving a refund of any qualified higher education expenses would be allowed to redeposit those funds into a 529 plan within 60 days without penalty. The bill also contains a technical amendment that revises the way the earnings portion of a distribution is computed. Timing for a floor vote remains uncertain, but the Senate is expected to pass the bill.

No Fable! ESOPs Get Bipartisan Boost in Proposed Legislation. Congressman Dave Reichert (R-WA), along with some of his colleagues on the Ways and Means Committee, has re-introduced a bill that would provide tax incentives to encourage pass-through businesses structured as S corps to set up or expand employee stock ownership plans. ThePromotion and Expansion of Private Employee Ownership Act of 2015 (H.R. 2096) would allow for the deferral of tax for certain sales of employer stock to an ESOP sponsored by an S corp. The legislation would also create a tax deduction for interest on loans to finance the purchase of employer securities by an S corp-sponsored ESOP. The bipartisan bill is co-sponsored by Reps. Kind (D-WI), Paulsen (R-MN), Blumenauer (D-OR), Tiberi (R-OH), Neal (D-MA), Boustany (R-LA), and Pascrell (D-NJ).

Ryan Says "No" to Repatriation Holiday for Highway Reauthorization. "Repatriation does not work and we will not do a holiday," Ways and Means Chairman Paul Ryan told reporters recently. Both Ryan and Senate Finance Chairman Orrin Hatch have publicly stated that they would not consider using a repatriation holiday to fund the dwindling Highway Trust Fund outside of tax reform. As the clock winds down for the Highway Trust Fund, lawmakers are planning to pass another short-term patch to get through the year, which means the tax-writing committees will be looking for ways to come up with $10 billion between now and May 31. For a long-term reauthorization bill, lawmakers may have to turn to a mixed bag of pay-fors, especially if tax reform fails to materialize this year. Both Ryan and Hatch have indicated they would like to introduce a narrow tax reform package overhauling the business side of the tax code this summer. Such a limited overhaul would aim to reform the international tax system, make permanent certain business tax extenders, and provide a longer term solution to the Highway Trust Fund problem.

It's Repatriation! It's a Gas Tax Hike!

It's Private Activity Bonds? The options of using a

repatriation tax or a gas tax increase to help fund a six-year

highway reauthorization bill have been proposed in the Senate and

House earlier this year with dim prospects. In view of the

nation's infrastructure funding crisis, Senate Finance Ranking

Member Ron Wyden (D-OR) has introduced a bill that would create a

new class of tax-exempt PABs called "Move America Bonds"

to facilitate private investment in public infrastructure. Under

the proposal, qualified facilities would be limited to

publicly-available transportation infrastructure such as airports,

docks, mass transit facilities, and highways. In addition, Move

America Bonds would be exempted from the government ownership

requirements that normally come with exempt facility bonds, as long

as the facilities are available for public use. Also unlike other

categories of PABs, interest income from Move America Bonds would

be excluded from the alternative minimum tax. The Move America Act of 2015 would

provide up to $180 billion in tax-exempt bond authority and up to

$45 billion in infrastructure tax credits for states over the next

decade. Read the section-by-section analysis of the bill here.

Brady Pushing for Partial FIRPTA Repeal. Reps. Brady (R-TX) and Crowley (D-NY) recently introduced the Real Estate Investment and Jobs Act (H.R. 2128), which takes steps towards repealing the Foreign Investment in Real Property Act (FIRPTA). The bill would raise the threshold from 5 percent to 10 percent for the allowable percentage ownership of publicly owned real estate investment trusts by foreign investors. Also, this bill would exempt certain collective investment vehicles and foreign pension funds from the 35% FIRPTA tax altogether. Brady said that lessening the effects of the FIRPTA tax would significantly attract investment in the U.S. A similar bill was passed by the Senate Finance Committee in February of this year except that it did not have the exemption for foreign pension funds. Because a limited tax reform is currently trending, it is possible that a bill like this, were it to garner enough bipartisan support, could pass at some point this year.

REGULATORY WORLD

IRS to Propose New Regulations on CFCs and Inversion Transactions. An IRS official recently announced that the agency is completing regulations preventing certain loans between controlled foreign corporations (CFCs) and foreign partnerships, and it will also be replacing Section 7874 regulations on substantial business activities related to inversion transactions. IRS officials have noted that the regulations on loans between CFCs and foreign partnerships are a high priority and are expected "very soon." In addition, the guidance issued last fall on "substantial business activities" under Section 7874, intended to curb inversions, has been re-examined. Keep an eye out for replacement proposed regulations in the coming weeks.

BEPS Project Demanding Attention. As the international Base Erosion and Profit Shifting (BEPS) project nears its slated end date this fall, Robert Stack, deputy assistant secretary for international tax affairs at the Treasury Department, warns that multinational companies will have to spend more time analyzing the risks of engaging in international tax planning. Stack recently emphasized that with the implementation of country-by-country reporting and transfer pricing-related recommendations, multinationals will face greater scrutiny in the years ahead. Recommendations produced by the BEPS project, an effort chartered by the Organization for Economic Cooperation and Development (OECD), will not have binding authority on any OECD member countries, but several countries are already adopting changes reflective of the BEPS discussions.

LOOKING AHEAD

Wednesday, 5/6

G20 International Tax Symposium – Istanbul,

Turkey

The aim of the symposium is to discuss developments in

international taxation that focus on key items of the G20 tax

agenda by gathering together a broad range of stakeholders. The

event also aims to ensure that developing and low-income countries

benefit from the G20's work on tax and other related matters.

The event will mainly focus on Base Erosion and Profit Shifting

(BEPS) and developments in exchange of information between tax

administrations. The symposium will provide a broad perspective to

the participants about delivered and currently progressing BEPS

Action Items.

Friday, 5/8

The Tax Council

The council hosts a legislative luncheon with Senator Dan Coats

(R-IN), where he will discuss his top tax priorities for the year

and share his views on comprehensive tax reform. Register here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.