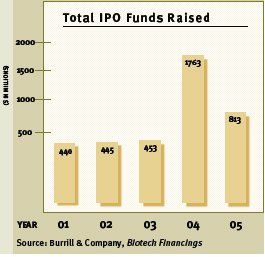

Fewer IPOs in 2005

2005 saw only seventeen biotechs enter the public markets, raising a total of $813 million from their IPOs— a 50% drop from the amount raised in 2004. (Source: Burrill & Company) A number of these newly public companies are now trading below the IPO share price. In fact, of the five biotech IPOs in the third quarter of 2005, only one has retained or increased in value—Genomic Health. (NASD: GHDX Closing price on February 13, 2006 of $15.75) The other four—Advanced Life Sciences, Coley Pharma, Sunesis and Avalon Pharma are trading from 7% to 60% below their IPO share prices.

Ten years ago, when a biotech company needed to raise capital, the avenue most frequently sought was the capital markets. Today, rising drug development costs can approach $1 billion, making a biotech’s need for capital more intense than ever. Yet in 2005, the IPO market was a tight, uninviting place to be. As a result, biotech companies deployed alternative strategies that would allow them to raise capital. Chief among these alternatives was partnering with other biotechs and pharmaceutical companies. Partnering for biotechs is not a new strategy, but the deals signed in the last year demonstrated a biotech’s ability to obtain financing, with increased flexibility and creativity in terms of control over developmental decisions, collaboration structures and commercialization rights.

2005 Trends

During 2005, financings and partnering deals were on the upswing, with the sector raising $34 billion. Half of this amount—$17 billion—resulted directly from partnering and collaboration deals. This $17 billion represents an astounding 58 % increase over partnering activity in 2004, which was valued at $10.9 billion. Additionally, the number of alliance deals continues to grow, albeit more moderately; in 2004 the total number of deals was approximately 625 and in 2005 total deals were 653.

Over the last several years, three interesting partnering and alliance trends have emerged in the life sciences sector. Pharma participation in alliances is declining and small biotech/large biotech alliances are making up a bigger piece of the pie. Since 1996-1997, biotech deals with other biotech firms have grown from under 34% of total collaborations to over 59% in 2004-2005 time frame. What is more, the stage at which pharma is investing and the value of these partnerships is also changing.

Trend #1: Early Stage Activity

Traditionally, pharma has not been particularly interested in early stage opportunities, preferring to become more involved in partnerships later in the product life cycle, i.e., after Phase II. Late stage deals, however, have lost much of their former luster: the number of validated, latestage products has declined and the more conservative regulatory environment continues to generate a high degree of risk even for late-stage therapeutics.

Recent deal activity reveals that pharma clearly is moving further upstream and is exhibiting a strong desire to get involved with early-to mid-stage products. Over the past three years, Phase I deals have more than doubled each year—from 22 in 2001, to 45 in 2004. The average value of early stage deals has risen from $65.3 million in 2001 to $125.1 million in 2005. Additionally, mid-stage deals (preclinical development–Phase I) increased in this same time span from $29 million to $172 million—an almost 600% increase.

One interesting development stemming partly from the increase in early and mid-stage deal activity is the increase in deals that include significant milestone payment structures. Average milestone payments increased from $26.4 million in 2001 to $147.3 million in 2005. Milestone payment deal structures provide benefits for all parties–pharma manages its risk and flexibility with earlier stage drugs and biotech is able to obtain funding at earlier stages in its product development cycle.

The deal between Novartis and Anadys provides an example of one of the early-stage deals that characterized 2005. Anadys is developing a drug in one of today’s hottest target areas—toll-like receptors ("TLR")—and pharma is paying top dollar for access to products in this space. TLRs, a family of proteins that serve as our first line of immune response, recognize the presence of viruses or bacteria and trigger our immune system to fight these pathogens.

In this deal—potentially worth almost $600 million—Novartis made a large upfront cash payment and committed to R&D funding in return for an option to buy into the Anadys program once some of the early stage risk has been eliminated. This structure allowed Novartis to lock up an early stage opportunity while managing its risk. Once later stage data is available for this TLR product, Novartis will be in a better position to decide whether to continue investing in the drug. Meanwhile, Anadys benefited because it was able to receive a large amount of cash upfront and a partner committed to supporting future R&D if this drug is promising.

Similarly, last year’s Roche/Amira deal was structured to manage risk, but also to provide flexibility to both companies. Roche and Amira will collaborate on research and screening Amira’s compound repository against three targets. If successful, Roche can opt into two of the targets and Amira retains full rights to the third. However, Amira can exercise an option to partner with Roche on the third target—with Roche purchasing a significant equity stake in Amira if the option is exercised. This scenario protects Roche and also provides Amira the flexibility to develop the third target on its own or with another partner.

Trend #2: Increasing Deal Size

The increase in the value of the deals being struck is as dramatic as the increase in the number of early stage deals. Pharma and large biotech are not only digging deeper in the product life cycle to find earlier stage opportunities, they also are paying top dollar for the right to participate in these early opportunities. In fact, Pfizer, the world’s largest drug maker, recently announced that it would be targeting acquisitions between $1 billion and $4 billion—primarily focused on gaining intellectual property and innovative therapeutic products. So it appears that in 2006, we can expect more of what we saw during 2005 in terms of deal size.

Two of the largest deals during 2005 were Pfizer/Incyte and AtheroGenics/AstraZeneca; both closed in the fourth quarter of 2005. Pfizer paid Incyte $40 million upfront and bought $20 million in convertible subordinated notes to participate in Incyte’s Phase II CCR2 antagonist program. With milestone payments that could total as much as $743 million, this research and licensing deal is worth over $803 million.

The AtheroGenics/AstraZeneca deal—to develop and commercialize AtheroGenics’ Phase III-stage atherosclerosis drug—is potentially worth $1 billion. AtheroGenics will receive $50 million upfront and will be entitled to $300 million in regulatory milestone payments and $650 million in commercial milestone payments.

Trend #3: Biotechs Are Retaining More Control: Co-Promotion and Co-Development

Retaining more control over the continued development, and ultimately, the commercialization of drug products is something that biotech companies have wanted for a long time. Traditionally, pharma companies have been unwilling to allow smaller biotech companies to do so. For many years, only large cap biotech companies were consistently successful in retaining significant development and commercialization rights. However, this is rapidly changing. In a recent announcement, Pfizer Vice Chairman, David Shedlarz, acknowledged that the company increasingly must be prepared to consider giving up its historical preference for full control over its partners’ products: "We’re going to have to be more open to other types of opportunities." While Shedlarz also added that the company’s "history is going to rub against that," Pfizer’s announcement is a strong indication that biotech/pharma deals have evolved.

As important, there also has been a fundamental shift in the way biotech companies approach partnerships and alliances. Many biotechs are successfully retaining a more active role in the development and commercialization of products, primarily because pharma’s key objective of building pipeline through access to early stage drugs means they now are more willing to share control and responsibility with their partners. The result? Biotech companies have more leverage to negotiate a favorable deal as an equal partner.

PDL BioPharma/Roche

Deal type: Worldwide development, co-development and co-promotion

Summary: PDL BioPharma entered into a global alliance with Roche to develop and commercialize an antibody product, Zenapax, a drug targeting the IL-2 receptor alpha chain (CD25). PDL’s relationship with Roche dates back to 1989, when it first licensed to Roche worldwide rights to Zenapax, the first humanized monoclonal antibody approved by the FDA for the treatment of kidney transplant rejection. Over the years, PDL continued to conduct investigator-sponsored trials to test Zenapax’ potential in autoimmune diseases and asthma. In 2003, PDL paid $80 million to Roche to buy back the rights to Zenapax, except for use in kidney transplant patients. Following the announcement of positive Phase II data in asthma, PDL approached Roche to negotiate a collaboration for Zenapax in asthma and other respiratory disorders. Key features in the asthma collaboration are equal representation and decision-making on development and commercialization decisions, a 50/50 cost-profit split, and a co-promotion arrangement in the U.S. The financial terms call for $17.5 million in upfront payments plus milestone payments up to $187.5 million.

Co-Promotion Terms & Conditions:

- PDL BioPharma will co-promote and detail product with Roche in the U.S.

- The companies agreed to a 50/50 profit-expense share in the U.S., with Roche paying PDL BioPharma royalties on product sales outside the U.S.

- PDL BioPharma books sales in U.S.

- Roche has all commercialization rights in the rest of the world.

- Minimal detailing activities required by an agreed upon marketing plan and budget.

- Management and decision making is jointly owned by the companies through a Joint Steering Committee made up of equal representation from both companies.

Analysis: A key element of the PDL BioPharma/Roche asthma collaboration was the 50/50 economics, and the co-promotion arrangement for the U.S. market. PDL BioPharma’s long-term relationship with Roche was an important factor in negotiating and executing a balanced collaboration agreement for a large, complex disease indication—asthma. The deal provided PDL BioPharma with access to Roche’s worldwide development, regulatory and commercial expertise to take the asthma program from early stage clinical development into pivotal trials as quickly as possible. Through the co-promotion rights in the U.S., PDL BioPharma was able to plan for development of its own sales force and commercial infrastructure in the U.S. Meanwhile, Roche gained access to an antibody drug with a strong safety profile in a therapeutic area, asthma, in which it had been seeking to build a franchise. Overall, this deal is a win-win for PDL BioPharma and Roche.

Theravance /Astellas

Deal type: Worldwide (excluding Japan) co-promotion and co-development

Summary: Theravance entered into a worldwide alliance with Astellas to collaborate on the development and commercialization of Theravances’s Phase III antibiotic, Telavancin. The deal terms call for $65 million in upfront payments plus milestone payments of up to $136 million based on clinical filings and approvals. Theravance will receive royalties on global sales of Televancin that range from the high teens to the upper twenties.

Co-Promotion Terms & Conditions:

Theravance will collaborate with Astellas in promoting the product in the U.S. for the first three years.

- Theravance will lead the development of Telavancin (and be responsible for substantially all costs) for the treatment of complicated skin and skin structure infections (cSSSI) and Hospital-Acquired Pneumonia (HAP).

- Astellas will be responsible for substantially all costs associated with commercialization and further development of Televancin.

- Astellas receives an option to commercialize and further develop another antibiotic compound, TD-1792, which is currently in IND-enabling pre-clinical studies.

Analysis: Several elements of this collaboration merit a closer look. The deal structure allowed Theravance control over drug development and access to Astellas’ global infrastructure—essentially the "best of both worlds." Theravance retained significant control over the drug, particularly in regard to continued development for disease states other than cSSSI and HAP. In pursuing a shared control arrangement, as in this case, smaller companies often can maintain decision-making over how broad a label the drug might obtain in the partnered indication, while continuing to explore other disease states in which the drug might be effective.

For its part, Astellas offered Theravance the needed infrastructure to effectively launch Televancin on a global scale. Through the milestone payment structure, Astellas is inviting Theravance to continue to demonstrate clinical efficacy of this drug outside of the partnered indication. This structure allows Astellas to manage future development risk, while retaining the opportunity to participate in further upside opportunities in other disease indications.

BioCryst /Roche

Deal type: Worldwide co-promotion and co-development

Summary: BioCryst entered into an exclusive worldwide development and commercialization agreement with Roche for its Phase I drug, BCX-4208, an orally delivered purine nucleoside phoshorylase (PNP) inhibitor that modulates T-cell activity. BCX-4208 is targeted at the prevention of acute rejection in transplantation and for the treatment of autoimmune diseases. The deal includes a $25 million upfront payment to BioCryst, a $5 million reimbursement payment for supply of material during the first two years of collaboration, and as much as $530 million in milestone payments.

Co-Promotion and Development Terms & Conditions:

- BioCryst retains U.S. co-promotion rights for several of the indications.

- BioCryst will retain all rights to any other PNP inhibitors it may later discover.

- Roche has a five-year right of first refusal on BioCryst’s existing back-up PNP inhibitors for the same indications.

- Roche obtains worldwide rights to develop and commercialize BCX-4208 and will be responsible for all clinical work and regulatory activities.

- BioCryst retains some direction over development and study designs.

- Both companies have equal representation on joint development and steering committees.

Analysis: The BioCryst/Roche collaboration is particularly interesting because BioCryst was able to obtain attractive financial terms in return for granting Roche certain carve-outs and rights of first negotiation. For example, BioCryst agreed to give Roche a right of first refusal on its back-up PNP inhibitors while retaining ownership on the back-ups, and on any PNP inhibitors BioCryst may later discover.

This deal is another good example of a biotech company and pharma collaborating to share development risks and working together to commercialize and promote a promising product. The governance committee, which is made up of equal representation from both parties ensures that the partnership is truly 50/50 with each party taking responsibility for managing and directing the strategic development and commercialization of the product.

Conclusion

Biotech companies increasingly are turning to partnering and strategic alliances to improve their ability to raise capital and meet their business objectives. Pharma companies and large biotech companies are also using partnerships to expand thinning pipelines and to increase the probability of regulatory approval and commercial success. Alliances for early stage drugs allow biotech to raise funds sooner in the development cycle while providing pharma early access. Deal size continues to increase, as evidenced by the AtheroGenics/AstraZeneca deal potentially worth over $1 billion.

Most importantly, recent partnering deals demonstrate that biotech companies are retaining more control over the development, promotion and commercialization of products. This trend bodes well for both biotech companies and pharma. Biotech companies not only gain access to clinical experience, regulatory expertise and a commercial infrastructure, but they also can learn and build their own infrastructure through the experience. Meanwhile, pharma has the opportunity to access earlier stage, innovative drug candidates, expand the pipeline, and manage drug development risk.

References

Burrill & Company, December 23, 2005; Burrill’s Biotech Outlook for 2006…and A Look Back at 2005

Anadys Pharmaceuticals, Inc., Press Release June 2, 2005; Anadys Pharmaceuticals Announces Exclusive Collaboration With Novartis to Develop and Commercialize ANA975 and Additional TLR7-B Therapeutics for Hepatitis C and Hepatitis B

Amira Pharmaceuticals, Press Release January 9, 2006; Roche and Amira Pharmaceuticals Announce Innovative Alliance Model

BIOWORLD Today, November 22, 2005; Pfizer, Incyte Enter CCR2 Deal Worth Up to $803M

Reuters, March 7, 2006; Pfizer Says it Plans to Continue Shopping Spree

BIOWORLD Today, December 23, 2005; AtheroGenics Signs Agreement With AstraZeneca For Up To $1B Protein Design Labs, Inc,

BIOWORLD Today, November 9, 2005; Theravance Get Telavancin Partner in Deal Worth $221M

BIOWORLD Today, December 1, 2005; BioCryst Out-Licenses BCX-4208 to Roche in Potential $560M Deal

Signals Magazine, February 16, 2006, Partnering Deals: Watch Those Milestones

PRNewswire – FirstCall, September 30, 2005, Roche and Protein Design Labs Restructure Commercial Alliance on Zenapax

*Sergio Garcia is the Co-Chair of the Life Sciences Group and a Partner in the Corporate and Intellectual Property Group, at Fenwick & West LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.