Directors, trustees and managers of foundations and endowments owe fiduciary duties to the organizations they oversee, similar to the fiduciary duties of directors at for-profit companies. However, foundations and endowments are different from for-profit companies in important ways, including their charitable mission and tax exempt status. Unlike fiduciaries of for-profit companies or pension trusts, fiduciaries of foundations and endowments owe legal duties of obedience to both the organization's charitable mission and to the observation of the social purposes required of non-profits. Accordingly, fiduciaries of foundations and endowments must approach investment decisions with these duties in mind.

" We believe that the fiduciary responsibilities of all philanthropic institutions mean that we have both a duty of obedience to our specific mission, and a duty of obedience to a larger public purpose. As a practical matter, we are obligated to examine our portfolio on an ongoing basis to identify holdings that may unintentionally do harm to our missions or to the broader shared interests of society."

Heron Foundation Investment Policy

Sources of Fiduciary Duty

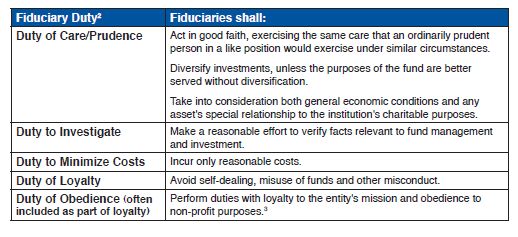

Foundations and endowments are typically structured as non-profit corporations or trusts. The investment functions of most foundations and endowments are governed by state statutes based on model laws called the Uniform Prudent Management of Institutional Funds Act (UPMIFA), which applies generally to all entities, and the Uniform Prudent Investor Act (UPIA), which applies specifically to trusts.1 The Acts impose fiduciary obligations on directors, trustees and managers which include:

Foundations and Endowments Have a Non-Profit Purpose and Charitable Mission

The fiduciary duties of foundations and endowments are similar to the fiduciary duties of those who manage the assets of pension and other trust funds. However, fiduciaries of foundations and endowments have an additional fiduciary duty of obedience to the unique charitable mission of the organization. The UPMIFA Drafting Committee advises in its Prefatory Note to the Act that "UPMIFA requires a charity and those who manage and invest its funds to... develop an investment strategy appropriate for the fund and the charity." The Committee also explains, "[The] decision maker must consider the charitable purposes of the institution and the purposes of the institutional fund for which decisions are being made. These factors are specific to charitable organizations." 4

Another distinguishing feature of foundations and endowments is that they have a non-profit purpose; they must provide a tax-exempt public benefit. Foundations and endowments are granted tax-exempt status on the basis of providing a public benefit that will reduce the burdens on government and benefit society. The fiduciary duties of obedience to the charitable mission and related obligations to serve a public benefit purpose require that fiduciaries of foundations and endowments consider their investment decisions in the context of these mandates.

Fiduciary Practices Evolve in Response to Changing Circumstances

While fiduciary principles remain constant, their application has been dynamic. Recent market downturns, including the dot-com bust of the early 2000s and the more recent Great Recession, raised questions about whether key investment assumptions developed and applied during the 20th century should continue to apply in the 21st century. Questions include whether an exclusive focus on short-term results and market-relative performance benchmarks remain appropriate. Investment and risk assumptions that fostered market volatility, resulted in massive losses and generated externalized costs—which added to government burdens—are being re-evaluated.

" There are no universally accepted and enduring theories of financial markets or prescriptions for investment that can provide clear and specific guidance to trustees and courts."

Restatement of Trusts, 3rd, §227, Comment (f)

In addition to this evolution in investment assumptions, there have been global economic, societal and environmental developments that affect the sustainable delivery of the public benefits provided by foundations and endowments. They include:

- Climate change and global natural resource constraints (e.g., adequate clean water and air) for economic activities;

- Economic and societal effects of reduced economic growth associated with stagnant wage growth and increasing income disparity;

- Collective market influence of institutional investors from the rising amount of assets they now manage—under very similar investment strategies;

- Broad economic impact of short-term investment practices fostered by computer technology and quarterly return competition in the investment industry;

- Behavioral science insights that investors do not always act rationally or in their own best interests; and

- Massive movement of investment assets into passive market index strategies that divorce investment decision making from analysis of sustainable company success.

Fiduciary principles have not changed, but they should be applied to reflect current economic, societal and environmental realities. Fiduciaries of foundations and endowments have an obligation to assess how their investment practices relate to their organization's charitable mission. For foundations and endowments with long-term or perpetual obligations, future needs must also be fairly balanced with short-term demands.

"[The duty of obedience] requires the director of a not-for-profit corporation to be faithful to the purposes and goals of the organization, since unlike business corporations, whose ultimate objective is to make money, nonprofit corporations are defined by their specific objectives."

Manhattan Eye, Ear and Throat Hospital v. Spitzer, 186 Misc. 2d 126, at 152 (NY, 1999)

Managing Both Sides of the Non-Profit Balance Sheet

An increasing number of foundations and endowments are responding to these challenges by cultivating a more contemporary approach to implementing fiduciary duties. This has led them to a greater focus on holistic integration of program and investment policies to recognize their full range of fiduciary duties and to develop a more balanced approach to investment management that is consistent with the entity's charitable mission and public benefit purposes. While divestment and portfolio screening were once seen as the only responsible investment options for foundations and endowments, current management techniques include investment strategies that integrate sustainability factors, asset owner proxy voting policies, company engagement initiatives, shareholder resolution sponsorship and selection of alternative performance benchmarks. The objective is to better align investment management practices with each organization's charitable mission and public benefit purposes.

These insights encourage non-profit fiduciaries to balance management of both the program and asset sides of their entity's balance sheet. Many have begun to seek advisors with the expertise to answer three fundamental questions:

- What societal or systemic side effects and externalities5 are being promoted by their investment practices?

- Do the entity's investment practices undermine success in achieving its charitable mission and public benefit purpose?

- Are there investment strategies or practices which could better promote charitable goals?

While the fiduciary duty context for this approach is unique to each foundation and endowment, basic fiduciary principles guide the process for examining these questions.

Philanthropic Fiduciary FAQs

1. Is integration of program and investment practices the same as impact or social investing?

Absolutely not. Management of the entire balance sheet requires evaluation of investment practices to determine if they undermine charitable goals and to identify whether there are better options for investment assets to further the organization's charitable mission and public benefit purpose

2. Will integration of program and investment strategies reduce investment returns?

Not necessarily. Integrated management of program and investment practices encourages foundations and endowments to work with their advisors to identify investment benchmarks and managers that are most consistent with their charitable purpose and to use appropriate time frames and measures for determining success. Even fiduciaries that conclude the best way to achieve their charitable mission is to seek competitive returns (over an appropriate, usually long-term, time frame) can select managers who employ a modern sustainability investment approach that seeks to minimize the risks and future costs transferred to taxpayers or society, which is a priority for tax exempt entities required to serve public benefit purposes.6

3. Does fiduciary duty require that all non-profits maximize current return on investment assets?

No. Charities are required to use an investment strategy that reflects the financial needs, charitable mission and public benefit purpose of the entity and is appropriate for those goals. This fiduciary duty of obedience is specific to charities. Investment strategies developed for other entities might not be appropriate for foundations and endowments.

4. Is divestment of unpopular holdings a breach of fiduciary duty?

Fiduciaries are precluded from making investment decisions (whether related to selling, buying or holding) based on political or personal biases. They are also required to verify facts relevant to investment and management decisions. Where a fact-based analysis of investment risks, portfolio construction and consistency with charitable purposes shows a reasonable basis for divestment of a holding, there could be an investment reason to sell it. Alternatively, some fiduciaries might determine that retaining a holding under a proactive strategy to engage the company or vote proxies on an issue is also consistent with their charitable purposes.

5. Is management of the full balance sheet relevant to small investors?

Yes. Regardless of size, philanthropic fiduciaries have the same obligation to use an investment strategy that is suitable for their fund and reflects its charitable purposes. Appropriate investment options or strategies for collaboration with other similar investors are likely to be available for many small investors. However, it is important to have advisors who are familiar with the special fiduciary obligations of charities and are informed about investment options that fit the unique charitable characteristics of foundations and endowments.

6. What if our legal counsel vetoes an integrated investment management program?

Many legal and investment advisors still assume that the same legal standards and investment goals which pertain to other fiduciaries should be applied to foundations and endowments. While most of the same principles do apply, fiduciaries of foundations and endowments must also consider the charitable mission and public purpose of the entity in the context of recent changes in economic, societal and environmental circumstances. Foundations and endowments are best served by selecting advisors who are up to date with the evolving understanding of fiduciary duty principles and investment management options.

" In concert with the Foundation's mission to promote a sustainable and just social and natural system, we seek to invest our endowment assets in companies that:

- Provide commercial solutions to major social and environmental problems; and/or

- Build corporate culture with concerns for environmental impact, equity and community."

Jessie Smith Noyes Foundation Investment Policy

Footnotes

1 See http://www.uniformlaws.org/Act.aspx?title=Prudent%20Investor%20Actandhttp://uniformlaws.org/ActSummary.aspx?title=Prudent%20Management%20of%20Institutional%20Funds%20Act

2 There are variations in how these duties are described across jurisdictions. The table is intended to provide a general overview.

3 Charitable mission means the specific goal of an entity contained in its organizational documents. Charitable or non-profit purposes are the required social benefits that non-profits are required to promote in order to be tax exempt. For a more detailed discussion of foundation and endowment fiduciary duties, see Johnson and Viederman, The Philanthropic Fiduciary: Challenges for Non-Profits, Foundations and Endowments, Cambridge Handbook of Institutional Investment and Fiduciary Duty (Cambridge University Press, 2014).

4 UPMIFA Drafting Committee Comment, section 3 (emphasis added).

5 Externalities are the consequences of an economic activity that affects other parties without this being recognized in the cost or valuation of the activity.

6 Under s. 501 of the Internal Revenue Code, non-profits are required to serve a public purpose. A 2012 comprehensive review of sustainability research by Deutsche Bank and Columbia University found that managers which integrate environmental, social and governance factors into investment analyses can provide superior risk-adjusted performance while engaging in responsible investment practices. See http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2222740

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.