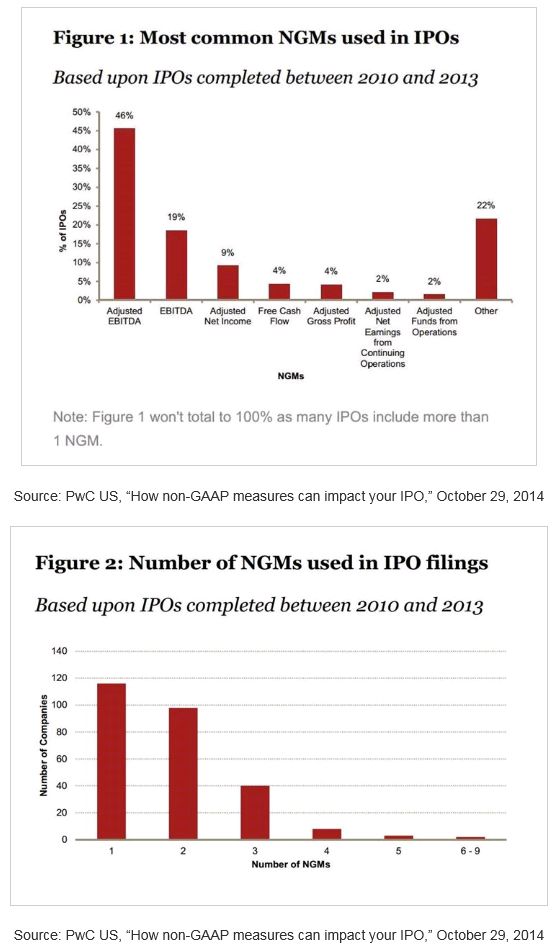

A new report released last week by PwC US analyzed the use of non-GAAP measures (NGMs) in IPOs and found that nearly 60% of the IPOs surveyed included at least one NGM, and approximately 95% of IPOs with NGMs included between one and three NGMs in their filing. PwC surveyed over 400 IPOs completed between 2011 and 2013. The most commonly used NGMs related to earnings before interest, income taxes, depreciation and amortization (EBITDA), with Adjusted EBITDA and EBITDA being included in 46% and 19% of filings, respectively. As figure 1 illustrates, a variety of NGMs were found to be used, with the study noting that 22% of IPOs used a NGM that appeared in less than 2% of filings. The report also found that companies in industries such as Banking & Capital Markets, Oil & Gas, Media & Communications, Technology, Asset Management and Real Estate chose to either modify NGMs used by other companies or define their own, making it difficult to compare NGMs between companies, even for those within the same industry. The PwC study supports the SEC's frequently expressed concern about noncomparability and raises some questions on the analytic usefulness of non-comparable NGMs. The full report can be found here.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved