MANAGEMENT FEE REDUCTION POSSIBILITIES.

In the current economic climate, several opportunities for reduced management fees exist for investors in private equity funds.

First, some funds have come back to their original investors, needing additional capital to support their existing (leveraged) investments. Where the original investors agree to commit additional capital, they have generally been able to negotiate away management fees.

Second, some private equity funds have extended fundraising beyond their originally contemplated 12 month period. In these situations, investors frequently succeed in negotiating reduced management fees, so that the "fee lookback" from final closing is capped at 12 months. The rationale is especially compelling where the fund has made few investments during the early part of the fundraising period, and where the management fee is high (with significant room for reduction).

For example, with a 22-month fundraising period (rather than 12-month fund-raising period), the investor might seek a 10-month fee waiver. With a 2% fee, this would save $16,667 for each $1 million of commitment, or $833,333 for a $50 million commitment.

Earlier close investors can also benefit, by virtue of their MFN provisions. Helpful actions to take at the time of the original commitment include:

- be sure that your MFN provision does not carve out management fee waivers; and

- request supermajority approval to extend fundraising period.

ADVISORY BOARD MEMBERSHIP WITH CAYMAN FUNDS.

The law of the Cayman Islands does not recognize "third party beneficiaries." Consequently, advisory board members of Cayman Islands funds are not entitled to indemnification under the partnership agreementʼs indemnification provision. Rather, indemnification is only available if there is

- a separate indemnification agreement between the advisory committee member and the Fund, or

- a "deed poll" which allows such enforcement.

Steps investors with advisory board seats may wish to take:

- For new and existing Cayman Islands funds: verify that a deed poll or other means to obtain indemnification exists – or else, modify the documents accordingly.

- For funds formed in unusual jurisdictions: determine (including by legal opinion from counsel to the fund) that indemnification is available before agreeing to serve on advisory boards.

FIRPTA AVOIDANCE FOR INVESTORS IN PRIVATE MARKET FUNDS (ALSO RELEVANT FOR UBTI-SENSITIVE INVESTORS)

Introduction

Non-U.S. investors frequently ask whether FIRPTA's1 35% tax applies to gains on investments in global real estate funds and U.S. infrastructure2 funds. The short answer is that if a fund is properly structured, FIRPTA will not apply, and in many cases U.S. tax returns do not need to be filed. Other structures – primarily debt overlays – can also meaningfully reduce FIRPTA taxes. If a Real Estate Investment Trust ("REIT") is used, UBTI-sensitive investors also benefit.

FIRPTA-Avoidance Techniques

Three techniques are commonly used to reduce the FIRPTA exposure of non-U.S. investors:

- Investing via a domestically controlled REIT.

- Investing via a leveraged blocker corporation, with debt (and a corresponding interest deduction).

- For some pension funds, qualification for taxation at individual rates rather than corporate rates (reduces tax from 35% to 15%).

1. Domestically Controlled REIT.

Investing through a domestically controlled REIT is the most investor-friendly investment structure, as FIRPTA can be completely eliminated and U.S. tax returns do not need to be filed.

It works as follows: The partnership in which the non-U.S. person participates makes each real property investment using a separate domestically controlled REIT subsidiary. (A domestically controlled REIT is a REIT owned at least 50% by U.S. investors.) Then, at the time of disposition, the fund sells REIT shares (rather than the underlying property).

The advantages are:

- No FIRPTA tax or capital gain tax is due upon sale of REIT shares. (But FIRPTA would apply if the underlying property were sold.)

- The REIT, rather than the investor, files U.S. tax returns.

- Current income from the property is paid out as a REIT dividend, which is tax-exempt for foreign governmental and pension investors, and which is frequently taxed at a reduced (or zero) rate for other non-U.S. investors under tax treaties.

2. Leveraged Blocker.

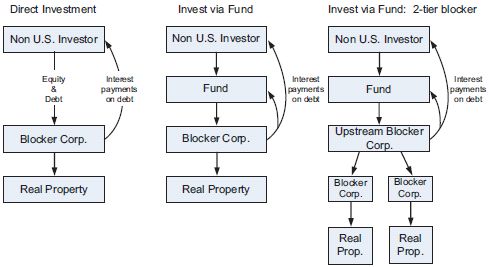

U.S. real estate can also be acquired using "leveraged blocker" corporations. This involves two components: (a) a corporation (generally formed by the fund sponsor), which holds the real property asset, and (b) high debt, since interest is not subject to FIRPTA. Sample structures are illustrated on the following page:

Certain limits apply to related party debt in order for the interest deductions to be allowed; at least one of the following tests must be satisfied:

- The debt to equity ratio must be less than 1.5:1, or

- The amount of interest may not exceed 50% of earnings (before interest, depreciation, taxes and amortization).

Sale of Real Property: The sale of the real property held by the leveraged blocker can be accomplished two ways. In either case, FIRPTA must be paid (but interest payments will have greatly reduced gain that is subject to FIRPTA). The two ways are:

- Sale of Blocker's Stock: Non-U.S. investor (or fund, as applicable) sells the stock of the blocker company. Blocker company – rather than investor – files tax return and pays FIRPTA. (Rarely used single tier blocker structure would require investor to file tax return.)

- Sale of Property by Blocker: Blocker company sells real property, and distributes proceeds upstream. If the real property was the only asset of the blocker company, then the distribution of sales proceeds is generally a tax-exempt liquidating distribution; otherwise, it is a dividend. To avoid dividend withholding, many use a separate blocker for each real property, so that a tax-free liquidation of the blocker can take place at the time of each disposition. Of course, foreign governmental investors and other investors that are exempt from dividend withholding are indifferent in this regard.

3. Taxation at Individual Rates.

Some non-U.S. pension funds have obtained a tax ruling from the IRS, confirming that the pension investor is a non-corporate "trust" that is taxed at individual (rather than corporate) rates. Key to obtaining this ruling is that the investor not have a separate legal personality.

Advantages of following this approach are:

- FIRPTA tax is paid at individual, rather than corporate rates. This can reduce the FIRPTA capital gain tax rate from 35% to 15%.

- This approach can be combined with the use of a leveraged blocker to further reduce gains that are subject to FIRPTA.

Disadvantages are:

- Time and effort involved in obtaining an IRS tax ruling.

- Does not completely eliminate FIRPTA tax (as would a REIT structure).

- Investor needs to file tax returns in the U.S. to take advantage of the lower rate.

Summary of U.S. Real Property and Infrastructure Investing.

Most conservative Investors: No FIRPTA Tax and No Filing Obligations: The most conservative investors will only want to make FIRPTA-exempt investments, without tax filing obligations. The two types of investments that qualify are:

- Domestically controlled REITs (where the shares of the REIT, rather than the underlying assets, are sold), and

- Mortgage Loans (without equity kicker).

Conservative Investors: Some FIRPTA Tax, But No Filing Obligations: Other investors may determine that the economic benefit of some U.S. investments makes those investments worthwhile, even if they are subject to FIRPTA on the capital gains that remain after interest is paid via the leveraged structure. To avoid tax filings in the United States, these investors would likely also be willing to invest using leveraged blockers (but being sure to obtain comfort that property will be disposed of in a manner that does not create filing obligations).

Less Conservative Investors: Some FIRPTA Tax, Not Adverse to Tax Filings: Investors that are not adverse to making tax filings in the U.S. have the greatest flexibility, as they can invest in real estate without limit.

Footnotes

1. FIRPTA is the Foreign Investment in Real Property Tax Act of 1980, which requires tax withholding in the event of the sale of U.S. real property interests owned by non-U.S. investors.

2. Infrastructure funds are a hybrid entity, with a real estate component and an operating business component. (For example, a toll road or airport consists of both real property and an operating business.) Each investment where the U.S. real property component exceeds 50% is potentially subject to FIRPTA. Infrastructure funds will, at times, separate investments into a real property company and an operating company, to limit the application of FIRPTA (and also to make it easier to qualify the real estate assets as a domestic REIT). This benefits UBTI-sensitive U.S. investors as well.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.